Facebook, China weigh on market sentiment

David Nelson, CFA, is the Chief Strategist of Belpointe Asset Management

No way to sugar coat it. Last week was a miserable one for equity investors with the S&P 500 (SPY) posting its worst weekly return in two years. Futures are up sharply this morning following news that U.S. Secretary of Treasury Steve Mnuchin is meeting with Chinese officials discussing ways to reduce the trade deficit between our two nations. Let’s see how we close before we pop the champagne.

On the heels of continued dollar weakness oil and gold were the best offsetting asset classes up +5.7% and +2.9% on the week, respectfully. The weak dollar is also an anchor for currency hedged international assets which are starting to roll over.

The pace of the news cycle is probably the most frustrating for investors. Every day there is a major event or announcement from the White House forcing everyone back to the drawing board to adjust their models.

The Facebook (FB) fiasco, the Fed post meeting press conference, China tariffs and another change in the national security adviser all weighed on sentiment. Add a Mueller investigation that continues to march toward the Oval office and it’s understandable why investors are quick to pull the rip cord. The broadcast and print media throw gasoline on the fire with every story getting a BREAKING NEWS graphic.

All of the above are a potential concern but I think the Facebook news and its aftermath deserves a hard look. If in fact the Facebook model is forced to change then that’s a significant event likely to affect big cap tech for years to come. Big Data is Big Money and a big part of the revenue and earnings stream of some of the best performing stocks in a generation. Mining that data can be even more valuable than subscription service models.

If I’m a vendor and suddenly Facebook let’s its users turn off their data sharing, then that data is worth far less to me. Same for Google (GOOGL) and any other internet firm dependent on Big Data analytics. It’s way too soon to even speculate just where this will end up but it won’t take long for analysts to start crunching numbers lowering revenue and earnings estimates.

As for the China Syndrome it’s important to note that Trump often comes out with over the top proposals. Slowly but surely they get walked back as he comes more center. The steel tariffs started off as no exemptions. Today, Canada, Mexico, South Korea and the European Union are all off the list as negotiations go on. Mnuchin told Meet the Press host Chuck Todd that he was in ongoing discussions with China on trade and the transfer of intellectual property concerns the administration has voiced.

One look at a chart of the S&P shows we’re setting up for a retest of the February lows. We closed Friday just above the 200-day moving average.

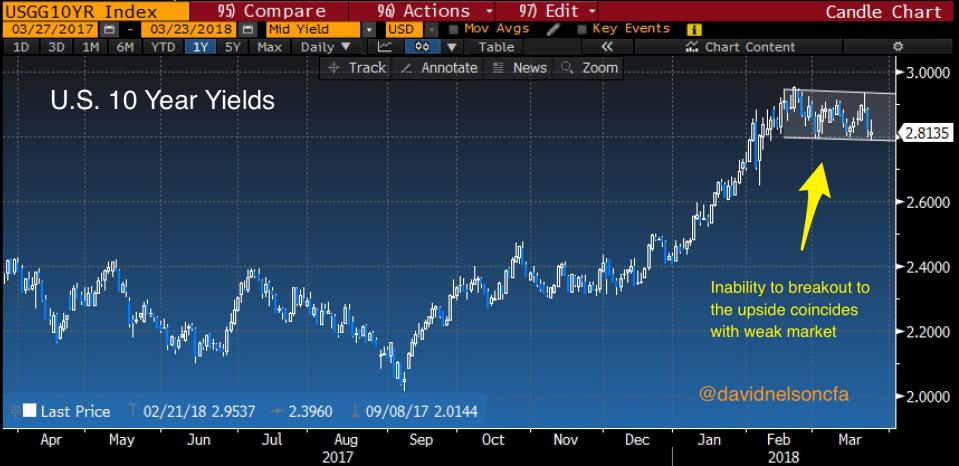

If you’re looking for a leading indicator it just may be in the bond market. Despite being given every chance to do so, yields were not able to breakout of a 3% ceiling. After a brief spike to the highs following the Federal Reserve announcement yields and stocks headed south Wednesday giving up all the gains setting up two back-to-back drawdowns in stocks Thursday and Friday. The chart below shows the recent trend channel.

The Fed rhetoric is pointing to four rate hikes this year and potentially a 3.4% terminal Fed Funds rate in the out years. Stocks and bonds aren’t buying it and I fully expect Fed Char Jerome Powell to walk back last week’s comments to something more benign before the next meeting.

*At the time of this post some funds managed by David Nelson were long SPY and GLD

Yahoo Finance

Yahoo Finance