Jacobs (J) Selected as PMCM Partner by thyssenkrupp Steel

Jacobs Solutions Inc. J is selected as a Program and Construction Management (“PMCM”) partner by thyssenkrupp Steel for its $2.5 billion worth decarbonization project.

Jacobs, as a PMCM partner, will deliver services that include the overall coordination and management of engineering services, assembly management of the Engineering Procurement Construction contractor for the direct reduction plant, construction management and supporting contract management and other related services.

This project, for the steel mill in Duisburg, Germany, will incorporate a new process, that uses green hydrogen for iron reduction, and will replace traditional coal-powered blast furnaces with hydrogen-powered electric smelters. Per the project, the decarbonized steel plant is scheduled to start its operation by 2026 end. This plant is expected to produce 2.5 million metric tons of direct reduced iron and reduce carbon emissions by up to 3.5 million metric tons per year.

Following this contract win announcement, shares of Jacobs gained 1.2% during trading hours on Nov 20.

Solid Backlog Driving Growth Prospects

Jacobs has been experiencing increased demand for consulting services in various sectors, including infrastructure, water, environment, space, broadband, cybersecurity and life sciences. The company's strong performance in recent quarters can be attributed to efficient project execution and the ongoing contract wins bear testimony to the fact.

Efficient project execution has been a key factor driving Jacobs’ performance over the last few quarters. This is reflected in the solid backlog level, which was $28.9 billion at the end of the third quarter of fiscal 2023, representing a 2.9% increase from the prior year.

Although foreign exchange risks, high costs and expenses are major concerns, Jacobs expects to benefit from the strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply-chain investments in the upcoming period. This will help the company to maintain positive momentum in the near term.

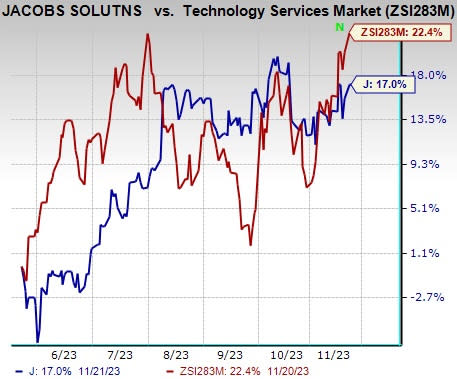

Image Source: Zacks Investment Research

Shares of this provider of professional, technical and construction services have increased 17% in the past six months compared with the Zacks Technology Services industry’s 22.4% growth. Even though the shares of the company underperformed its industry, its consistent contract wins are likely to boost its growth prospects.

Zacks Rank & Key Picks

Jacobs currently carries a Zacks Rank #4 (Sell).

Here are some better-ranked stocks that investors may consider.

Acuity Brands, Inc. AYI currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AYI delivered a trailing four-quarter earnings surprise of 12%, on average. The stock has declined 6.4% in the past year. The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and earnings per share (EPS) indicates a decline of 3% and 4.7%, respectively, from a year ago.

M-tron Industries, Inc. MPTI presently flaunts a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 290.7% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Construction Partners, Inc. ROAD currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 10.6%, on average. Shares of ROAD have rallied 54.7% in the past year.

The Zacks Consensus Estimate for ROAD’s fiscal 2024 sales and EPS indicates an improvement of 14.6% and 47.1%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance