Japan Post: Rethinking, Reinventing, Rising

Introduction

Japan Post (TSE:6178) has a rich history that began in 1871 with the establishment of a modern postal service, which initially connected Tokyo with Kyoto and Osaka. Over the years, key milestones included the introduction of registered mail, the completion of a nationwide postal network, and the adoption of the iconic ? mark for the Ministry of Communications in 1887.

The organization expanded its services, adding international mail and postal savings, and joined the Universal Postal Union in 1877. Subsequent developments included the launch of a governmental pension payment service, express mail and various financial services like postal life insurance.

In 2003, Japan Post became a government-owned corporation and, in 2007, the Japan Post Group was established with multiple subsidiaries. Further restructuring occurred in 2012, leading to the formation of Japan Post Co. Ltd., and public listings of its entities on the Tokyo Stock Exchange in 2015. This evolution represents Japan Post's transformation from a traditional postal service to a diversified, modern corporation offering financial and postal services.

Boosting both core and new businesses

Japan Post Holdings Company Ltd. generates income primarily through its core business operations, which encompass postal and domestic logistics, banking and life insurance. The real estate sector is one new business area that Japan Post Group is actively seeking to grow as a significant source of revenue along with other businesses.

Real estate to bring stable recurring income

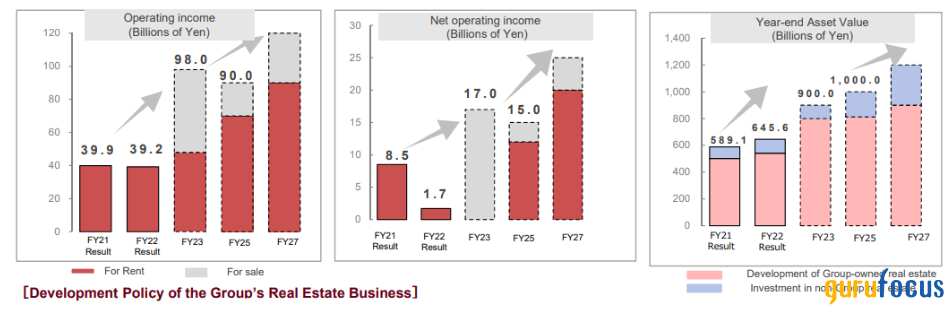

Japan Post Group has been developing high-profitability real estate projects, such as those near train stations, retail establishments, residential properties, etc.

Japan Post Group strategically plans to tap into its 2,600 billion property portfolio, focusing on prime locations in inner-city and station-front areas. The company is prioritizing post office and company housing development for steady rental income, considering local market dynamics and contributions to urban development. Actively acquiring properties in major metropolitan areas, especially central Tokyo, the group diversifies its rental portfolio to include offices, residences, elderly facilities, and logistics centers. With an eye on expansion, Japan Post Group is engaging in calculated real estate investments, weighing factors like use, location, scale, and associated risks.

The below charts showcase their forecast for operating income, net operating income and year-end asset value in the upcoming years.

Source: Japan Post filings

Going digital in banking

In its banking business, the company aims to maintain its network of physical bank branches while simultaneously expanding digital and self-service channels. To this end, it is improving the functionality of Madotab ATMs and self-service terminals, as well as broadening the features offered by the Yucho Bankbook App and the Yucho Reco Personal Financial Management (PFM) App.

Offering sturdy life insurance solutions

When it comes to the life insurance market, in addition to striving to make customers genuinely happy that they selected Japan Post Insurance through better customer convenience and solicitation quality, the company will also continue to develop insurance services that address the needs of clients from all generations for protection up to the age of 100-year life, and will improve their insurance offerings in line with these needs.

Reviving postal business

Japan Post is working to maintain postal service utilisation in the postal and domestic logistics industry. This includes supporting letter-writing workshops, offering a smartphone service that allows users to send traditional New Year's greeting cards, and taking other steps to encourage people to write and receive letters again. In addition, Japan Post is working to improve productivity and efficiency through initiatives like the promotion of DX.

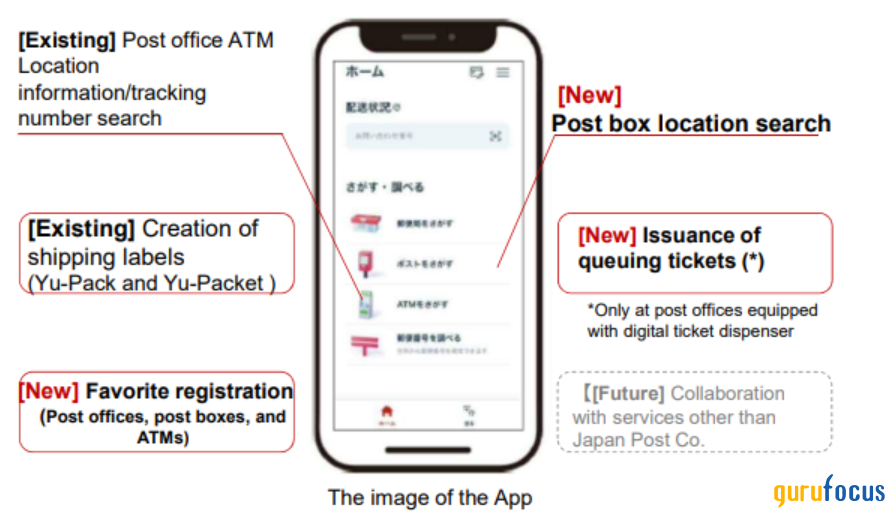

Japan Post Group entered the digital era with the October 2023 launch of the Post Office App. Aiming for digital efficiency, the company plans to consolidate various Group apps, organise customer data systematically, and promote cashless payments at post office counters. The strategic move extends to introducing cashless payments at all directly-managed post office postal counters, enhancing convenience. To provide integrated real and digital services, Japan Post Group operates a Financial Services Contact Center, offering high-value added solutions for the evolving needs of its customers.

Source: Japan Post filings

These diverse revenue streams enable the company to maintain its financial stability and profitability.

Efficient management with vision

The management of Japan Post Holdings Company, Ltd. has played a crucial role in the company's growth. Hiroya Masuda, the CEO of the company has made significant achievements in driving growth by implementing strategic initiatives, enhancing customer accessibility, and ensuring financial inclusion.

In an era marked by rapid technological advancements and evolving customer expectations, the Japan Post Group is setting its sights on a transformative vision - to become a "Co-creation Platform" that actively supports customers and local communities. This vision reflects a commitment to innovation, adaptability, and a seamless integration of traditional services with cutting-edge digital technologies.

Extensive competition

In the bustling financial landscape of Japan, where the titans of industry vie for supremacy, Japan Post Holdings stands as a multifaceted giant, a colossus that extends its influence across both financial and postal realms. As the sun sets on Tokyo, the neon glow of the city reflects off the sleek glass facade of Japan Post Holdings headquarters, a symbol of its dominance.

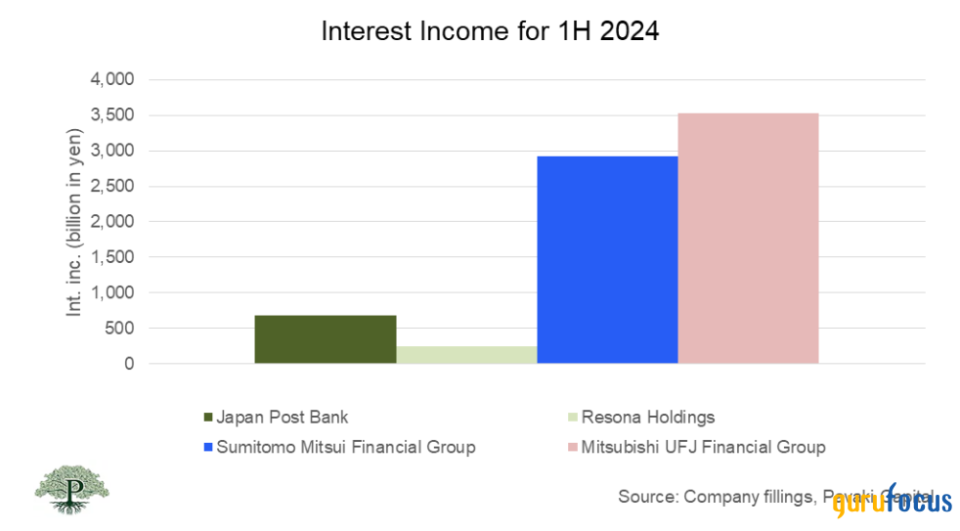

Within the intricate web of financial services, Japan Post Bank emerges as a formidable force, its financial report for the six months ending September 2023 revealed an interest income of 677.6 billion yen. It is a financial powerhouse, catering to the diverse needs of a vast clientele.

Another in on the list is Resona Holdings Inc (TSE:8308) with interest income of 245.87 billion yen as per their financial report ending September 2023. They have been providing a range of financial services, including banking, insurance and asset management through its subsidiaries.

However, in the shadows, Sumitomo Mitsui Financial Group Inc. (TSE:8316) looms large, presenting a robust challenge with its comprehensive suite of financial services. With an annual report reflecting substantial interest income of 2,923.71 billion yen, according to its financial report, it underscores its prowess in the competitive banking industry.

Yet, the plot thickens with the entrance of Mitsubishi UFJ Financial Group (TSE:8306), a stalwart competitor in the realm of banking and asset management. Its financial report for the six months ending September 2023 reveals an impressive interest income of 3,532.39 billion yen, a testament to its significance in the Japanese financial sector.

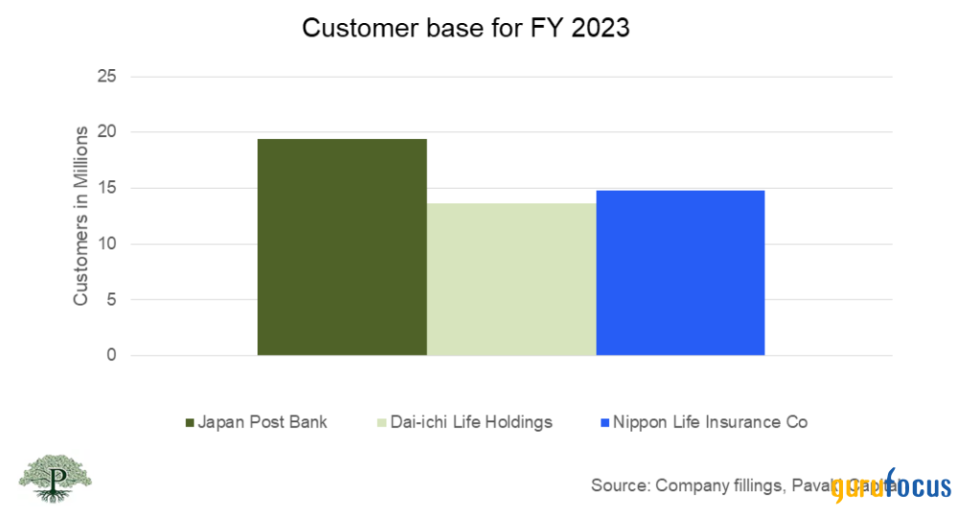

As the financial drama unfolds, the stage transitions to the world of insurance. Japan Post Life takes centre stage, serving a staggering customer base of 19.38 million individuals according to its annual report for the year ending March 2023. A behemoth in the life insurance sector, it casts a wide net, covering a substantial portion of the Japanese populace.

However, the competition is fierce, and Dai-ichi Life Holdings, Inc.(TSE:8750) steps into the spotlight. With 13.62 million customers in Japan's domestic market according to their annual report, it challenges Japan Post Insurance in the relentless battle for supremacy in the Japanese insurance market.

The plot thickens further with the entry of Nippon Life Insurance Co., a formidable rival boasting a substantial customer base of 14.8 million. Its annual report solidifies its standing as one of the leading life insurance companies in Japan, emphasising its commitment to serving a diverse range of policyholders.

The below graph depicts Japan Post leading the competition with the most number of customers amongst its competitors.

Amidst the financial drama, the narrative takes a turn to the realm of postal services. According to their annual report, Japan Post, with its vast network of 24,251 post offices nationwide, weaves an intricate tapestry of postal and financial services for residents across the country. Its international logistics network, spanning approximately 150 countries, paints a picture of global connectivity and influence.

Yet, on the international stage, a rival emerges. The United States Postal Service (USPS), one of the largest postal services globally, stands as a worthy competitor. They have an extensive network of 27,113 post offices nationwide and an international logistics network reaching over 180 countries.

As the tale of Japan Post Holdings unfolds, it becomes clear that the narrative is not just about financial figures and postal networks. It is a story of competition, resilience, and the pursuit of excellence in the dynamic landscape of Japan's financial and postal arenas.

Valuation report

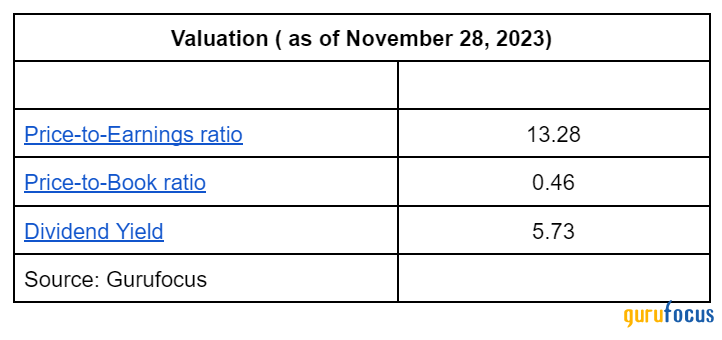

As per Gurufocus, Japan Post Holdings Co's PE ratio stands at 13.28. The PE Ratio today is 13.28, considered a good value compared to the industry average of 14.6x.

The Book Value per Share for Japan Post in the quarter ending Sept 2023 was 2871.43. Consequently, the PB Ratio today is 0.46. Over the last 9 years, the company's PB Ratio has ranged from 0.22 to 0.62, and currently, it's better than 85.34% of 1460 companies in the Banks industry.

Looking at Dividend Yield over the past 9 years, Japan Post Holdings Co's highest was 6.97%, while the lowest was 1.61%. Its Dividend Yield ranks better than 73.73% of 1199 companies in the Banks industry.

Japan Post has had stable share prices and hasn't been significantly more volatile than other Japanese stocks in the last 3 months, typically fluctuating within +/- 3% a week.

Summary

Japan Post is a large company with strong financials. However, some of its businesses, such as the postal division, have been underperforming. To address this, the company is taking measures to boost these businesses, such as forming partnerships, revising rates and implementing cost-saving measures. Additionally, Japan Post is entering into new ventures, like real estate, to provide stable recurring income to the business.

The company's balance sheet is robust, with significant investments in securities, cash and loans. These assets far outweigh the deposits, borrowings, bonds and policy reserves liabilities. This financial position gives Japan Post the strength to weather the current macroeconomic challenges and position itself for future growth opportunities. The new business ventures should start yielding results within the next two to three years.

Overall, Japan Post is a strong company that has the resilience to withstand the challenges and grow in the future.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance