Iovance (IOVA) Q2 Earnings Miss Estimates, Pipeline in Focus

Iovance Biotherapeutics, Inc. IOVA incurred a loss of 53 cents per share in second-quarter 2021, wider than the Zacks Consensus Estimate of a loss of 52 cents as well as the year-ago quarter’s loss of 47 cents.

In the absence of any marketed products and revenue-generating collaborations, the company did not record any revenues during the quarter, in line with the Zacks Consensus Estimate.

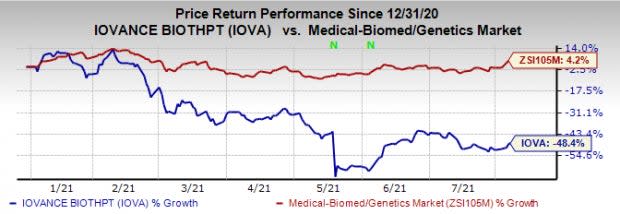

Shares of Iovance have declined 48.4% so far this year against the industry’s increase of 4.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development (R&D) expenses were $62.1 million, 26% higher than the year-ago quarter, primarily due to an increase in related personnel costs and higher manufacturing and Iovance Cell Therapy Center (iCTC) facility-related costs.

General and administrative (G&A) expenses increased 34.5% to $19.3 million due to an increase in related personnel costs.

The company had $708.7 million in cash, cash equivalents, short-term investments and restricted cash as of Jun 30, 2021, compared with $610.2 million as of Mar 31, 2021.

The company expects the cash level to be sufficient for more than two years based on its current operating plan.

Pipeline Updates

Iovance is developing its lead pipeline candidate, lifileucel, as a monotherapy for treating metastatic melanoma and metastatic cervical cancer in separate pivotal studies. Currently, the company is developing lifileucel in separate pivotal phase II studies — C-144-01 and C-145-04 — for metastatic melanoma, and recurrent, metastatic or persistent cervical cancer, respectively, in previously-treated patients. The company plans to file biologics license application (BLA) seeking approval for lifileucel in 2022 for melanoma.

In May 2021, Iovance announced plans to continue its ongoing work of developing and validating its potency assays for lifileucel following feedback from the FDA on its previously-submitted assay data. The company plans to submit additional assay data to the FDA in the second half of 2021, thus delaying its potential BLA submission for lifileucel for melanoma to first-half 2022.

At American Society for Clinical Oncology 2021 (ASCO), Iovance presented data on Cohort 1A of the C-145-04 basket study. The study evaluated lifileucel in combination with Merck’s MRK Keytruda (pembrolizumab) in melanoma patients who are naive to anti-PD-1 therapy. While the overall response rate (ORR) was 86%, the complete response rate was 43% at a median follow up of 8.2 months.

In June 2021, the company reported promising initial data from Cohort 3B of its ongoing phase II basket study, IOV-COM-202, evaluating single administration of its tumor infiltrating lymphocyte (TIL) therapy candidate, LN-145, in patients with metastatic non-small cell lung cancer (mNSCLC). Data showed that LN-145 monotherapy achieved an ORR of 21.4%, and a disease control rate of 64.3%. The company plans to present detailed data from the Cohort 3B at a medical meeting in the second half of 2021. The company also initiated dosing of first patient in its registration-enabling phase II study — IOV-LUN-202 — to evaluate LN-145 in second-line mNSCLC.

Iovance is also progressing a novel IL-2 analog (IOV-3001) as well as a genetically modified TIL (IOV-4001) to IND-enabling studies. IOV-4001 leverages TALEN technology licensed from Cellectis S.A. CLLS to genetically knock out PD-1 in TIL cells.

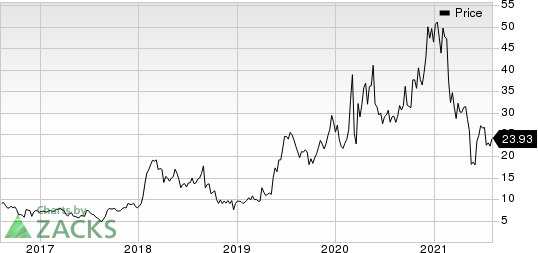

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Iovance currently has a Zacks Rank #4 (Sell). A better-ranked stock in the same sector is Repligen RGEN, which currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Repligen’s earnings per share estimates for 2021 have moved up from $2.26 to $2.69 in the past 30 days. The same for 2022 has risen from $2.56 to $2.94 over the same period. The stock has rallied 32.9% so far in the year

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Cellectis S.A. (CLLS) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance