Issa brothers' forecourt firm posts record quarterly profit

The billionaire Issa brothers who are buying Asda have posted record quarterly profits for their petrol station business EG Group.

The update comes days after it emerged that the firm’s auditor Deloitte had resigned, with KPMG replacing it.

The company said it was “pleased” to work with a new auditor and added that Deloitte was still auditing its business in Australia.

It did not comment further regarding a clash with Deloitte over corporate governance and the lack of independent directors.

EG Group said it made underlying profits of $478m (£369m) for the three months to September 30, up 54pc compared with the same period last year. Underlying profits for the nine month period were up 17pc to just over $1bn.

Zuber and Mohsin Issa’s petrol station business has racked up debt of more than €8bn buying forecourts across the world including hundreds of sites in Australia and the US.

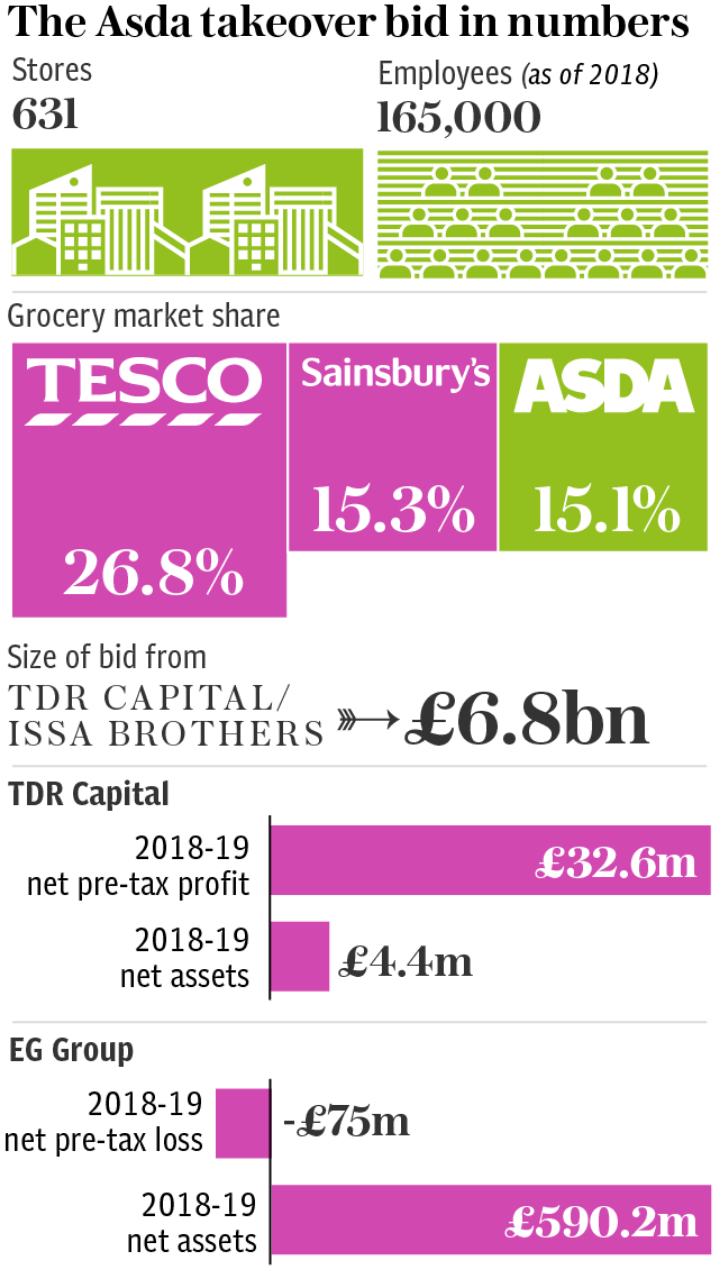

Together with private equity firm TDR, they bought a majority stake in Asda in a £6.8bn deal this month.

Mohsin Issa said: “To deliver such a strong performance … is testament to the resilience and differentiation of our best-in-class, diversified business model.

“While the impact of tightening lockdown restrictions in a number of markets is yet to be fully seen, EG Group is strongly positioned to weather these external challenges and continue driving long-term growth across our global business.”

EG said profits were driven by grocery, merchandise and food service as well as petrol, with most regions now operating less than 20pc down year-on-year in terms of volume despite ongoing guidance to travel less.

Yahoo Finance

Yahoo Finance