Japan's New Economy Depends on Robots and Tourism

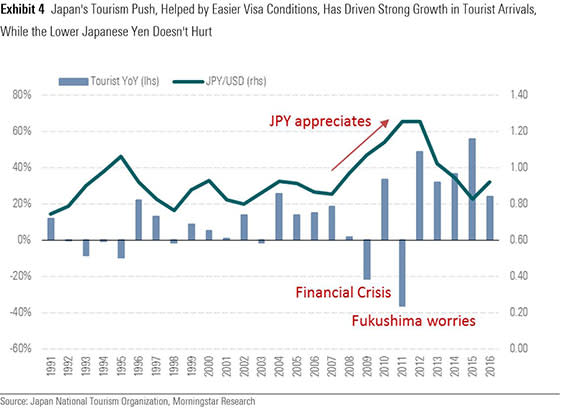

With an ageing population and sluggish domestic demand, the Japanese government sees tourism as a key growth driver for their economy. The Tokyo Olympics in 2020 will be a crucial test for the country’s ability to attract visitors.

Japan is targeting 40 million tourists by 2020. This is double its original goal after the country attracted almost 20 million visitors in 2015, four years ahead of schedule. Following the Tokyo Olympics, the target rises to 60 million visitors by 2030, which the country hopes will drive 15 trillion yen in spending. According to the World Travel and Tourism Council, direct and indirect contributions from tourism are forecast to make up 8.2% of Japan's GDP by 2027, up from 7.4% in 2016; the global average is around 10%.

While Morningstar analysts think the enhancement of facilities to meet the tourism influx is likely to make up a good portion of the contributions to GDP, we're more interested in the sustainable benefits to Japanese brands. We think the tourism push provides a platform for Japanese brands to boost exports, and in our view, cosmetics and personal-care brands are already benefiting.

Because of concerns over counterfeits and poor-quality local brands, and with Japan known for making high-quality products, items carrying the "Made in Japan" label are resonating with Chinese tourists, as well as other Asian buyers. We've seen this trend with Australian and New Zealand dairy products too, but the influx of tourists to Japan from China and the rest of Asia will help expand knowledge of Japanese brands. Monetising this brand awareness depends, of course, on the companies' ability to build on this tourism platform, and the proliferation of online shopping platforms is making it easier for Japanese brands to sell into China.

Tokyo Olympics and Casinos

Current estimated spending on the Tokyo Olympics is $16.8 billion, of which around $10 billion is allocated for facilities and infrastructure, $4 billion for services, and the balance as buffer. The cost of the Tokyo Olympics is equivalent to only around 0.3% of Japan's nominal GDP in 2016, and so the direct economic impact is limited.

However, the boost in terms of sprucing up hospitality facilities is ongoing, and research from the Bank of Japan estimates that this should peak in 2017-18, adding to these two years' GDP growth by around 0.4%-0.6%. More importantly is the realisation that the construction aspect of the games is only a short-term boost and that the ongoing positive impact will be driven by continued investment in promoting Japan as a travel destination.

Hence, while casinos are unpopular with the Japanese public, we think they are more likely than not to be introduced in Japan, and this should take place after the Olympics. We think the casinos or integrated resorts (IRs) will have a longer-term sustained impact on visitor arrivals relative to the Olympics, which is a one-off event and based only in one city. The IRs could encourage repeat visitors.

While it's still early to speculate, we think leading local real estate groups such as Mitsubishi Estate and Mitsui Fudosan may be prime joint-venture partners for international resort operators. Unlike Macau and Singapore, the government will likely mandate that the integrated resorts will have local partners. In fact, Mitsubishi Estate is earmarking 100 billion yen in capital expenditure toward potential projects, in line with government initiatives.

Mitsubishi Estate should be one of the stronger Japanese IR partners, given its experience in both local and overseas hospitality. Moreover, given the company's own exposure to retail and hotel properties, we think any influx in tourists will boost returns on these assets.

Industrial Robotics

Undoubtedly, Japan's ageing demographics are a key cause of its current economic challenges. The country's population peaked in 2010 at around 128 million and is presently declining at a pace of around 300,000 per year, equivalent to a town or village a year. The IMF estimates that the portion of those 65 years and older will make up 40% of the population by 2050.

Pressure from pension commitments will only rise because of Japan's ageing society and shrinking labour pool. In the meantime, conversations with some companies we cover indicate they will invest externally because of uncertain or slow domestic sales growth over the next several years.

The flipside of the ageing problem for Japan is that it has created opportunities for robot makers. In addition, it's not just Japan that is facing the ageing threat, but also China. We project that the working-age population will decline by 20 million by 2026. While this is still a small number relative to China's overall population, it is a trend reversal and portends potentially greater wage cost pressures, especially for the country's manufacturing sector. As a result, China's government has encouraged companies to mechanise in much the same way that Japan has been. One of the strongest growing opportunities is therefore in industrial robotics.

Of the world's four major industrial robot makers, two are Japanese companies: Fanuc and Yaskawa Electric. Both companies have outperformed over a prolonged period on the back of robust earnings growth. However, the ongoing market pullback will provide a more attractive entry level for investors. While robot demand is not immune to global economic events, is facing slowing growth in the smartphone industry, and is sensitive to clients' capital-spending plans, the prospects for growth remain robust over the medium to long term.

We still see potential for increased robot use in Japan itself, where IFR estimates a 5% CAGR through 2019. In fact, industrial conglomerate Mitsubishi Heavy Industries has recently installed a new plant armed by Fanuc's robots to manufacture Boeing fuselage. The same can be said for the US. However, the strongest near-term growth is mainly seen in China, spurred on by government incentives that have sparked robust demand.

Yahoo Finance

Yahoo Finance