Janus (JBI) Boosts Product Portfolio With Noke Ion's Launch

Janus International Group, Inc. JBI announces the release of Noke Ion, the newest addition to its Noke Smart Entry products line.

This new product is a hardwired smart locking system, which is magnetic and fits on the inside track of the door, thus showcasing an innovative and simplified design. This low voltage powered smart locking system has customization options through LED lights and motion sensors and aligns with a cloud native software portal. Furthermore, its mobile application is customer friendly and offers easy accessibility, while the robust manager mobile app makes the operating facility much smoother.

Paired with the JBI Noke Smart Entry platform’s already existing product, Noke ONE, Noke Ion will jointly offer a solution for all self-storage smart access applications. Noke ONE is a high-tech, battery-powered external smart lock.

Shares of Janus declined 2.4% during the trading hours on Apr 2, 2024.

Product Innovation Bodes Well

Janus primarily focuses on achieving long-term growth targets by expanding its position in its end markets, increasing the Noke Smart Entry system adoption by its self-storage customers, driving efficiencies across the platform along with executing strategic and value-accretive mergers and acquisitions.

Regarding the Noke Smart Entry system, the company witnessed 66.3% year-over-year unit growth to 276,000 in 2023. Also, the complete backend migration of the Noke Smart Entry system to Amazon Web Services, Inc. in October 2023 complemented this uptrend. This migration allowed Noke to ensure its digital innovation by leveraging Amazon Web Services’ leading industrial Internet of Things, Artificial Intelligence and security capabilities.

Apart from its focus on the expansion of the product portfolio and adoption of the Noke Smart Entry system, Janus also seeks accretive inorganic growth opportunities to support its uptrend. It states that the potential merger and acquisition pipeline remains strong through 2024.

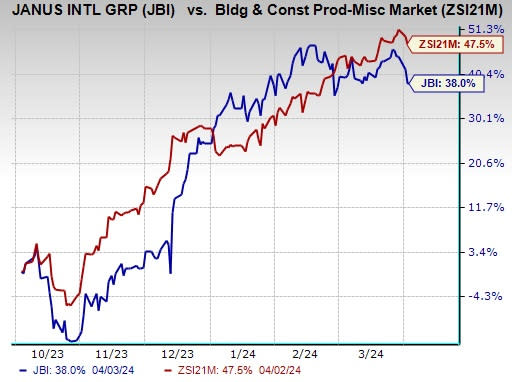

Image Source: Zacks Investment Research

Shares of this manufacturer and supplier of turnkey solutions gained 38% in the past six months compared with the Zacks Building Products - Miscellaneous industry’s 47.5% growth. Although the shares of the company have underperformed its industry, its focus on the efficient execution of business growth strategies, especially through the expansion of Noke Smart Entry system adoption, is likely to ensure possibilities of an outperformance in the near term.

Zacks Rank & Key Picks

Janus currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

Armstrong World Industries, Inc. AWI currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AWI delivered a trailing four-quarter earnings surprise of 13.1%, on average. The stock has surged 69.6% in the past six months. The Zacks Consensus Estimate for AWI’s 2024 sales and earnings per share (EPS) indicates growth of 4.1% and 7.9%, respectively, from the prior-year levels.

Vulcan Materials Company VMC currently sports a Zacks Rank of 1. VMC delivered a trailing four-quarter earnings surprise of 19.5%, on average. The stock has gained 29.8% in the past six months.

The Zacks Consensus Estimate for VMC’s 2024 sales and EPS indicates an improvement of 1.3% and 19.7%, respectively, from a year ago.

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 20.4%, on average. Shares of STRL have increased 44% in the past six months.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 11.4%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance