Jabil Inc. (JBL): Navigating Challenges and Achieving Revenue Milestones for Future Growth

We recently published a list of 16 Best Mid Cap Growth Stocks To Buy Now. In this article, we are going to take a look at where Jabil Inc. (NYSE:JBL) stands against other best mid cap growth stocks.

50 Basis Point Reduction: Exaggeration or Hidden Benefit?

Recent discussions among financial strategists emphasize the current stock market dynamics, particularly regarding the upcoming US elections. Investors are encouraged to view dips in stocks of some sectors as long-term buying opportunities, as historical trends suggest that 10% corrections can be advantageous entry points.

While recent sell-offs were driven by sector-specific issues rather than broader economic concerns, the long-term outlook remains positive. Despite recession worries, the US economy is stable, with strong consumer performance and corporate profits exceeding expectations. This has contributed to a rebound in the NASDAQ and S&P 500.

Inflation has reportedly dropped to a three-year low of 2.6% in August, marking the lowest rate since March 2021. As inflation continues easing, there has been ongoing speculation that the Fed may begin cutting interest rates, potentially starting with a 25 basis point reduction.

Market analysts, including Gene Goldman and Craig Johnson, anticipate multiple rate cuts due to slowing inflation and economic growth. We discussed this earlier in our article about the 12 Best Small Cap Tech Stocks to Buy. Here’s an excerpt from it:

“Gene Goldman expressed that his base case anticipates 3 rate cuts of 25 basis points each, beginning in September. His belief lies in the slowing inflation, a deceleration in economic growth, and the overall resilience of the economy, which he thinks is not as dire as some reports suggest. Goldman noted that while the labor market showed mixed signals, with both positive and negative data, the market’s expectations for deeper rate cuts may be exaggerated….

Craig Johnson was also of the opinion that a 25 basis point cut is already anticipated by the market, suggesting that a 50 basis point cut could raise concerns among investors. He believes that a series of 25 basis point cuts would align with their perspective. Craig emphasized the importance of staying calm considering that, historically, October has been a strong month for the markets, with gains observed 86% of the time since 1929.”

However, on September 16, Erika Najarian, UBS senior equity research analyst, mentioned that small and mid-cap stocks could potentially benefit from a 50 basis point cut.

Najarian attributes the recent underperformance of financial stocks to market concerns about the implications of potential rate cuts for economic stability, leading investors to question a less favorable economic outlook. She believes some anticipated cuts may already be reflected in money center bank stock prices due to their strong year-to-date performance. A 50 basis point cut could especially benefit mid-cap stocks affected by commercial real estate issues.

She explains that a 50 basis point cut would significantly impact net interest income. Money center banks benefit more from rising rates, while mid-caps are liability-sensitive and may see deposits repriced faster, favoring them if rates are cut aggressively.

The recent Basel III news with lower capital thresholds triggered negative stock reactions, exacerbated by JPMorgan’s comments on reduced investment banking and trading growth targets. Factors included ongoing Basel III discussions since December 2023 influencing pricing, a leading bank suggesting consensus net interest income expectations are too high, casting doubt on other banks, and emerging signs of consumer weakness potentially spreading beyond lower-income segments.

Najarian highlights the challenges analysts face in predicting net interest income due to shifting rate expectations. While higher rates have traditionally benefited bank profitability, potential cuts create uncertainty about financial performance. She points out that banks must choose between cutting rates to remain competitive or maintaining volume, complicating forecasts for net interest income.

As Najarian emphasizes the uncertainty surrounding interest rate cuts and their effects on the financial sector, and investors await clarity from the Fed, we’re bringing you a list of the 16 best mid-cap growth stocks to buy now.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

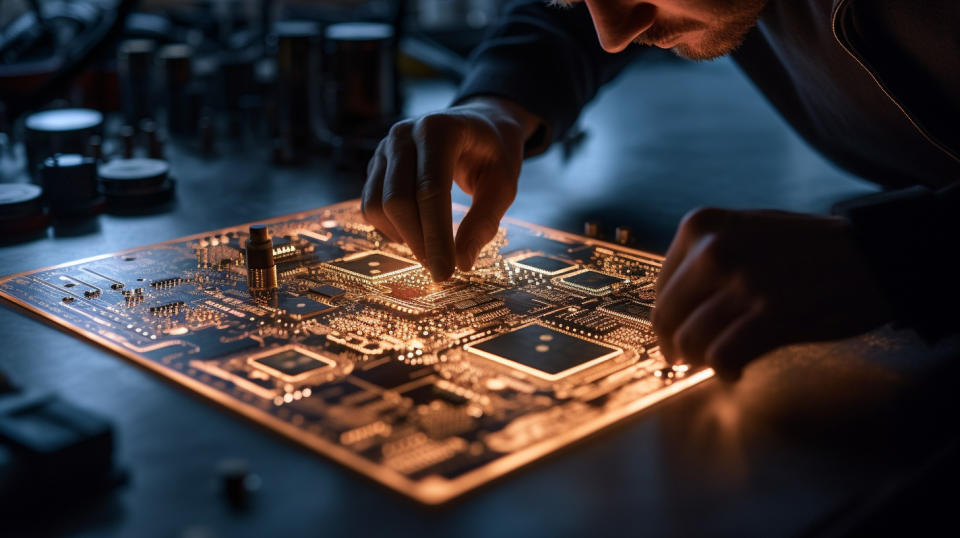

A technician overseeing an application-specific integrated circuit design, etched on a metallic plate.

Jabil Inc. (NYSE:JBL)

Market Capitalization as of September 13: $12.01 billion

Number of Hedge Fund Holders: 51

Jabil Inc. (NYSE:JBL) is a global manufacturing company involved in the design, engineering, and manufacturing of electronic circuit board assemblies and systems, along with supply chain services, primarily serving original equipment manufacturers, and helping several industries bring their products to market efficiently and cost-effectively.

In FQ3 2024, the company repurchased 3.7 million of its shares for about $500 million, leaving approximately $700 million remaining from its $2.5 billion share repurchase authorization in late May.

The company’s revenue declined 20.18% year-over-year in the same quarter, and came to $6.77 billion. This was still higher than estimates by $235.38 million. DMS segment revenue was down approximately 23%, driven by the mobility divestiture. EMS revenue was down roughly 18%, driven by lower revenue in end markets like 5G, renewable energy and digital print, offset slightly by good growth in cloud.

The healthcare sector is experiencing softness in medical devices, which may impact short-term revenue. However, this decline is offset by strong performance in connected devices and AI data centers, with other markets meeting expectations. It plans to benefit from the world’s increasing demand for AI data center infrastructure, healthcare, pharma solutions, and automated warehousing.

Jabil Inc. (NYSE:JBL) is well-positioned for future growth, having successfully navigated a dynamic environment while achieving significant revenue milestones. The company remains focused on strategic investments, including a commitment to share repurchases, and is positioned to deliver value to shareholders while addressing evolving market demands.

Artisan Mid Cap Fund stated the following regarding Jabil Inc. (NYSE:JBL) in its fourth quarter 2023 investor letter:

“Along with DexCom, notable adds in the quarter included Quanta Services and Jabil Inc. (NYSE:JBL). Jabil provides outsourced manufacturing services to a diverse set of end markets and customers. For two decades, Jabil focused on manufacturing to customer-specified blueprints, which inherently carried low margins (2%–3%), a problem further exacerbated by Asian competition. However, in 2017, Jabil commenced a strategic pivot to focus on manufacturing high-growth, low-volume and high-value products in areas such as health care, industrial, automotive, cloud and 5G infrastructure. We believe moving away from more cyclical consumer electronics markets toward secular growth areas, such as EVs and medical devices, will lead to both faster growth and higher margins. Like other electronic components providers, Jabil saw slowing demand late in the year and lowered its fiscal 2024 outlook as a result. However, consistent with our thesis that Jabil has shifted its business mix toward more profitable, higher growth end markets, the company’s earnings and cash flow outlook remains relatively strong despite the cyclical pressures. Furthermore, the company sold its smartphone manufacturing business late in the quarter, which removes a low-growth, low-margin legacy exposure, further shifting its business mix in the right direction. We used the stock’s underperformance to increase our GardenSM position ahead of what we expect to be a compelling profit cycle once the current macro headwinds abate.”

Overall, JBL ranks 4th on our list of best mid cap growth stocks to buy now. While we acknowledge the potential of JBL as an investment, our conviction lies in the belief that AI stocks hold great promise for delivering high returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than JBL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.