IQVIA (IQV) Beats on Q2 Earnings & Revenues, Raises 2021 View

IQVIA Holdings Inc. IQV reported solid second-quarter 2021 results wherein the company’s earnings as well as revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings per share of $2.13 beat the consensus mark by 2.9% and improved 80.5% on a year-over-year basis. Total revenues of $3.44 billion outpaced the consensus estimate by 5.5% and increased 36.4% year over year on a reported basis and 33.2% on constant-currency basis.

Let’s check out the numbers in detail:

Segmental Revenues

Revenues from Technology & Analytics Solutions totaled $1.35 billion, up 22% on a reported basis and 17.9% on constant-currency basis.

Research & Development Solutions’ revenues of $1.89 billion increased 53.1% on a reported basis and 50.7% on constant-currency basis.

Revenues from Contract Sales & Medical Solutions totaled $194 million, up 9.6% on a reported basis and 7.3% on a constant-currency basis.

Operating Performance

Adjusted EBITDA was $722 million, up 49.5% year over year.

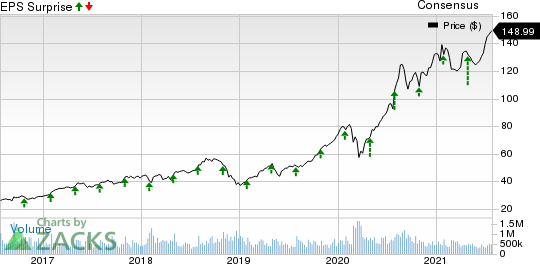

IQVIA Holdings Inc. Price, Consensus and EPS Surprise

IQVIA Holdings Inc. price-consensus-eps-surprise-chart | IQVIA Holdings Inc. Quote

Balance Sheet and Cash Flow

IQVIA exited second-quarter 2021 with cash and cash equivalents balance of $1.81 billion compared with $2.31 billion at the end of the prior quarter. Long-term debt of $12.1 billion was flat sequentially.

The company generated $539 million of cash from operating activities in the reported quarter and CapEx was $145 million. Free cash flow was $394 million.

During the reported quarter, IQVIA repurchased shares worth $45 million. As of Jun 30, 2021, the company had nearly $822 million of share-buyback authorization remaining.

Third-Quarter 2021 Guidance

IQVIA expects third-quarter revenues in the range of $3.29-$3.365 billion. The current Zacks Consensus Estimate of $3.25 billion lies below the guidance.

Adjusted earnings per share are expected between $2.06 and $2.13. Adjusted EBITDA is anticipated between $710 million and $730 million.

2021 Guidance

For the full year, IQVIA now expects revenues in the band of $13.55-$13.7 billion compared with the prior projection of $13.2-$13.5 billion. The current Zacks Consensus Estimate of $13.44 billion is lower than the updated view.

Adjusted earnings per share are expected between $8.70 and $8.90 compared with the prior forecast of $8.50-$8.75. The current Zacks Consensus Estimate of $8.69 falls short of the revised outlook.

Adjusted EBITDA is anticipated between $2.950 billion and $3 billion compared with the prior prediction of $2.900-$2.965 billion.

Currently, IQVIA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Equifax’s EFX second-quarter 2021 adjusted earnings of $1.98 per share beat the Zacks Consensus Estimate by 15.8% and improved on a year-over-year basis. Revenues of $1.23 billion outpaced the consensus estimate by 6.4% and rose 26% year over year on a reported basis and 23% on a local-currency basis.

Robert Half’s RHI second-quarter 2021 earnings of $1.33 per share beat the consensus mark by 26.7% and were up more than 100% year over year. Revenues of $1.6 billion surpassed the consensus mark by 6.5% and surged 42.3% year over year on a reported basis and 40% on an adjusted basis.

ManpowerGroup’s MAN second-quarter 2021 adjusted earnings of $2.02 per share beat the consensus mark by 68.2% and soared above 100%. Revenues of $5.28 billion beat the consensus mark by 2% and jumped 41% year over year on a reported basis and 31.3% on a constant-currency (cc) basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance