Is This 1929 or 1997?

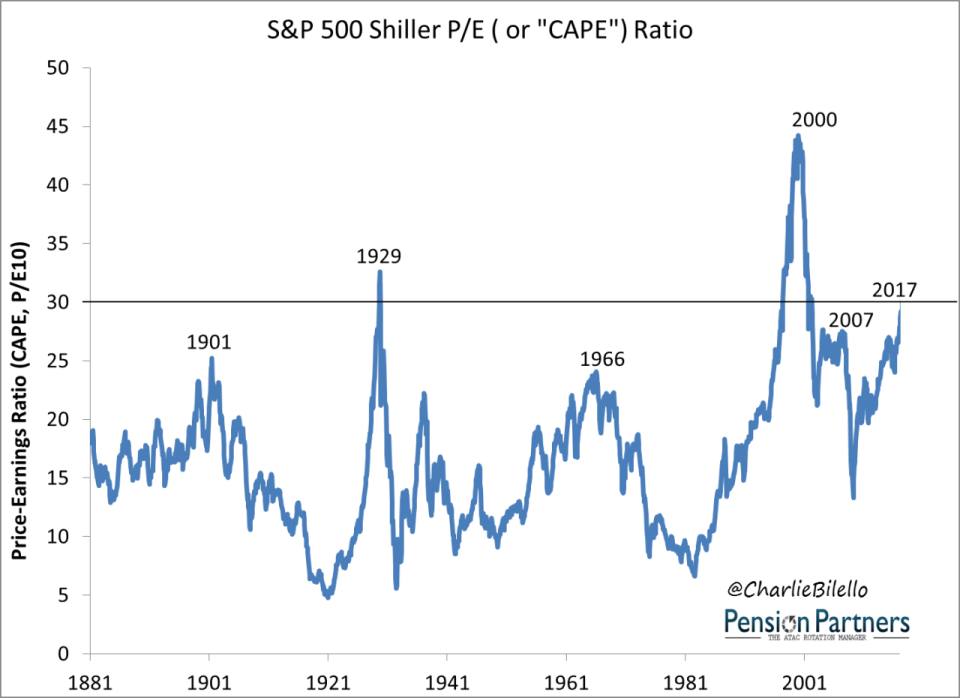

The CAPE Ratio or “Shiller PE” just crossed above 30.

In layman’s terms, what does that mean?

Stock valuations in the U.S. are high.

How high?

Going back to 1871, the only periods in history with a CAPE above 30 were as follows (data from Robert Shiller):

August to September 1929

June 1997 to March 2002

Today

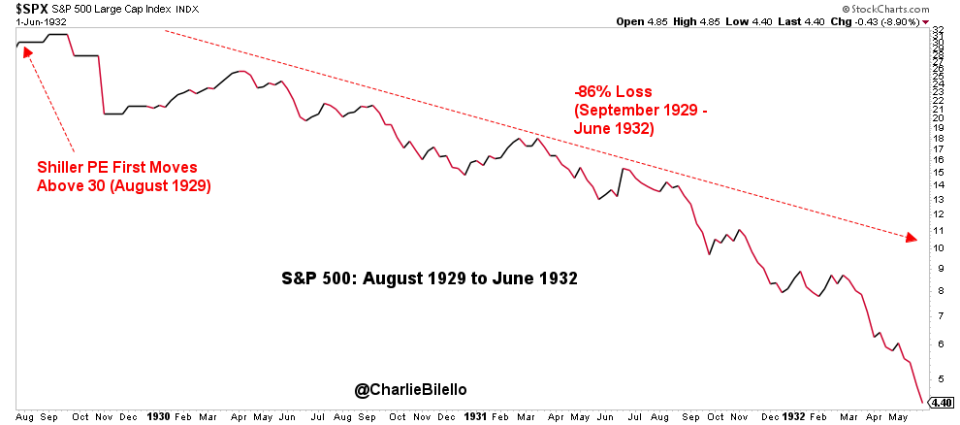

In August 1929, the CAPE ratio moved above 30 for the first time in history. A month later the S&P 500 would hit a generational high. From there, it would fall over 86% before bottoming in June 1932.

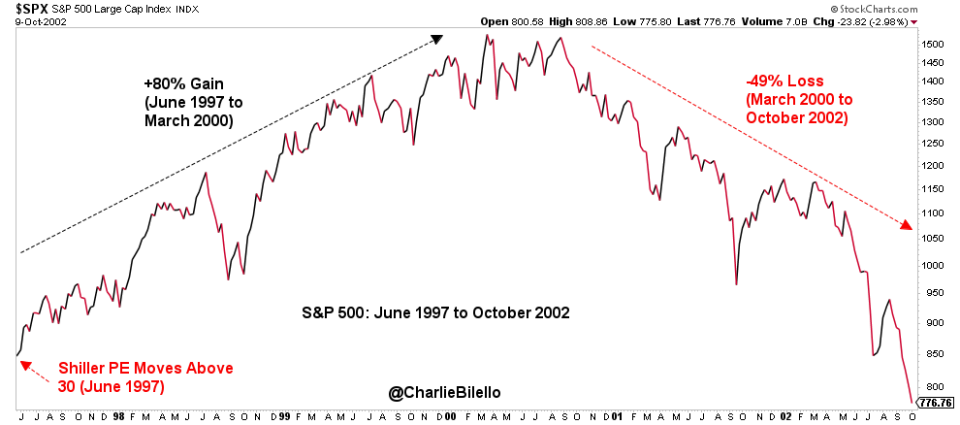

In June 1997, the CAPE ratio moved above 30 for the second time in history. From there the S&P 500 would gain an additional 80% before peaking in March 2000 at a CAPE ratio of 43. From the peak in March 2000 to the low in October 2002, the S&P 500 would give back all of those gains, declining over 49%.

Is this 1929 or 1997?

Neither. This is 2017. No one knows what will happen from here because every time is different. Stocks could fall starting tomorrow or they could run for a few more years, going from “overvalued” to more overvalued. Or they could trade in a sideways range for years to come, frustrating bears and bulls alike. Anything can happen in the short-run and we should be surprised by none of it.

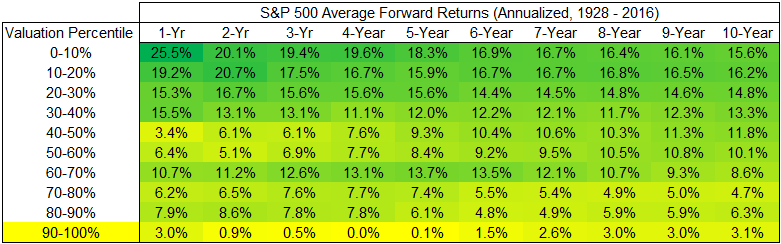

With the CAPE ratio above 30 (>96th percentile), what should investors be prepared for in the longer-run?

Below average forward returns.

Above average forward volatility.

Above average forward maximum loss.

These are probabilities, not predictions. Objectively, the risk/reward in U.S. equities is less favorable today than it has been in some time. That says nothing about what will happen tomorrow, but if the price one pays for something still matters, will be a factor weighing on returns for years to come.

After the CAPE ratio hit 30 in 1929, the S&P 500 would trade at the same level 25 years later, in 1954 (note: price only, not including dividends).

After the CAPE ratio hit 30 in 1997, the S&P 500 would trade at the same level 12 years later, in 2009 (note: price only, not including dividends).

With the CAPE ratio above 30 once again, how many years into the future will the S&P 500’s current level of 2450 be revisited?

***

Related Posts:

Valuation, Timing, and a Range of Possible Outcomes

To sign up for our free newsletter, click here.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

CHARLIE BILELLO, CMT

Charlie Bilello is the Director of Research at Pension Partners, LLC, an investment advisor that manages mutual funds and separate accounts. He is the co-author of four award-winning research papers on market anomalies and investing. Mr. Bilello is responsible for strategy development, investment research and communicating the firm’s investment themes and portfolio positioning to clients. Prior to joining Pension Partners, he was the Managing Member of Momentum Global Advisors and previously held positions as a Credit, Equity and Hedge Fund Analyst at billion dollar alternative investment firms.

Mr. Bilello holds a J.D. and M.B.A. in Finance and Accounting from Fordham University and a B.A. in Economics from Binghamton University. He is a Chartered Market Technician (CMT) and a Member of the Market Technicians Association. Mr. Bilello also holds the Certified Public Accountant (CPA) certificate.

You can follow Charlie on twitter here.

Yahoo Finance

Yahoo Finance