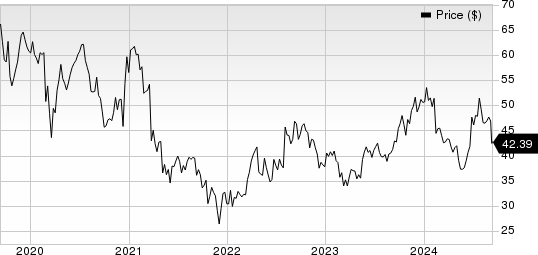

Ionis Stock Drops 12% on Pricing of $500M Common Stock Offering

Ionis Pharmaceuticals IONS announced that it is floating a secondary issue of 11.5 million shares of its common stock to the public at an issue price of $43.50 per share, amounting to nearly $500.3 million.

The company also granted an option to underwriters of the issue to purchase an additional 1.725 million shares at the same price.

The secondary offering is expected to close today.

Buy Why Did IONS Stock Fall?

Ionis’ shares fell more than 12% on Tuesday after the announcement. Though the issue does not significantly dilute the existing shareholder base, the issue price per share did not sit well with investors. The issue price was at a discount to the closing price on Monday, with the stock closing at $48.33.

Year to date, the stock has lost 16.3% compared with the industry’s 0.8% fall.

Image Source: Zacks Investment Research

Plans for the Proceeds

Management plans to use the net proceeds from this new issue and its existing cash balance to fund its independent commercial launches and support the clinical development of its pipeline candidates. Management will also use the proceeds for its general corporate purpose, including working capital requirements.

Ionis Boasts a Diverse Revenue Stream

Despite marketing no wholly-owned drug in its portfolio, Ionis enjoys a diverse stream of revenues, including commercial products and royalties and numerous sources of collaborative and R&D revenues. The company has collaboration deals with leading drugmakers/biotech companies, likeAstraZeneca AZN, Biogen BIIB, GSK plc GSK and Novartis, for developing and marketing its medicines.

IONS earns commercial revenues in the form of royalty payments on net sales of Spinraza, approved in the United States to treat spinal muscular atrophy (SMA) worldwide. Ionis licensed this drug to Biogen, which is responsible for commercializing it. Ionis and Biogen also market Qalsody, which was approved by the FDA in April 2023 for amyotrophic lateral sclerosis (ALS) with superoxide dismutase 1 (SOD1) mutations.

Last December, the FDA approved Wainua for treating patients with hereditary transthyretin-mediated amyloid polyneuropathy, commonly called hATTR-PN or ATTRv-PN. The drug has been developed in partnership with AstraZeneca. While Ionis and AstraZeneca will jointly market Wainua for ATTRv-PN in the United States, AZN has exclusive rights to commercialize Wainua outside U.S. markets. The drug was commercially launched in the United States in first-quarter 2024. Regulatory filings seeking approval for eplontersen in ATTRv-PN are under review in the EU and some other countries.

AstraZeneca and Ionis are also developing Wainua as a treatment for cardiomyopathy caused by hATTR amyloidosis (ATTR-CM) in the phase III CARDIO-TTRansform study, which is on track for a data readout in first-half 2025.

Novartis and GSK are its partners for pelacarsen and bepirovirsen, respectively. While the GSK-partnered drug is being developed in two late-stage studies for chronic hepatitis B (CHB), the Novartis-partnered drug is being developed in a late-stage study for patients with cardiovascular disease due to elevated Lp(a) levels. Data readout from the Novartis- and GSK-partnered drug studies are expected in 2025 and 2026, respectively.

Independent Product Launches Planned by IONS

Ionis’ collaboration with the above leading drugmakers/biotech companies provides it with funds in the form of license fees, upfront payments and milestone payments to invest in its internal pipeline development. Some of its wholly-owned candidates include olezarsen for familial chylomicronemia syndrome (FCS) and severe hypertriglyceridemia (SHTG), ulefnersen for ALS, donidalorsen for hereditary angioedema (HAE) and zilganersen for Alexander’s disease. These drugs are already being evaluated in late-stage studies.

In June, the FDA accepted Ionis’ regulatory filing seeking approval for olezarsen to treat FCS. This filing is based on results from the phase III BALANCE study, which showed that treatment with olezarsen led to significant triglyceride-lowering and substantial reductions in acute pancreatitis attacks in FCS patients. If approved, olezarsen will be Ionis’ first medicine that will be launched independently. A final decision from the FDA is expected before Dec. 19, 2024.

In May, Ionis reported top-line results from two phase III studies — OASIS-HAE and OASISplus — which evaluated donidalorsen in HAE patients. Data from these studies showed that treatment with the drug achieved a significant and sustained reduction in the rate of HAE attacks for monthly and every two-month dosing. Based on these results, the company is making preparations to file an NDA for donidalorsen with the FDA in 2024. IONS’ partner, Otsuka, is preparing to submit for marketing approval in Europe before 2024-end.

Management is also progressing well with the development of its other wholly-owned pipeline drugs. In the first half of 2024, Ionis reported that a mid-stage study on MASH/NASH candidate ION224 and a phase I/IIa study on Angelman syndrome drug ION582 achieved their respective primary endpoints. A phase III study on ION582 is expected to begin in the first half of 2025.

Ionis is advancing and expanding its wholly-owned pipeline to drive future revenue growth. While the company does have a broad pipeline of partnered programs with leading drugmakers/biotech companies, its recent decision to increase investments in its internal pipeline seems encouraging, given the recent positive data readouts. The expansion of its internal pipeline will help Ionis diversify its revenue stream and narrow down its dependence on collaboration partners.

Ionis Pharmaceuticals, Inc. Price

Ionis Pharmaceuticals, Inc. price | Ionis Pharmaceuticals, Inc. Quote

IONS Zacks Rank

Ionis carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report