Investors Holding Back On Singulus Technologies AG (ETR:SNG)

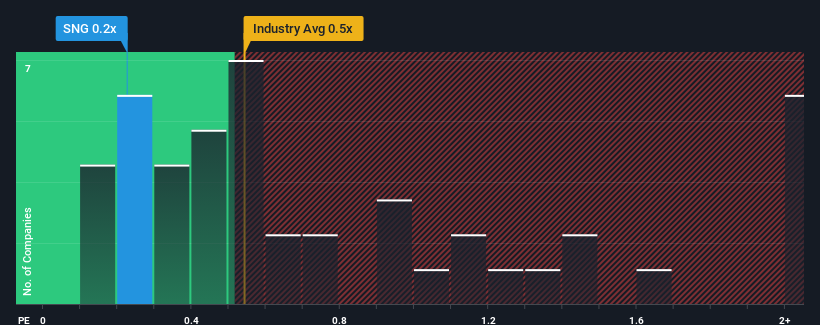

It's not a stretch to say that Singulus Technologies AG's (ETR:SNG) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Machinery industry in Germany, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Singulus Technologies

How Has Singulus Technologies Performed Recently?

With revenue growth that's superior to most other companies of late, Singulus Technologies has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Singulus Technologies will help you uncover what's on the horizon.

Is There Some Revenue Growth Forecasted For Singulus Technologies?

The only time you'd be comfortable seeing a P/S like Singulus Technologies' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 70%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 6.1% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 3.5% per year growth forecast for the broader industry.

With this information, we find it interesting that Singulus Technologies is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Singulus Technologies' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Singulus Technologies (2 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Singulus Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance