Jazz (JAZZ) Q1 Earnings & Sales Fall Short of Estimates

Jazz Pharmaceuticals JAZZ reported adjusted earnings of $2.68 per share in first-quarter 2024, missing the Zacks Consensus Estimate of $4.14. Earnings fell 32% year over year, primarily due to increased operating expenses incurred during the quarter.

Total revenues in the reported quarter rose 1% year over year to $902 million, driven by higher oncology product sales, which were partially offset by lower neuroscience revenues. Per management, revenues were impacted by seasonal headwinds from payor reauthorizations and inventory drawdown. Total revenues missed the Zacks Consensus Estimate of $939 million.

Quarter in Detail

Net product sales fell 5% year over year at $842.1 million. The reported figure missed the Zacks Consensus Estimate and our model estimates of $895 million and $884 million, respectively.

Jazz recorded $49.9 million as royalty revenues from high-sodium oxybate authorized generic (AG), beating the Zacks Consensus Estimate of $44 million and our model estimate of $45 million.

Other royalties and contract revenues rose 53% to $9.9 million in the quarter.

Neuroscience Products

Sales of Jazz’s neuroscience products dropped 11% to $581 million.

Net product sales for the combined oxybate business (Xyrem + Xywav) fell 17% to $379.5 million in the quarter. This combined revenue figure missed the Zacks Consensus Estimate of $421 million and our model estimates of $420 million.

Sales of the sleep disorder drug Xyrem plunged 64% year over year to $64.2 million due to patients switching to Xywav and the launch of AGs last year.

Xywav, a low-sodium formulation of Xyrem, recorded sales of $315.3 million in the quarter, up 14% year over year. The upside can be attributed to the encouraging uptake of the drug in narcolepsy and idiopathic hypersomnia (IH) indications. The drug is currently Jazz’s most extensive product by net sales.

Sales of the epilepsy drug Epidiolex/Epidyolex rose 5% to $198.7 million. During the quarter, management stated that the drug’s growth was negatively affected by inventory drawdown in first-quarter 2024. Epidiolex sales missed the Zacks Consensus Estimate and our model estimates of $216 million and $209 million, respectively.

Cannabis-based mouth spray Sativex recorded sales of $2.7 million in the quarter, down 61% year over year.

Oncology Products

Oncology product sales increased 13% to $257.5 million.

Chemotherapy drug Rylaze/Enrylaze recorded sales of $102.8 million in the quarter, up 20% year over year, driven by strong demand for the drug. Rylaze is approved in the United States for treating acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL) patients. The drug was recently approved in Europe for a similar indication, where it was commercially launched in fourth-quarter 2023 under the trade name Enrylaze.

Rylaze sales beat the Zacks Consensus Estimate and our model estimates of $101 million and $92 million, respectively.

Zepzelca, approved for small cell lung cancer, recorded sales worth $75.1 million in the quarter, up 12% year over year.

Acute myeloid leukemia drug Vyxeos generated sales of $32.0 million, down 13% from the year-ago period’s levels.

Defitelio sales were up 22% year over year at $47.7 million in the quarter.

Cost Discussion

Adjusted selling, general and administrative (SG&A) expenses were up 20% year over year at $311.5 million due to higher compensation-related and litigation expenses incurred during the quarter.

Adjusted research and development (R&D) expenses rose 17% to $204.0 million, primarily to provide support for the increased costs of developing the company’s pipeline candidates.

2024 Guidance

Jazz reiterated its previously issued financial guidance for the full year 2024.

Total revenues are expected in the range of $4.0-$4.2 billion, suggesting approximately 7% year-over-year growth at the midpoint compared with 2023 levels. In 2023, Jazz expects continued growth in net sales of Xywav, Epidiolex, its oncology portfolio and royalties on net sales of AG.

The company expects 2024 adjusted earnings in the range of $18.15-$19.35 per share.

Jazz’s shares fell 3% in after-market trading on Wednesday post the earnings announcement. Despite the dismal earnings results, the fall in stock price was limited, likely due to management reaffirming its previously-issued financial guidance for 2024.

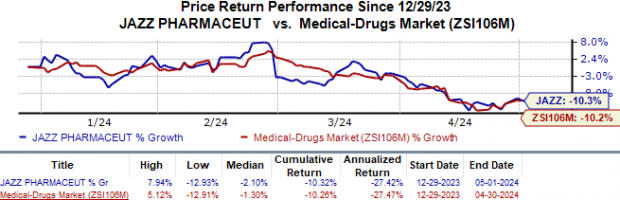

Jazz’s shares have lost 10.3% year to date, in line with the industry.

Image Source: Zacks Investment Research

Neuroscience sales are expected in the range of $2.80-$2.95 billion, suggesting a 3% year-over-year growth at the midpoint compared with 2023 levels. Management also expects high-sodium oxybate AG royalty revenues to exceed $200 million in 2024. The Oncology franchise is expected to record sales in the range of $1.12-$1.22 billion, indicating growth of 15% at the midpoint compared with 2023 levels.

While adjusted SG&A expenses are anticipated to be between $1.17 billion and $1.23 billion, adjusted R&D expenses are expected in the band of $800-$850 million.

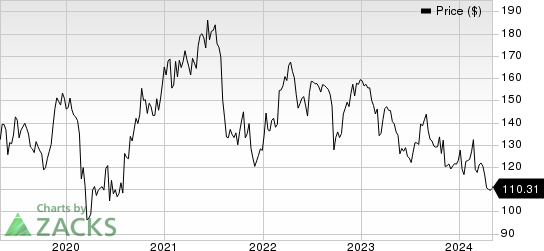

Jazz Pharmaceuticals PLC Price

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Key Picks

Jazz currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP, Ligand Pharmaceuticals LGND and Voyager Therapeutics VYGR, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share (EPS) have risen from $4.25 to $4.44. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.83 to $5.04. Year to date, shares of ANIP have risen 20.6%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, estimates for Ligand Pharmaceuticals’ 2024 EPS have risen from $4.42 to $4.56. During the same period, EPS estimates for 2025 have improved from $5.11 to $5.27. Year to date, LGND’s shares have registered breakeven growth.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. Ligand delivered a four-quarter average earnings surprise of 84.81%.

In the past 60 days, estimates for Voyager Therapeutics’ 2024 loss per share have improved from $1.89 to $1.64. Year to date, shares of VYGR have lost 1.0%.

Earnings of Voyager Therapeutics beat estimates in three of the last four quarters while missing the same on one occasion. VYGR delivered a four-quarter average earnings surprise of 545.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Voyager Therapeutics, Inc. (VYGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance