IPG Photonics (IPGP) Up 6.6% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for IPG Photonics Corporation IPGP. Shares have added about 6.6% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is IPGP due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

IPG Photonics delivered first-quarter 2018 adjusted earnings of $1.93 per share, which beat the Zacks Consensus Estimate by 13 cents. The figure was better than the guided range of $1.62-$1.87.

The strong year-over-year growth was driven by a 26% surge in sales from the year-ago quarter to $359.9 million. The figure surpassed the Zacks Consensus Estimate of $347 and also outperformed managements guided range of $330-$355 million.

Materials processing jumped 28% year over year and accounted for approximately 94% of total sales driven by strength in 3D printing and cutting applications.

IPG Photonics is benefiting from strong adoption of fiber lasers over conventional lasers as well as non-laser cutting and welding equipment. According to management, secular transition to high powered products and increased electric vehicle battery production were the primary drivers behind the increased adoption of the high powered lasers.

The year-over-year sales growth was driven by robust performance in China, Europe and Japan with strong demand across a variety of applications and industries. Apart from strong order flow, robust integration of the company’s business model with vertically-integrated manufacturing operation, production & operations management, customer credit management and global administration aided growth.

Geographic Revenue Details

China reported year-over-year sales growth of 28.5% and represented 41.7% of total sales. The robust performance was driven by strong sales of high-power CW lasers for cutting and welding applications.

However, welding sales were down year over year due to the anticipated reduction in demand pertaining to the smart-phone investment cycle. Electric vehicle battery welding, which are project driven, were also down in the region.

Sales in Japan surged 39% from the year-ago quarter. In spite of the ongoing softness in sales in the region, growth was achieved on the back of increasing adoption of its cutting, engraving, and marking and welding applications.

Further, Japan lags other regions regarding adoption of fiber laser technology. To address the issue, IPG Photonics is making investments in new sales personnel to enhance capabilities in the region.

Sales in Europe increased 35% from the year-ago quarter. Europe benefited from strength in medium-power lasers for 3D printing applications, and high power lasers for cutting and welding applications. Moreover, pulsed laser sales for marking, solar cell manufacturing and engraving continued to drive growth in the region.

Sales in the United States and other North America grew 3.4% year over year. Sales in America benefited from strength in welding and cutting applications which offset the softness in communications. Further, ILT acquisition contributed meaningfully to domestic sales.

Product Details

Sales of high-power CW lasers (64.1% of total revenues) surged 37.3% from the year-ago quarter. Moreover, management also noted that demand for 6 kilowatt ultra-high power CW lasers gained momentum.

Medium-power CW laser sales (6.0% of total revenues) increased 8.8% as increased demand for fine welding and 3D printing mitigated softness in cutting. Management noted that within the lower-end cutting applications, many OEMs are moving away from medium-power to high-power lasers at 1 kilowatt and 1.5 kilowatt.

Sales of low-power CW lasers (1.1% of total revenues) climbed 15.76% from the year-ago quarter.

Pulsed lasers sales (10.6% of total revenues) grew 17.9% year over year. Sales of new green and high-power pulsed lasers across broad-based applications drove results. Sales of low-power pulsed lasers for marking and engraving applications also contributed significantly.

An expected reduction in demand pertaining to the smart-phone investment cycle led to a 24.2% decline in the sales of QCW lasers (4.5% of total revenues) on a year-over-year basis. However, management anticipates IPG Photonics’s rich laser technology portfolio to enable it to capture market share, given the increasing complexity of new smart-phones, from non-laser processing.

Other products revenues (13.7% of total revenues) advanced 20.8% year over year due to solid sales growth witnessed across systems and beam delivery accessories.

Operational Details

IPG Photonics reported gross margin of 56.5%, which expanded 150 basis points (bps) on a year-over-year basis and came ahead of management’s guided range of 50-55%. This can be attributed to improved cost reductions, manufacturing efficiency and favorable product mix that offset lower average selling price (ASP).

As a percentage of revenue, sales & marketing expenses, R&D expenses remained flat year over year. However, G&A expenses increased 80 bps. Consequently, operating margin expanded 371 bps from the year-ago quarter.

Balance Sheet & Cash Flow

IPG Photonics ended the first quarter with $1.18 in cash & cash equivalents and short-term investments up from $1.12 billion reported in the previous quarter. Total debt outstanding was $48 million down from $49 million in the previous quarter.

However, the company generated $100 million in cash from operations down from the previous quarter’s figure of $108 million. Further, it incurred $39 million to finance capital expenditure up from $27 million in the previous quarter.

During the first quarter, IPG Photonics bought back 83K shares for $20 million. Notably, since the buyback program began in July 2016, the company has repurchased 461K shares for $69 million.

Outlook

IPG Photonics expects sales in the range of $400-$430 million for the second quarter of 2018, reflecting 8-15% growth from the year-ago quarter.

Earnings are projected in the range of $2.05-$2.35 per share, which reflects an increase of 7-23% from the year-ago quarter.

For 2018, management reiterated the outlook. IPG Photonics continues to expect revenue growth in the range of 10-15%.

IPG Photonics anticipates capital expenditure for 2018 in the range of $170-$190 million, or approximately 8-12% of revenues.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter.

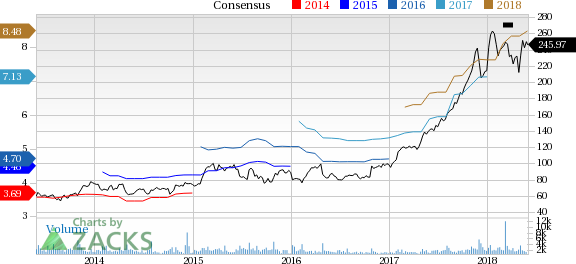

IPG Photonics Corporation Price and Consensus

IPG Photonics Corporation Price and Consensus | IPG Photonics Corporation Quote

VGM Scores

At this time, IPGP has a strong Growth Score of A, though it is lagging a lot on the momentum front with a C. However, the stock was allocated a grade of F on the value side, putting it in the bottom 20% quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. It comes with little surprise IPGP has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IPG Photonics Corporation (IPGP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance