Investors Interested In Aevis Victoria SA's (VTX:AEVS) Revenues

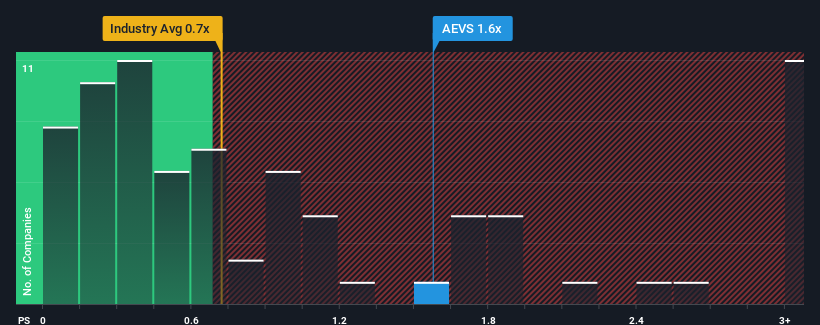

Aevis Victoria SA's (VTX:AEVS) price-to-sales (or "P/S") ratio of 1.6x may not look like an appealing investment opportunity when you consider close to half the companies in the Healthcare industry in Switzerland have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Aevis Victoria

What Does Aevis Victoria's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Aevis Victoria's revenue has been unimpressive. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Aevis Victoria's earnings, revenue and cash flow.

Is There Enough Revenue Growth Forecasted For Aevis Victoria?

In order to justify its P/S ratio, Aevis Victoria would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 48% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

In contrast to the company, the rest of the industry is expected to decline by 7.6% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's understandable that Aevis Victoria's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Aevis Victoria's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We see that Aevis Victoria justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

It is also worth noting that we have found 4 warning signs for Aevis Victoria (2 are a bit concerning!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance