J&J's Rybrevant Receives FDA Nod for Expanded Use in NSCLC

Johnson & Johnson JNJ announced that the FDA approved a combination therapy involving EFGR/MET inhibitor Rybrevant (amivantamab) for expanded use in certain patients with non-small cell lung cancer (NSCLC).

With this nod, Rybrevant combined with standard-of-care chemotherapy (carboplatin and pemetrexed) is approved for treating patients with locally advanced or metastatic NSCLC with EGFR exon 19 deletions (ex19del) or L858R substitution mutations, whose disease has progressed on or after receiving with an EGFR TKI inhibitor. This combination therapy was approved for a similar indication in the European Union last month.

This latest FDA approval is based on data from the phase III MARIPOSA-2 study, which evaluated the safety and efficacy profile of the Rybrevant-chemotherapy combo in patients with locally advanced or metastatic EGFR ex19del or L858R substitution NSCLC whose disease progressed on or after treatment with AstraZeneca’s AZN blockbuster cancer drug Tagrisso (osimertinib).

The study achieved its primary endpoint — treatment with the Rybrevant-chemotherapy combination reduced the risk of disease progression or death by 52% versus chemotherapy alone in the given patient population.

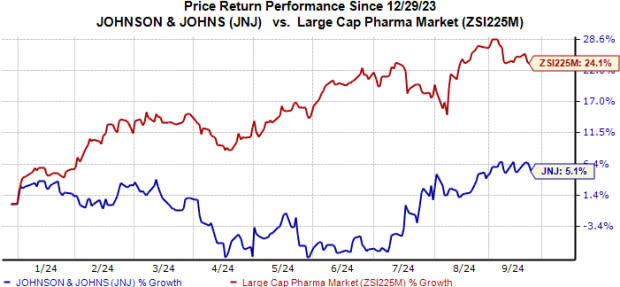

JNJ Stock Performance

Year to date, J&J’s shares have moved up 5.1% compared with the industry’s 24.1% rise.

Image Source: Zacks Investment Research

Recent Developments Related to JNJ's Rybrevant

This is the third FDA approval for Rybrevant this year. Last month, the agency approved the combination of Rybrevant and oral EGFR-TKI inhibitor Lazcluze (lazertinib) for the first-line treatment of adult patients with locally advanced or metastatic NSCLC with EGFR ex19del or exon 21 L858R substitution mutations. In March, the FDA approved the combination of Rybrevant and chemotherapy (carboplatin-pemetrexed) for the first-line treatment of patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations.

Rybrevant is approved as a single agent for treating adults with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations whose disease progressed on or after platinum-based chemotherapy.

Through these approvals, the J&J drug intends to take on AstraZeneca’s Tagrisso, which is the current standard of care for EFGR-mutated NSCLC.

In June, J&J submitted a regulatory filing with the FDA, which seeks approval for a subcutaneous formulation of Rybrevant for all currently approved or submitted indications of the drug. Management claims that the FDA granted a priority designation to this filing last month.

Apart from NSCLC, J&J is also evaluating Rybrevant in other cancer indications. Last week, management reported new data from the phase Ib/II OrigAMI-1 study, which evaluated the combination of Rybrevant plus chemotherapy in certain patients with metastatic colorectal cancer. Patients who received the combo therapy achieved an overall response rate of 49% and a disease control rate of 88%.

JNJ’s Zacks Rank

J&J currently carries a Zacks Rank #4 (Sell).

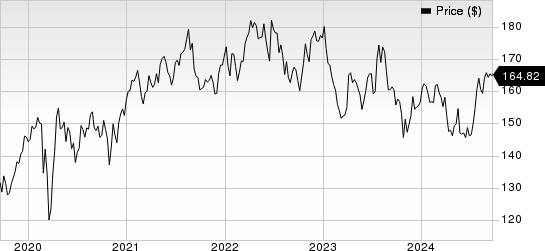

Johnson & Johnson Price

Johnson & Johnson price | Johnson & Johnson Quote

Our Key Picks Among Biotech Stocks

Some better-ranked stocks in the overall healthcare sector are Illumina ILMN and Krystal Biotech KRYS. Each stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Illumina’s 2024 EPS have risen from $1.84 to $3.63. Estimates for 2025 have increased from $3.22 to $4.43 during the same period. Year to date, Illumina’s shares have lost 3.5%.

Earnings of Illumina beat estimates in each of the last four quarters. Illumina delivered a four-quarter average earnings surprise of 463.46%.

In the past 60 days, estimates for Krystal Biotech’s 2024 EPS have risen from $2.09 to $2.38. Estimates for 2025 have increased from $4.33 to $7.31 during the same period. Year to date, Krystal Biotech’s shares have surged 48.7%.

Earnings of Krystal Biotech beat estimates in three of the last four quarters and missed the mark on one occasion. Krystal Biotech delivered a four-quarter average earnings surprise of 45.95%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report