IWC and Jaeger-LeCoultre owner Richemont says Gen Z and millennials are getting into luxury watches

Sales and profits have jumped at luxury group Richemont as millennials and Gen-Z get into high-end watches.

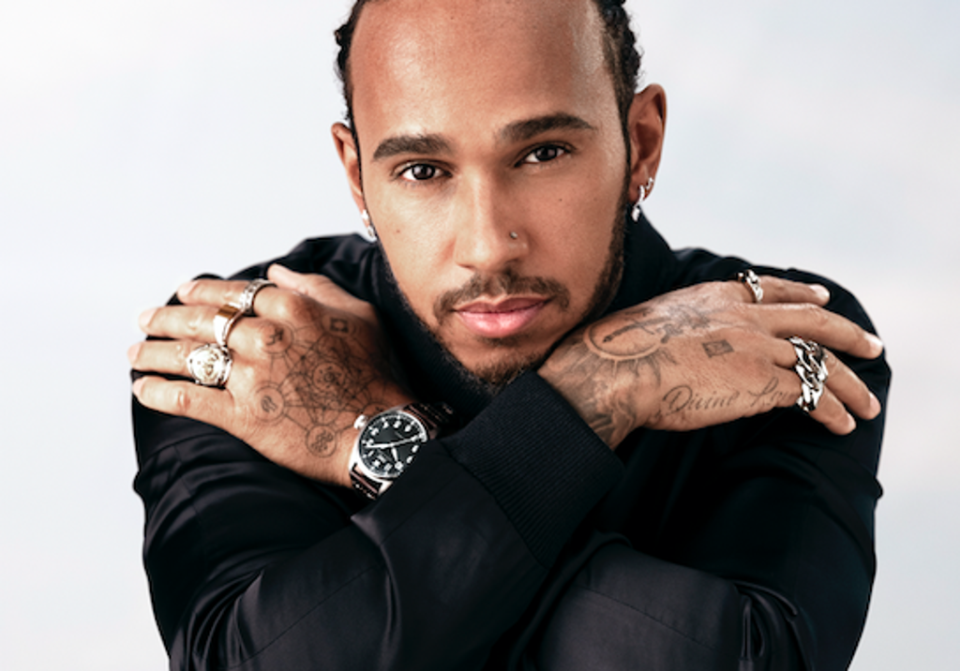

Chairman Johann Rupert noted the “increased appeal of high-quality watches” to both demographics in the Swiss group’s annual results, saying it was a “positive trend” for the future. Richemont owns luxury watch brands such as Jaeger-LeCoultre and IWC, advertised by Formula 1 star Lewis Hamilton.

Announcing results for the 12 months to 31 March, Richemont, which also owns brands including Cartier and Montblanc, said sales jumped 46% to reach €19.2 billion (£16.3 billion) while operating profit more than doubled to €3.4 billion.

Double digit growth was led by the Americas (79%). Sales in Asia Pacific rose by 32%, with mainland China sales growing by 20% compared to the prior year.

Shares in Richemont dropped by more than 10% in early trading, with investors spooked by the relatively slow growth in China.

Harry Barnick, senior analyst at Third Bridge, said: “Today the spotlight is on China, where covid-related restrictions and lockdowns are limiting growth in a market that represents roughly 25% of Richemont‘s sales.”

“With shops shuttered in key markets such as Shanghai and customers unwilling to spend on luxury goods in other cities, the country which electrified 2021 luxury goods consumption could dampen Richemont‘s global outlook in 2022.“

Europe recorded a 51% sales increase, while in the Middle East and Africa sales grew at a similar pace, surpassing Japan as the group’s fourth largest market.

However, the suspension of commercial activities in Russia cost the group €168 million.

Richemont confirmed it was in close contact with its colleagues in Ukraine and Russia, and said the safety and wellbeing of its employees was the group’s “highest priority”.

“Even if the worst of Covid is hopefully behind us, we face a global environment which is the most unsettled we have experienced for a number of years,” Rupert said.

“I am confident that the group is well positioned to benefit from any strength in consumer demand. We will work to maintain the necessary agility and flexibility to manage global uncertainties.”

Yahoo Finance

Yahoo Finance