Iron Mountain Inc (IRM) Q1 2024 Earnings: Exceeds Revenue Expectations, Aligns with EPS Projections

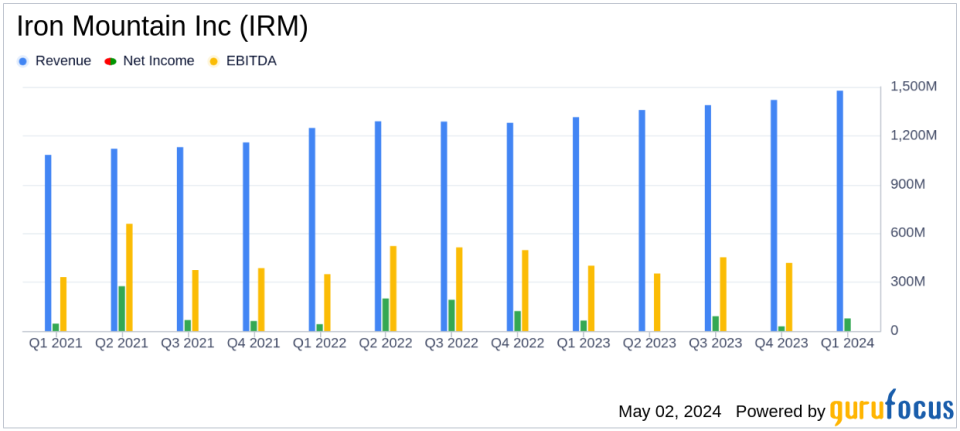

Revenue: Reported at $1,477 million, up by 12% year-over-year, surpassing estimates of $1,453.29 million.

Net Income: Achieved $77 million, an increase of 18% from the previous year, but fell short of estimates of $127.65 million.

EPS (Reported): Recorded at $0.25, up from $0.22 year-over-year, below the estimated $0.42.

EPS (Adjusted): Reached $0.43, slightly above the estimated $0.42.

Adjusted EBITDA: Rose to $519 million, marking a 13% increase year-over-year, driven by growth in storage rental revenue and data center commencements.

AFFO: Increased to $324 million, up 10% year-over-year, supported by improved Adjusted EBITDA.

Dividend: Declared a quarterly cash dividend of $0.65 per share, payable on July 5, 2024, to shareholders of record as of June 17, 2024.

On May 2, 2024, Iron Mountain Inc (NYSE:IRM), a global leader in information management services, announced its first-quarter results, showcasing a strong performance with record revenues and strategic advancements. The detailed financial outcomes are accessible through Iron Mountain's 8-K filing.

Iron Mountain reported a significant year-over-year increase in total revenue, reaching $1.477 billion, up 12.4% from $1.314 billion in the first quarter of 2023. This performance surpasses the analyst's revenue estimate of $1.453 billion. Net income also saw an improvement, totaling $77 million compared to $66 million in the previous year, an increase of 18%. However, the reported earnings per share (EPS) of $0.25 slightly missed the estimated $0.42, though the adjusted EPS of $0.43 was in line with expectations.

Company Overview

Founded in 1951, Iron Mountain operates primarily as a Real Estate Investment Trust (REIT), focusing on storage and information management services. The company's revenue streams are largely derived from its storage operations, complemented by various value-added services. Iron Mountain serves enterprise clients across developed markets, with its business segments including Global Records and Information Management (RIM) Business, Global Data Center Business, and Corporate and Other Business.

Financial Highlights and Strategic Initiatives

The first quarter saw a robust increase in storage rental revenue by 9% and service revenue by 17%. Adjusted EBITDA rose to $519 million, up 13% year-over-year, maintaining a consistent margin of 35.1%. The company's Adjusted Funds From Operations (AFFO) increased by 10% to $324 million, reflecting strong operational efficiency and financial health.

Iron Mountain's strategic initiatives, particularly its Project Matterhorn, aim to enhance integrated solutions and services for customers, supporting sustained growth. The company also reported significant leasing activities in its Data Center segment, with 30 megawatts leased during the quarter.

Balance Sheet and Future Outlook

The balance sheet remains robust with total assets increasing to $17.83 billion from $17.47 billion at the end of 2023. Iron Mountain continues to manage a healthy liquidity position with $191.65 million in cash and cash equivalents. Looking forward, Iron Mountain reaffirmed its full-year 2024 guidance, projecting total revenue between $6.0 billion and $6.15 billion and an Adjusted EBITDA of $2.175 billion to $2.225 billion.

Dividend Announcement

Reflecting confidence in its financial stability and cash flow generation, Iron Mountain's Board of Directors declared a quarterly cash dividend of $0.65 per share for the second quarter of 2024, payable on July 5, 2024, to shareholders of record as of June 17, 2024.

Investor Considerations

Iron Mountain's performance in the first quarter of 2024 demonstrates its capability to generate substantial revenue growth and maintain profitability. The alignment of its reported adjusted EPS with analyst projections, alongside its strategic growth initiatives, positions the company favorably for sustained long-term growth. Investors and stakeholders might view the company's reaffirmed guidance and robust dividend as indicators of a stable investment in the REIT sector.

For detailed financial figures and further information, stakeholders are encouraged to review the full earnings release.

Explore the complete 8-K earnings release (here) from Iron Mountain Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance