Japanese sneaker platform SODA raises $56.4M, acquires rival Monokabu

Just half a year after leading SODA’s Series B, SoftBank Ventures Asia is raising its bet on the Tokyo-based sneaker reselling platform. The early-stage venture capital arm of SoftBank Group announced today it has returned to lead SODA’s Series C, which currently totals $56.4 million.

Other investors include South Korean sneaker reselling platform KREAM (another SoftBank Ventures Asia portfolio company), Altos Ventures and JAFCO.

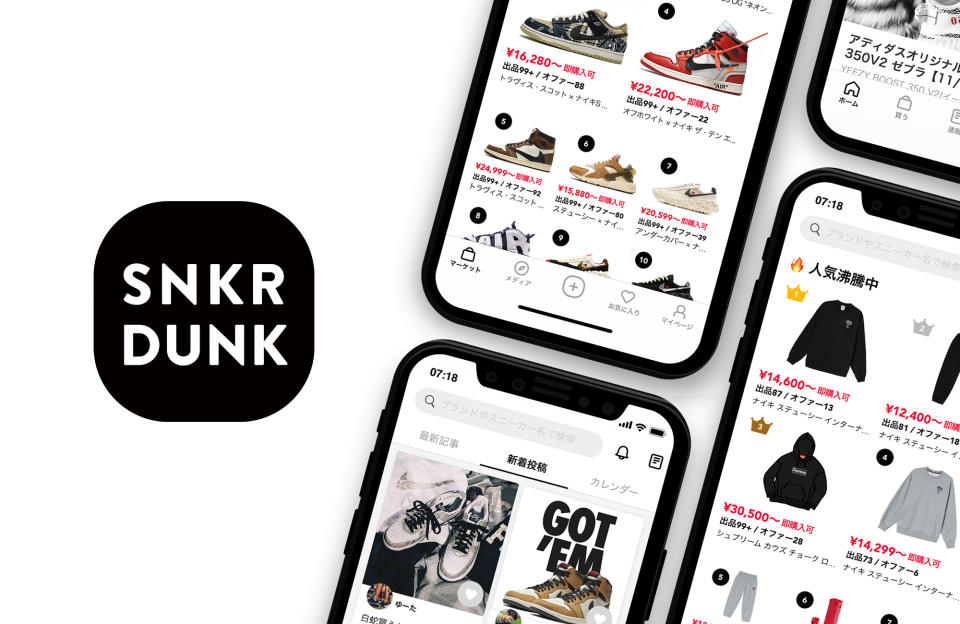

Launched in 2018, SODA runs SNKRDUNK, one of Japan’s largest sneaker reselling platforms with about 2.5 million monthly users. Along with its new funding, SODA announced it has acquired rival Monokabu. SODA said that the deal means its share of Japan’s sneaker resale industry is now 80%, making it the market leader by far.

A SoftBank Ventures Asia spokesperson told TechCrunch the fund decided to invest in SODA again because the company's growth has increased rapidly since its previous funding. SODA's post-money valuation is now about 24 billion Japanese Yen, or about $218 million.

Part of SODA's Series C funding will also be used to expand into other Asian markets, starting with Indonesia and the Philippines next year because both countries have growing e-commerce markets and a large Generation Z population, an ideal combination for SNKRDUNK.

The company's previous funding, its $22 million Series B, was announced in January. At the time, SODA CEO Yuta Uchiyama told TechCrunch that demand for sneakers remained high despite the pandemic's economic impact, adding that increased adoption of online shopping helped drive sales.

SODA claims it hit record sales in May 2021, growing 900% year-over-year. Despite COVID-19, many sneaker C2C marketplaces, like StockX, have also seen their sales increase.

SNKRDUNK will work closely with KREAM to share knowledge about sneaker authentication, inventory management, logistics and other operations-related areas, with the goal of increasing their share of the Asian sneaker reselling market.

In addition to KREAM and SODA, SoftBank Ventures Asia is also an investor in China-based sneaker trading platform Nice.

Yahoo Finance

Yahoo Finance