Is J. Smart (Contractors) (LON:SMJ) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies J. Smart & Co. (Contractors) PLC (LON:SMJ) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for J. Smart (Contractors)

How Much Debt Does J. Smart (Contractors) Carry?

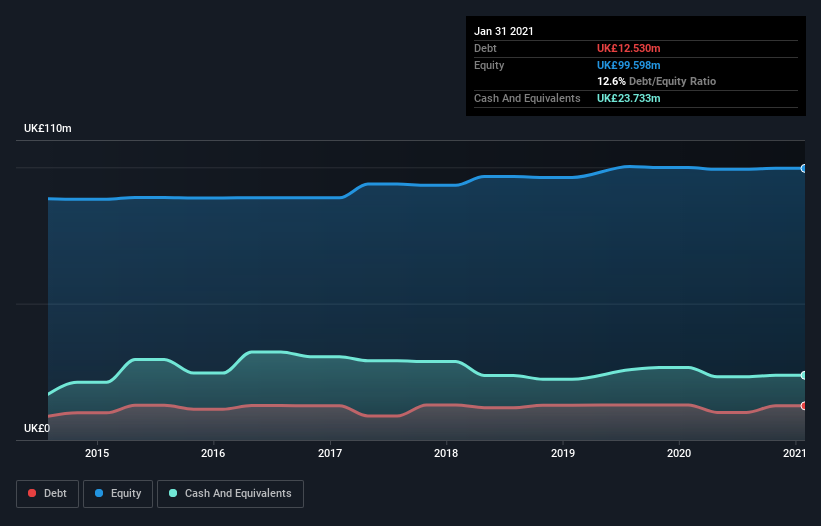

The chart below, which you can click on for greater detail, shows that J. Smart (Contractors) had UK£12.5m in debt in January 2021; about the same as the year before. However, it does have UK£23.7m in cash offsetting this, leading to net cash of UK£11.2m.

How Healthy Is J. Smart (Contractors)'s Balance Sheet?

According to the last reported balance sheet, J. Smart (Contractors) had liabilities of UK£15.2m due within 12 months, and liabilities of UK£2.55m due beyond 12 months. Offsetting these obligations, it had cash of UK£23.7m as well as receivables valued at UK£3.32m due within 12 months. So it can boast UK£9.25m more liquid assets than total liabilities.

This surplus suggests that J. Smart (Contractors) is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that J. Smart (Contractors) has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that J. Smart (Contractors)'s load is not too heavy, because its EBIT was down 23% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is J. Smart (Contractors)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While J. Smart (Contractors) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, J. Smart (Contractors) produced sturdy free cash flow equating to 74% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that J. Smart (Contractors) has net cash of UK£11.2m, as well as more liquid assets than liabilities. The cherry on top was that in converted 74% of that EBIT to free cash flow, bringing in UK£2.0m. So we are not troubled with J. Smart (Contractors)'s debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for J. Smart (Contractors) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance