ITV's (LON:ITV) Shareholders Are Down 60% On Their Shares

It is doubtless a positive to see that the ITV plc (LON:ITV) share price has gained some 61% in the last three months. But if you look at the last five years the returns have not been good. After all, the share price is down 60% in that time, significantly under-performing the market.

Check out our latest analysis for ITV

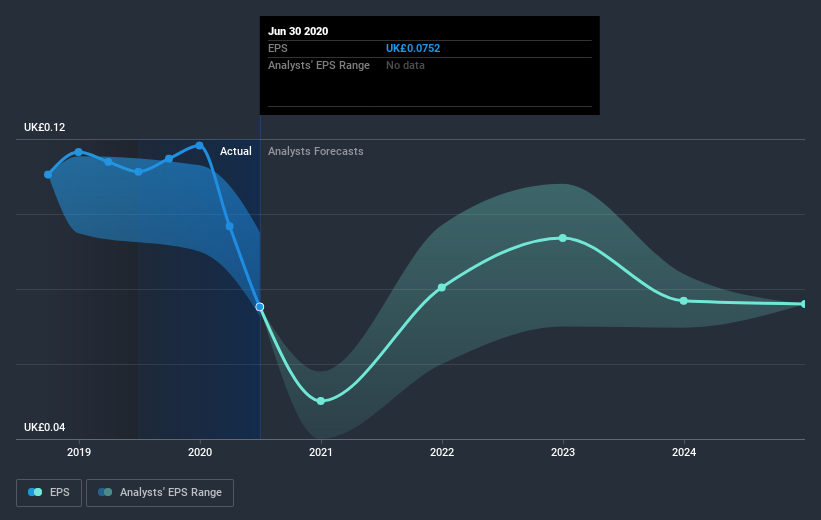

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, ITV's earnings per share (EPS) dropped by 11% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 17% per year, over the period. This implies that the market was previously too optimistic about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered ITV's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for ITV shareholders, and that cash payout explains why its total shareholder loss of 48%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 6.3% in the twelve months, ITV shareholders did even worse, losing 28%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand ITV better, we need to consider many other factors. Take risks, for example - ITV has 3 warning signs we think you should be aware of.

Of course ITV may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance