Investors five-year losses grow to 64% as the stock sheds US$34m this past week

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example the Verastem, Inc. (NASDAQ:VSTM) share price dropped 64% over five years. We certainly feel for shareholders who bought near the top. And some of the more recent buyers are probably worried, too, with the stock falling 55% in the last year. And the share price decline continued over the last week, dropping some 13%.

Since Verastem has shed US$34m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Verastem

Verastem recorded just US$1,696,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Verastem comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Verastem investors have already had a taste of the bitterness stocks like this can leave in the mouth.

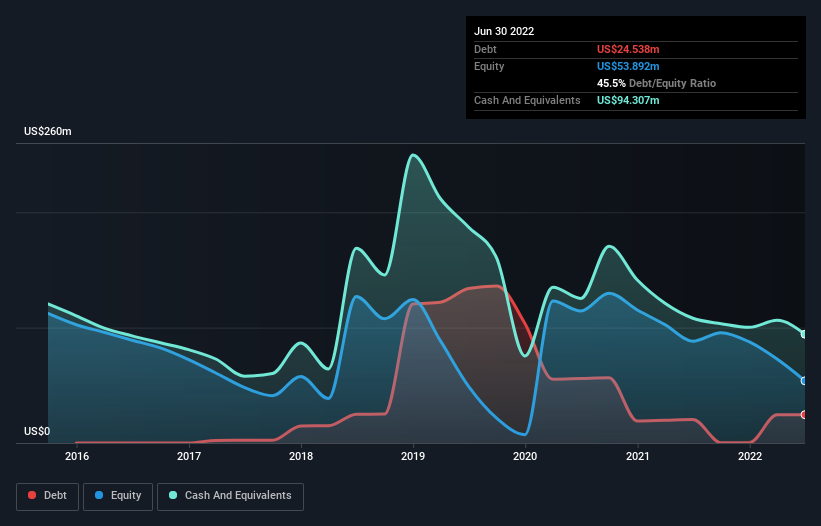

When it reported in June 2022 Verastem had minimal cash in excess of all liabilities consider its expenditure: just US$48m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. That probably explains why the share price is down 10% per year, over 5 years. You can click on the image below to see (in greater detail) how Verastem's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

While the broader market lost about 12% in the twelve months, Verastem shareholders did even worse, losing 55%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Verastem that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance