JAKKS Pacific Relies on Partnerships to Fight Sales Slump

JAKKS Pacific, Inc. JAKK, like most other traditional toy makers, has been bearing the brunt of soft consumer demand and a crunch in sales. To navigate such challenges, the Malibu-based toymaker is relying on strategic mergers and joint ventures, collaborating with popular brands and movie franchisees to drive revenues.

JAKKS Pacific Gains From Acquisitions & Partnerships

JAKKS Pacific has emerged as a diversified consumer products company, buoyed by a string of acquisitions over the past several years. We consider the company’s ability to successfully identify, close, and integrate acquisitions to be one of its primary competitive advantages. Through innovative partnerships, JAKKS Pacific aims to enter new categories and thereby gain market share in a competitive industry.

Meanwhile, the company has collaborations with Disney, Skechers, Nickelodeon, Cabbage Patch Kids and Chico to manufacture toys and merchandise related to these brands. Also, the company’s licensing agreements with popular movie and television franchises like Time Warner’s Cartoon network, Warner Bros. Consumer Products, LAFIG and Sony Pictures Consumer Products, and Universal Pictures are expected to boost sales, as merchandise based on movies enjoys immense popularity. Classic toys based on popular television shows and movies, large-scale figures based on action entertainment and Pre-School toys are liked by kids and are expected to be major top-line growth drivers for the company.

Notably, since the beginning of 2017, the company entered into multiple licensing agreements spanning across varied product lines, which hit stores throughout the year. Further, developing products specifically for alternative sales channels — including drug and grocery stores, as well as specialty stores — has proven to be successful with both domestic and international customers.

Challenging Retail Environment & Toys ‘R’ Us Fiasco Remain Potential Headwinds

Despite moderate improvement in economic growth, the retail industry for toys continues to experience a sluggish demand. This is because traditional toymakers are facing intense competition from a wide range of alternative entertainment modes like video games, MP3 players, tablets, smartphones and other electronic devices. Continuous competition from technology-based gaming companies is thereby posing a threat to JAKKS Pacific’s market share.

Meanwhile, Toys "R" Us, United States’ largest independent toy seller, filed for bankruptcy in last September. The company recently confirmed that it is liquidating its entire U.S. operations (735 Toys "R" Us and Babies "R" Us stores). Liquidation sales started on Mar 23.

With this chain going out of business, the industry is expected to grow at a much slower pace for quite some time. JAKKS Pacific, along with its famous peers like Hasbro HAS and Mattel MAT will be affected, as a considerable portion of their revenues were generated from sales to Toys "R" Us.

JAKKS Pacific, being a smaller player among its peers, will be hit harder because existing retailers like Amazon AMZN are likely to give preference to established brands in their limited shelf space. Further, Toys "R" Us’ exit will hurt innovation in the industry as it was the only major toy seller that promoted new products.

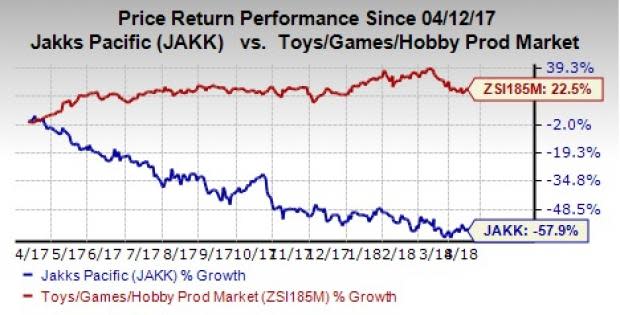

Meanwhile, shares of JAKKS Pacific have lost 57.9% in the past year, underperforming the industry’s gain of 22.5%. Also, the company has incurred losses in nine of the trailing 12 quarters. Given the challenging retail environment for toys, we remain doubtful about much improvement in the stock's performance.

Zacks Rank

JAKKS Pacific carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Mattel, Inc. (MAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance