Investors In Postal Realty Trust, Inc. (NYSE:PSTL) Should Consider This, First

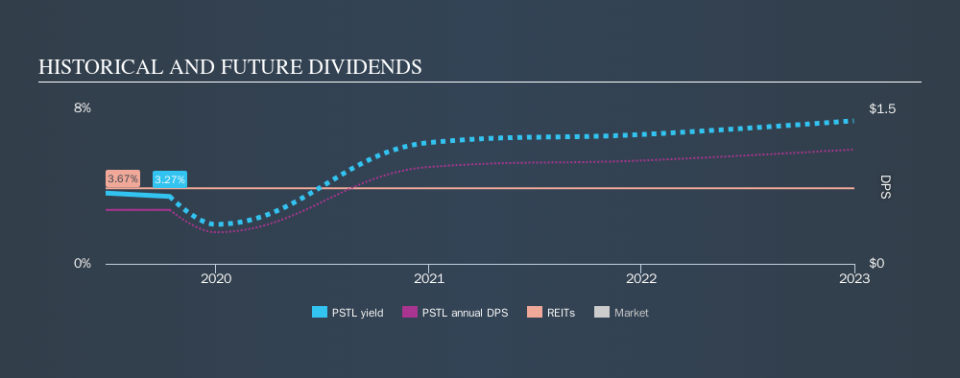

Could Postal Realty Trust, Inc. (NYSE:PSTL) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Postal Realty Trust paid out 131% of its profit as dividends, over the trailing twelve month period. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. With a cash payout ratio of 182%, Postal Realty Trust's dividend payments are poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. Cash is slightly more important than profit from a dividend perspective, but given Postal Realty Trust's payouts were not well covered by either earnings or cash flow, we would definitely be concerned about the sustainability of this dividend.

REITs like Postal Realty Trust often have different rules governing their distributions, so a higher payout ratio on its own is not unusual.

While the above analysis focuses on dividends relative to a company's earnings, we do note Postal Realty Trust's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Postal Realty Trust every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was US$0.52 per share.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Conclusion

To summarise, shareholders should always check that Postal Realty Trust's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Postal Realty Trust paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Unfortunately, there hasn't been any earnings growth, and the company's dividend history is shorter than the 10 years we ideally like to see before making a strong judgement. There are a few too many issues for us to get comfortable with Postal Realty Trust from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance