Investors three-year losses continue as Qurate Retail (NASDAQ:QRTE.A) dips a further 7.2% this week, earnings continue to decline

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Qurate Retail, Inc. ( NASDAQ:QRTE.A ) shareholders, since the share price is down 72% in the last three years, falling well short of the market return of around 58%. The more recent news is of little comfort, with the share price down 61% in a year. Shareholders have had an even rougher run lately, with the share price down 38% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report .

If the past week is anything to go by, investor sentiment for Qurate Retail isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Qurate Retail

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

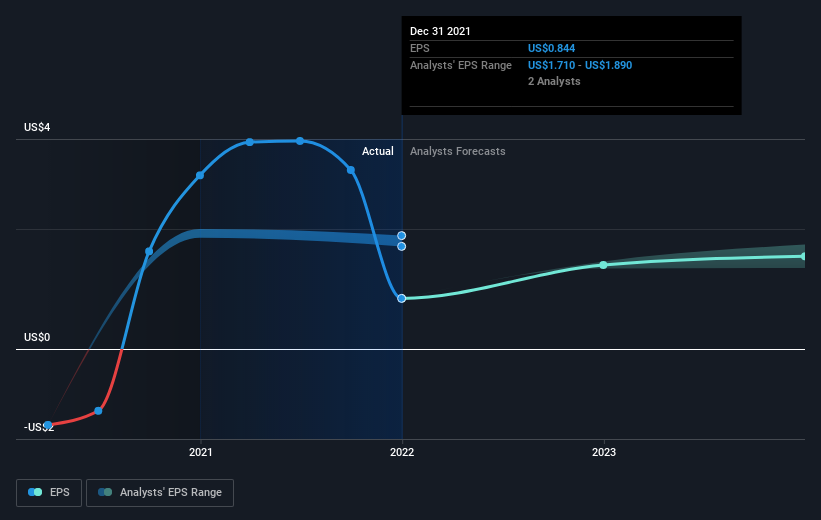

Qurate Retail saw its EPS decline at a compound rate of 8.1% per year, over the last three years. The share price decline of 34% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 5.60.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here .

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Qurate Retail's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Qurate Retail hasn't been paying regular dividends, but its TSR of -35% exceeds its share price return of -72%, implying it has also either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Over the last year, Qurate Retail shareholders took a loss of 55%. In contrast the market gained about 2.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 11% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Qurate Retail (1 is a bit concerning!) that you should be aware of before investing here.

But note: Qurate Retail may not be the best stock to buy . So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance