Investors are going crazy for Saudi Arabian debt

Reuters/Ali Jarekji

Investors are going wild for Saudi Arabian debt, with the country seeing "massive, massive demand" for its first ever international debt issuance, according to a report from the Financial Times.

Saudi Arabia is expected to issue the first international debt in its history within the next couple of months, as it seeks to diversify government revenue streams away from oil while prices for the commodity remain depressed, and it seems as though investors are pretty keen on buying it up.

As it stands, there are no concrete details on exactly what the debt offering will look like, other than that it will be worth around $15 billion (£11.3 billion). More details are expected after the end of the Islamic holiday Eid-al-Adha, which has led to the closure of many government offices. News of the borrowing was first reported by Reuters in March, when it emerged that the kingdom had asked lenders to submit proposals for a US-dollar denominated loan.

"We are seeing massive, massive demand," one banker cited by the FT noted. Investors from Asia are the most interested, the same banker suggested, saying: "Asian banks are throwing around billion-dollar numbers."

Appetite for the debt, which could be issued at some point in October, is so high that the kingdom has started to consider releasing a "full pipeline of bonds" to the markets, according to the FT, which cites "bankers briefed on the sale."

"Everyone is waiting to see how the appetite will turn out for the government, and at what price, which can then be used as a benchmark," a second banker told the FT. "There should be some other issuance before the end of the year."

The debt issuance is part of a plan from the kingdom's ambitious young Deputy Crown Prince Mohammed bin Salman to transform its economy, and wean it off its "addiction to oil" in the next decade and a half. The so-called Vision 2030 initiative sets out a series of plans designed to move Saudi Arabia towards a more services-based economy and expand revenue streams from areas like entertainment and tourism.

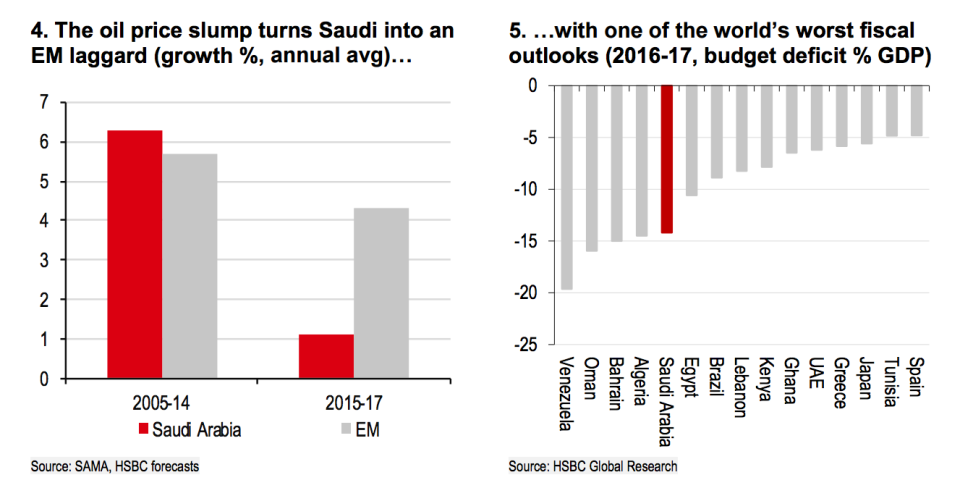

This comes as oil prices remain depressed, making the oil reliant country's economy much shakier, as these HSBC charts illustrate:

Reuters/Ali Jarekji

Saudi Arabia has no alternative to these sweeping reforms if it wants to remain viable in the future, and faces a "protracted cycle of stagnation and decay" without them, according to a note from HSBC circulated in May.

In the note titled "Saudi Arabia: Why the Kingdom must be reformed" HSBC economists Simon Williams and Razan Nasser argued that "a protracted period of marked economic decline" will be unavoidable if the oil-rich Gulf state doesn't start moving towards a less oil-reliant economy.

Ever since oil prices started to plunge in mid-to-late 2014, imbalances in the economy that have "ballooned" in the last decade have started to be exposed. Government revenues now cover just over half of outlays, and the country is deep in deficit, in both budgetary and current account terms. Earlier this week, the Saudi government reported a substantial drop in foreign assets in July, the latest in a series of "ugly warning signs" for the country.

Capital Economics' GDP Tracker, which derives from monthly activity data, estimates that the Saudi economy shrank by 2.3% year-over-year in June. It also estimates that output slumped by 2% year-over-year in the second quarter.

"If our tracker is correct, this would be the first contraction in the Saudi economy since 2009, in the midst of the global financial crisis," said Jason Tuvey, Capital Economics' Middle East economist said in late August.

Saudi Arabia's financial situation has led to it being downgraded by all three major ratings agencies. In May, Moody's downgraded the kingdom, saying that "the buffers will continue to erode" in the economy. Despite the downgrades, investors haven't been put off, with the country viewed as probably the safest haven in the emerging markets thanks to its low levels of debt and huge oil reserves.

NOW WATCH: How 2 brothers turned a virtually indestructible cooler into a half-billion-dollar brand

See Also:

Here's who would win and lose just about every economic scenario we can imagine

The Russia-Saudi oil cooperation is actually a sign of 'extreme economic duress'

SEE ALSO: More ugly warning signs are popping up in Saudi Arabia

DON'T MISS: Saudi Arabia is facing a 'squeeze'

Yahoo Finance

Yahoo Finance