How to beat HMRC on the last day of the tax year

Illustration credit: María Jesús Contreras

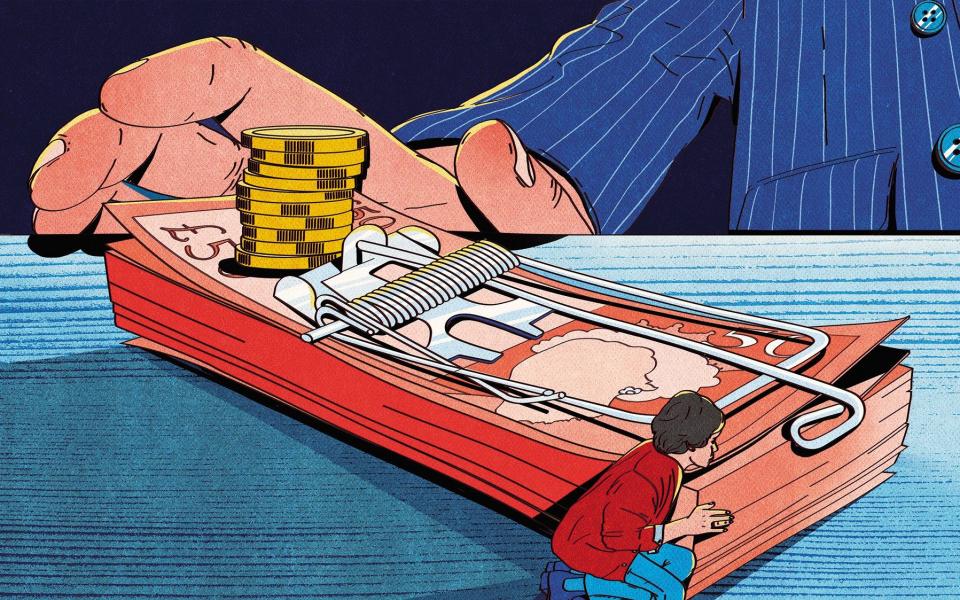

Crucial tax-free allowances for investors are being cut in half from tomorrow, unleashing a "tax tsunami" on savers and investors.

Dividend and capital gains tax allowances are being cut on April 6 to £1,000 and £6,000 a year, from £2,000 and £12,300 respectively. They will be halved again in 12 months’ time.

Around 635,000 people will pay tax in 2023-24 on their dividends as a result of the allowance being cut, Telegraph Money can reveal, making investments held within Isas, which grow free of tax, even more valuable.

By 2024-25, when the allowance is cut again, to £500 a year, an extra 1.1 million will be caught, an Freedom of Information requested submitted to HM Revenue & Customs found.

Laith Khalaf, of stockbroker AJ Bell, said: “A tax tsunami is about to wash up on Britain’s shores as consumers faces hikes in income tax, dividend tax and capital gains tax.”

He added: “It’s never been more important to use tax shelters like Sipps and Isas to protect what you can from the rising tax tide.”

Telegraph Money explains how to protect as much of your wealth as possible from the taxman before the £20,000 Isa allowance expires.

Protecting your investments

The rates on the payouts shareholders receive or profits from selling shares are not changing, but cutting the tax-free limit amounts to a tax rise on investments. Sarah Coles, of Hargreaves Lansdown, Britain’s biggest broker, said the move was “particularly unfair” this year.

“The capital gains tax allowance hasn’t been down at £3,000 for more than 25 years and inflation in the interim has more than halved the buying power of your money,” she said.

There is a double whammy for those who are dragged into higher income tax bands. For example, if you earned just over the higher-rate threshold and made £2,000 from dividends in the current tax year, there would be no dividend tax to pay.

But if you earn the same amount in dividends next year, you would pay 33.75pc on £1,000 – £338. If you made it the following year, you would pay 33.75pc on £1,500 – £506.

Meanwhile, higher-rate taxpayers who made a capital gain of £12,300 this year would owe no tax. But next year earning the same amount would see them pay £1,260 (20pc on £6,300) and £1,860 (20pc on £9,300) in the following year.

Investors with a portfolio that exceeds the £20,000 annual allowance should prioritise shielding their high-yielding investments inside an Isa, in order to save themselves from a dividend tax hit.

Jason Hollands, of broker BestInvest, urged savers who have not yet used up their Isa allowances to act now.

“While it is possible to secure your Isa allowance online right up until midnight on April 5, don’t forget this is when you need to complete rather than commence the process. Leaving opening or funding an Isa until the very last minute is akin to playing roulette.

“All it takes is a dodgy internet connection or problem with a bank transfer and you could lose that allowance forever. I would therefore urge people intending to use their allowance not to leave it until the last couple of hours of the tax year.”

Don’t forget children also have an Isa allowance of £9,000 a year, meaning a family of four can stash £116,000 away in the next few weeks.

Use Cash Isas as rates rise

Income tax is not just levied on your earnings – it is also due on income from bonds and any interest from savings above the personal savings allowance. This is £1,000 for basic rate taxpayers, £500 for higher earners, and £0 for additional rate taxpayers.

The allowance made Cash Isas almost irrelevant for anyone except workers paying the top rate of tax when it was introduced in 2016 but savings rates as high as 4pc mean thousands are now breaching their allowances and having to pay tax on their savings.

Wage inflation also increases the risk that more savers will face an unexpected tax bill this year. If a saver earned £48,269 in the previous tax year, and received interest of £2,000, they would pay tax on £1,000 of savings – resulting in a bill of £200.

But if they then got a 6.7pc pay rise – the average rate of wage inflation – they would cross over into the higher-rate bracket, so the same interest would mean 40pc tax on £1,500 of savings, landing them a £600 tax bill. However, there would be nothing to pay if they had moved their savings into a Cash Isa.

The top rate on an easy-access Cash Isa is currently 3.2pc which may not be high enough to trigger a bill this year. But even if the maths does not quite add up for this year, a Cash Isa still might be the most sensible option if the savings allowance is cut in the future or the continued freeze on income tax thresholds drag you into higher tax bands.

Yahoo Finance

Yahoo Finance