Japanese deal for AI champion Graphcore faces national security review

A proposed Japanese takeover of the British artificial intelligence company Graphcore is facing a national security review amid growing concern over foreign buyers targeting sensitive UK technology.

The inquiry has emerged in the wake of SoftBank, the Tokyo-based tech conglomerate that owns a majority stake in semiconductor company Arm, striking a deal for Graphcore.

It is understood the government review is the final hurdle to the tie-up being announced.

The deal is expected to be worth more than $500m (£400m), but substantially less than the $2.8bn the Bristol-based microchip company was valued at in 2020.

Multiple sources said the takeover was being scrutinised by the Business Department’s investment security unit (ISU).

ISU monitors investments in companies dealing in cutting-edge technology.

Hundreds of transactions are reviewed each year by the ISU, which was set up in 2022 under national security laws. The majority are cleared without restrictions.

Potential deals are often reviewed before investments are agreed and the Cabinet Office can in some circumstances apply conditions to takeovers.

AI tech under increasing scrutiny

Semiconductor and artificial intelligence (AI) technologies have faced increasing national security scrutiny in recent years because of their importance to defence and critical infrastructure.

One City lawyer said: “It would be shocking if the Government wasn’t looking at this given the nature of Graphcore’s business and the sensitivity that the UK has had about acquisitions for UK companies in this sector.”

SoftBank and Graphcore have not yet confirmed takeover talks.

Employees at the company are also believed to have been kept in the dark about developments.

However senior investors are understood to have been updated on the deal.

Graphcore, which develops semiconductors designed for AI software, has been struggling to gain traction amid Nvidia’s domination of the market.

Nvidia’s graphics processors have proved critical for developing and powering AI software, such as OpenAI’s ChatGPT technology.

Demand for its chips has sent the US company’s valuation soaring to more than $3 trillion, as it briefly became the world’s most valuable business in June.

Despite raising more than $700m from technology investors, Graphcore said in its latest accounts that it needed to secure new funding to keep operating.

Its revenues fell by 46pc to $2.7m in 2022 amid the company battling export controls in China.

Talks with SoftBank are believed to have reached a recent breakthrough after wavering for months.

Graphcore recently updated its share structure to clear the way for it to return money to shareholders.

Several shareholders have also raised the value of their stakes in recent months.

Chrysalis Investments, a London-listed investment manager, flagged an unnamed “likely disposal” to investors in December and has more than valued the double of its Graphcore stake.

In interim results released on Friday, Chrysalis said it hoped a deal for the unnamed company “will come to a conclusion in the short-term”.

Earlier investors face loss

Recent valuations by public funds have put Graphcore’s value at between $450m and $1bn.

A sale at that price would mean some earlier shareholders make a loss on their investments, according to company documents.

Graphcore’s structure allows for investors who participated in a $222m funding round in 2020 to make their money back but earlier backers may receive only a fraction of the value of any sale.

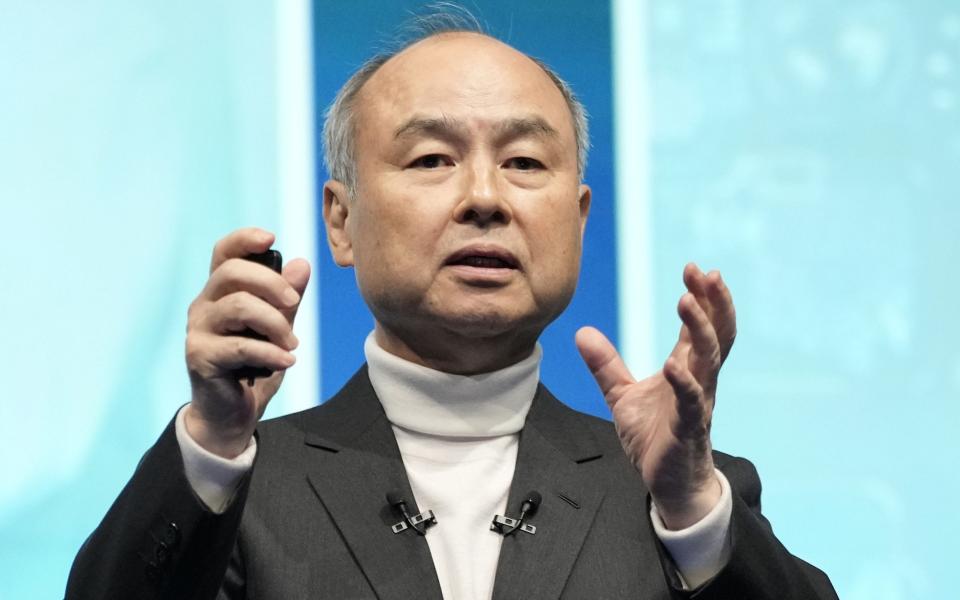

Masayoshi Son, SoftBank’s enigmatic chief executive, has vowed to invest billions of dollars in AI companies – raising an initial $1.8bn to do so this week.

The company also led a recent $1bn funding round for British driverless car company Wayve.

The SoftBank founder, who previously launched the $100bn Vision Fund, recently told investors: “I think I was born to realise ASI [artificial super intelligence].”

Graphcore and SoftBank declined to comment.

Yahoo Finance

Yahoo Finance