ITT to Acquire Svanehoj, Expand Industrial Process Unit

ITT ITT has entered into an agreement to acquire Svanehøj Group A/S for $395 million. The acquisition will boost ITT’s engineered pumps, valves and aftermarket services within the Industrial Process segment. Subject to regulatory approvals, the transaction is expected to close in the first quarter of 2024.

Headquartered in Svenstrup, Denmark, Svanehøj supplies pumps and related aftermarket services to the marine sector. Its product portfolio consists of deepwell gas cargo pumps, fuel and energy pumps and tank control systems.

ITT aims to strengthen and expand its businesses through acquisitions. In May 2023, the company acquired Micro-Mode Products, Inc., expanding its product portfolio and customer base specifically for long-term defense programs. The acquisition has strengthened ITT’s existing North American connectors platform.

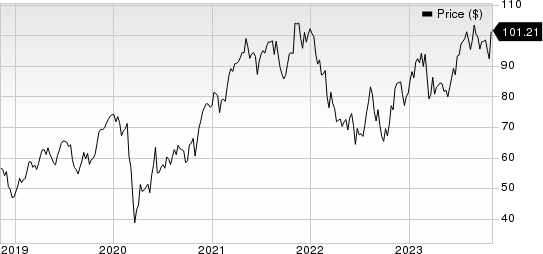

ITT Inc. Price

ITT Inc. price | ITT Inc. Quote

Last August, ITT acquired Clippard Instrument Laboratories’ product lines, expanding its Compact Automation product offering in the robotics, packaging and automation end markets.

In the third quarter of 2023, ITT’s revenues increased 9% year over year on a reported basis and 5% organically, driven by growth in the Industrial Process and Connect & Control Technologies segments. Growth in the aftermarket parts and service and project shipments are aiding the Industrial Process segment. Pricing actions, volume growth in aerospace and defense components, and the acquisition of Micro-Mode are key catalysts to the Connect & Control Technologies segment’s growth.

Zacks Rank & Key Picks

ITT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the Industrial Products sector are as follows:

Applied Industrial Technologies AIT presently carries a Zacks Rank #2 (Buy). The company pulled off a trailing four-quarter earnings surprise of 13.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Applied Industrial has an estimated earnings growth rate of 5.8% for the current fiscal year. Shares of the company have rallied 24.7% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of 14%, on average.

A. O. Smith has an estimated earnings growth rate of 19.4% for the current year. Shares of the company have gained 25% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report