Investors might be losing patience for Zscaler's (NASDAQ:ZS) increasing losses, as stock sheds 6.9% over the past week

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Zscaler, Inc. (NASDAQ:ZS) which saw its share price drive 288% higher over five years. On top of that, the share price is up 23% in about a quarter. But this could be related to the strong market, which is up 12% in the last three months.

While the stock has fallen 6.9% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Zscaler

Because Zscaler made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Zscaler can boast revenue growth at a rate of 40% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 31% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Zscaler seems like a high growth stock - so growth investors might want to add it to their watchlist.

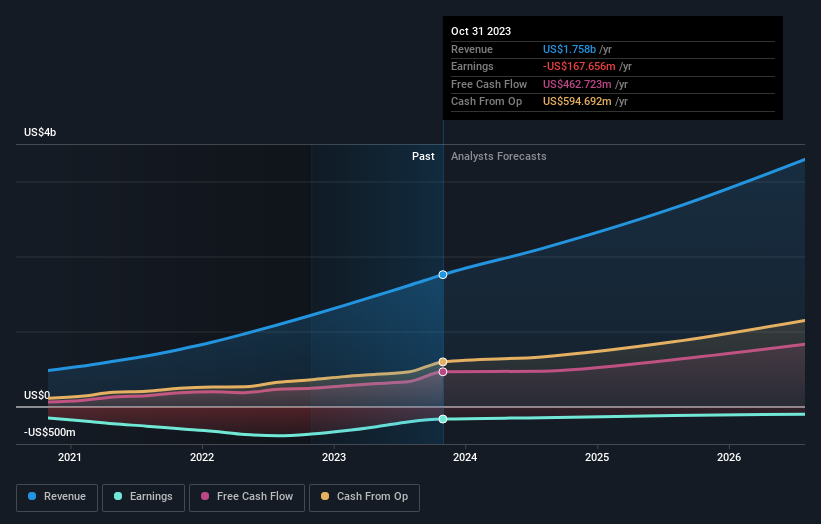

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Zscaler is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Zscaler stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We're pleased to report that Zscaler shareholders have received a total shareholder return of 80% over one year. That's better than the annualised return of 31% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Zscaler better, we need to consider many other factors. For instance, we've identified 3 warning signs for Zscaler that you should be aware of.

Of course Zscaler may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.