Jazz Pharmaceuticals: Unveiling Growth Potential From Non-Small Cell Lung Cancer Market

Jazz Pharmaceuticals (NASDAQ:JAZZ), a leading player in the narcolepsy market, is expanding its reach into other markets such as the non-small cell lung cancer (NSCLC) market by preparing a new biliary tract cancer drug; Zanidatamab.

Zanidatamab that belongs to the NSCLC market is estimated to be worth $32 billion. Capturing even a modest 5% share could translate into $1.6 billion in additional revenue for Jazz. Considering the company's 2023 revenue of $3.8 billion, this represents a substantial growth opportunity. And the success in penetrating this market would reflect higher stock prices. Let's take a look a little closer.

Company Description

Jazz Pharmaceuticals (NASDAQ:JAZZ) is an Ireland biopharmaceutical company focused on neuroscience and oncology treatments. In neuroscience, they have pipelines for narcolepsy and epilepsy. Their oncology pipeline includes meds for Small Cell Lung Cancer (SCLC), leukemia, and stem cell transplants.

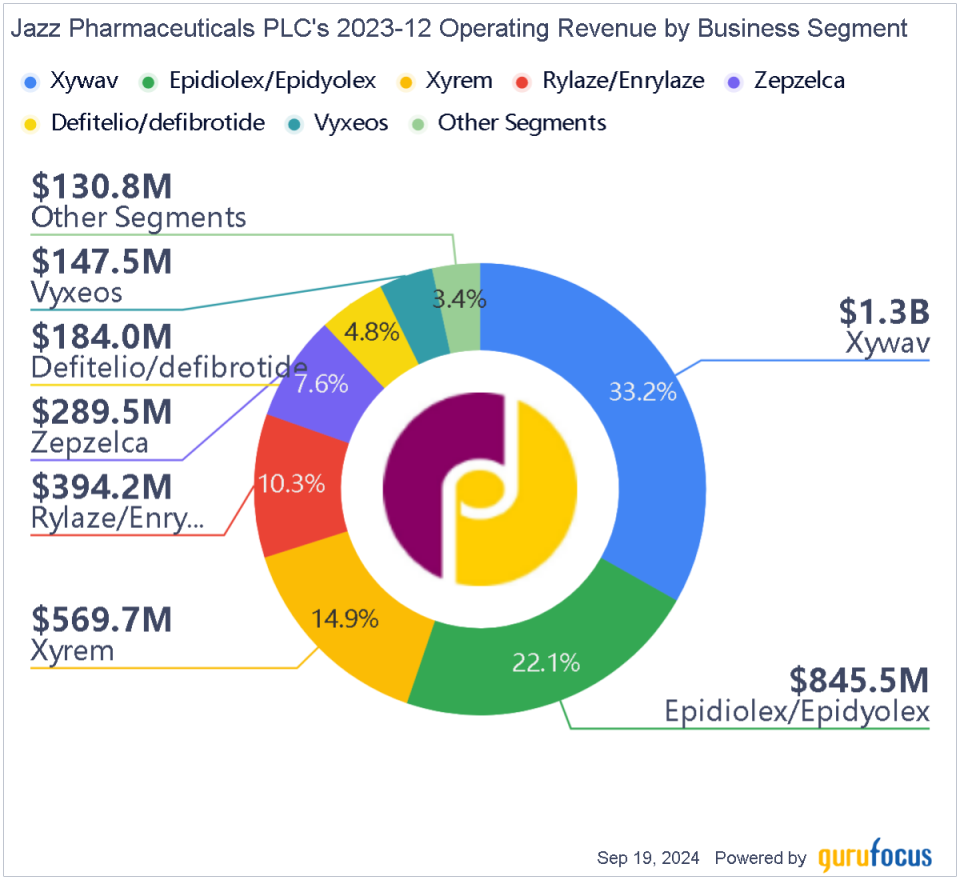

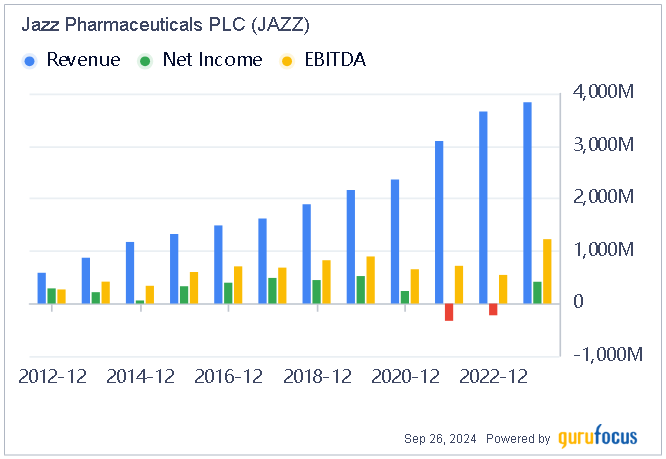

Of Jazz's $3.83 billion revenue in 2023, a significant 70.4% was generated by neuroscience drugs, with the remaining portion attributed to oncology products. GuruFocus has depicted a good breakdown of business segments of Jazz below:

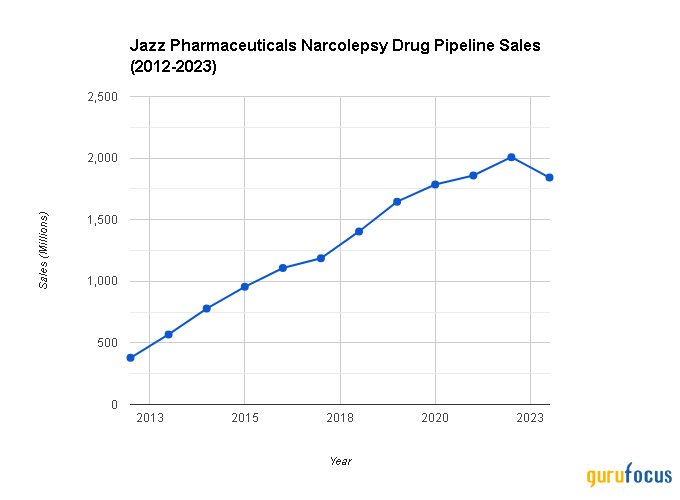

Jazz Pharmaceuticals has a strong presence in the narcolepsy market with its drugs Xyrem and Xywav. While Sunosi was previously part of their narcolepsy pipeline, it was discontinued due to declining sales. Combined, Xyrem and Xywav contributed a substantial $1.841.7 million to Jazz's total revenue of $3.834 million in 2023, making narcolepsy the company's largest revenue driver. For information, narcolepsy is a sleeping disorder such as excessive daytime sleepiness, fragmented sleep, sudden attacks of sleep and so on.

According to Market Research Future , the global narcolepsy market is estimated to be worth $2.5 billion. With Jazz's narcolepsy drug sales reaching $1.84 billion, the company holds a significant market share of 73.64%, solidifying its position as a leader in the narcolepsy treatment market.

While Jazz Pharmaceuticals has dominated the narcolepsy market, continued growth solely within this segment has become increasingly challenging. The market's maturity is evident in the slowing sales growth of Jazz's narcolepsy drugs, which have transitioned from double-digit increases to single-digit growth and even a decline in 2023.

Source: processed independently from financial reports

Prior to the COVID-19 pandemic, Jazz Pharmaceuticals experienced consistent double-digit growth, primarily driven by its narcolepsy pipeline. However, the onset of the pandemic marked a significant shift.

According to Market Research Future after 2019 there are changes in consumer behavior as people started becoming more health-conscious and focused on improving their well-being and increased awareness for better sleeping.

To maintain its position in the narcolepsy market, the company now focuses on strategies such as defending its patents and pursuing legal action against competitors such as Avadel Pharmaceuticals (NASDAQ:AVDL) for their narcolepsy drug Lumryz.

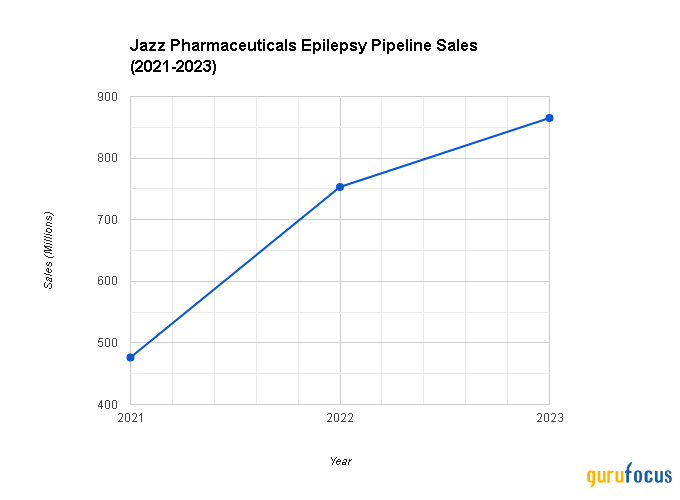

Jazz Pharmaceuticals currently has four more drug pipelines and is not reliant on the narcolepsy market only. Their epilepsy pipeline, featuring Epidiolex and Sativex, is another significant contributor to their revenue. In 2023, these two drugs generated a combined $845.06 million, making them the second-largest revenue stream for Jazz, out of a total revenue of $3.834 billion.

Furthermore, Jazz holds a noteworthy position in the global epilepsy market. Considering the estimated market size of $9.6 billion in 2024, Jazz's epilepsy pipeline captures approximately 8.9% of the global market share.

Source: processed independently from financial reports

Jazz entered the epilepsy market in 2021 with its cannabinoid-based medications Epidiolex and Sativex which are used to treat refractory epilepsy in children. These products demonstrated impressive growth, generating sales of $476.34 million in their first year and increasing to $865.06 million in 2023. As Jazz continues to invest in research and development, the company's epilepsy pipeline is expected to expand further, driving future growth.

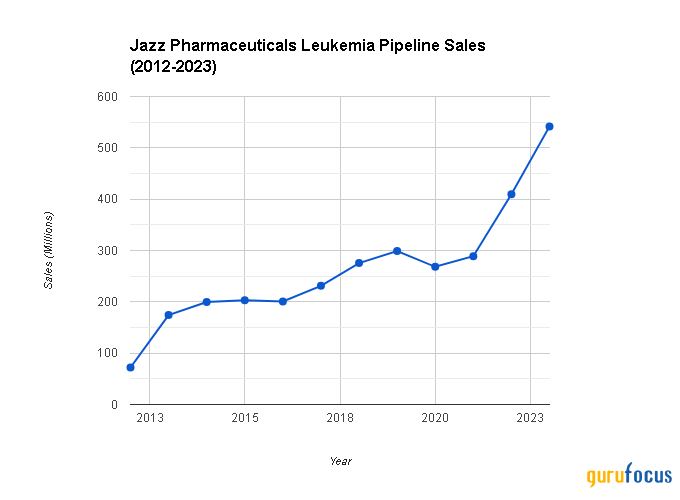

Other pipeline, Jazz also has a presence in the leukemia market. Leukemia it is a type of cancer that affects the white blood cells. This pipeline features two medications: Rylaze to treat the disease and Vyxeos to treat the acute nyeloid leukemia. While Erwinaze was previously part of the pipeline, Jazz discontinued it in 2022 due to declining sales.

Jazz's Leukemia pipeline has shown positive results. In 2023, these medications generated $541.69 million in revenue. This represents a significant market share, capturing approximately 15.7% of the global Leukemia market estimated to be worth $3.44 billion in 2024. Jazz has long been in this market and recently showed significant improvement in sales, giving hope for better revenue from this pipeline.

Source: processed independently from financial reports

The company has successfully introduced its Leukemia meds into the market and has achieved a significant market share and therefore they continue exploring new opportunities within the leukemia market.

But digging for more sales in this market is a complex and ongoing process. Jazz faces competition from other pharmaceutical companies and may encounter challenges related to clinical trials like treatment outcomes and reducing side effects.

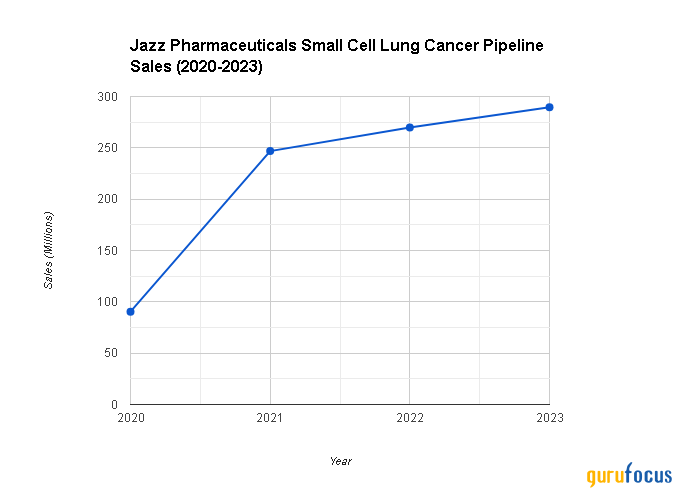

Jazz also expands its portfolio to include the small cell lung cancer (SCLC) market with its drug Zepzelca. Zepzelca is a chemotherapy medication designed to treat this type of cancer. In 2023, Zepzelca generated $289.53 million in revenue, capturing 8.41% of the global SCLC market, which is estimated to be worth $3.44 billion.

Source: processed independently from financial reports

Jazz Pharmaceuticals experienced a significant 173% increase in sales for Zepzelca in the year following its launch. However, growth rates subsequently moderated, with modest increases of 9% and 7% in 2022 and 2023, respectively. The small cell lung cancer (SCLC) market has a limited patient population and is highly competitive.

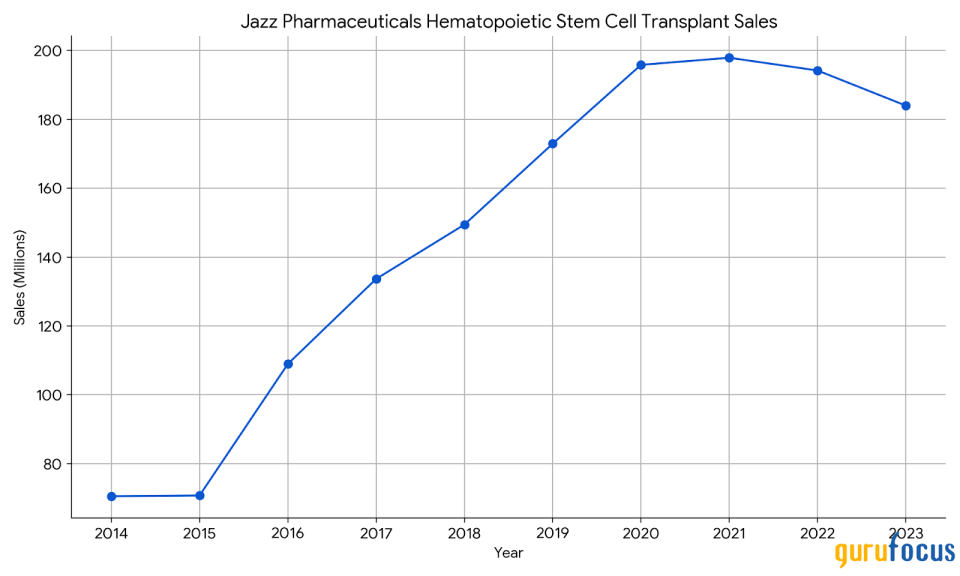

The last pipeline that Jazz Pharmaceuticals encountered is the stem cell transplant market with Defitelio. This medication specifically targets mitigating side effects associated with stem cell transplantation. In 2023, Defitelio generated $184 million in sales, capturing approximately 6.38% of the global hematopoietic stem cell transplantation market, estimated to be worth USD 2.88 billion. But there is one problem: sales of Defitelio have been declining for two consecutive years.

Source: processed independently from financial reports

According to Coherent Market Insights, the COVID-19 pandemic negatively impacted the hematopoietic stem cell transplantation market. Despite Jazz Pharmaceuticals' presence in this market with Defitelio, the company may face challenges in achieving significant growth due to the shift in market dynamics.

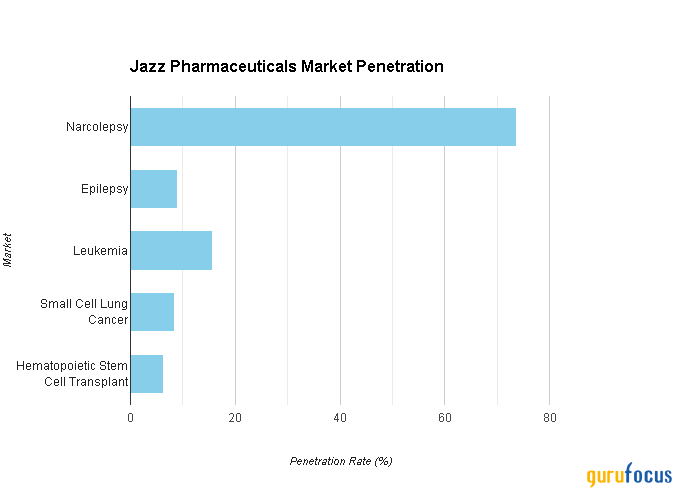

To better knowledge of Jazz Pharmaceuticals market penetration, below is a chart compiling their penetration by pipelines:

Source: processed independently

Jazz Pharmaceuticals has a strong market presence in narcolepsy but faces challenges in further expanding because they are already dominant in that market. While growth in the epilepsy and leukemia pipelines is promising, achieving significant growth in stem cell transplantation and small cell lung cancer may be more difficult.

Jazz strategically expands into other markets by working on several new drugs starting late 2023:

Zanidatamab: This drug is being tested for treating biliary tract cancer and gastroesophageal adenocarcinoma. (Non-Small Cell Lung Cancer market size is USD 32 billion )

Suvecaltamide: This drug is being tested for treating essential tremor and Parkinson's disease tremor. (Still in clinical trials)

JZP898: This drug is being tested for treating various cancers. (Still in clinical trials)

Jazz Pharmaceuticals has announced that its drug zanidatamab is nearing market launch as in 2Q24, the U.S. FDA accepted and granted a License Application for zanidatamab on November 29, 2024. While the other two are still in clinical trials.

Zanidatamab that belongs to non-small cell lung cancer, if successful in penetrating, even a modest 5% market penetration could translate to $1.6 billion in additional revenue for Jazz, representing nearly half of its 2023 annual revenue.

Zanidatamab

The company has a strong track record of success in penetrating several therapeutic areas. Jazz historically shows a fast response to their performance. They disrupt, cut production, and improve their meds to adjust their markets.

In narcolepsy, there was only Xyrem at first that helps people with excessive daytime sleepiness but then they launch Xywav that contains 92% less sodium than Xyrem. With less sodium, Xywav offers safety for people with narcolepsy that have high blood pressure. Now we are seeing every year increase in Xywav's sales complemented with decrease in Xyrem's sales. Jazz produces improvement to their own existing drugs.

If they fail, capturing only small market share with declining sales they quickly shift to other markets. There are many drugs that are stopped such as Prialt, Erwinase and Sunosi.

Research and development plays a pivotal role in pharmaceuticals from early stages to further development and post-launch, making sure that they create the right solutions to the problems of the markets they penetrate.

When launched, zanidatamab would be the first HER2-targeted treatment specifically approved for biliary tract cancer.

Projected Profit

Zanidatamab, if approved in November 2024, will be launched starting from 2025. The sales of this non-small cell lung cancer med will be reflected in 2026 on 2025's annual report released. Let's take a look.

First we are to project revenue. Below is data in the last 5 years:

2023: 6 mo: 1850.12M | Full Year: 3834.2M

2022: 6 mo: 1746.6M | Full Year: 3659.3M

2021: 6 mo: 1359.3M | Full Year: 3094M

2020: 6 mo: 1097.16M | Full Year: 2363.5M

2019: 6 mo: 1042.3M | Full Year: 2161.7M

Jazz Pharmaceuticals has historically generated between 41% and 44% of its annual revenue in the first half of the year, leaving the remaining 52% to 56% for the second half.

As of June 30, 2024, the company had already generated $1,925.8 million in revenue. Assuming that Jazz maintains its historical sales pattern and generates at least 52% of its remaining revenue in the second half of the year, we can estimate a total annual revenue of approximately $4,012 million for 2024.

It is known that the Compound Annual Growth Rate (CAGR) of jazz revenue is 12.09%. Assuming a continued CAGR of 12.09%, Jazz Pharmaceuticals could achieve a revenue of approximately $4.497 billion in 2025 financial statement. Additionally, if zanidatamab captures at least 5% of the non-small cell lung cancer (NSCLC) market, estimated to be worth $32 billion, it could contribute $1.6 billion in revenue.

Combining these projections, Jazz Pharmaceuticals could potentially reach a total revenue of $6.097 billion in 2025. This surely would represent a significant milestone for the company.

Then, let's see the net profit margin

Jazz Pharmaceuticals has historically maintained net profit margins between 10% and 15%. Following red dips in profitability due to the acquisition of GW Pharmaceuticals in 2021 and 2022, the company has successfully rebounded, achieving a net profit margin of 10.82% in 2023.

This turnaround was driven by a combination of cost-cutting of production and administrative measures and increased revenue from Epidiolex. They raise expenses for research and development though, but overall cost is lower. By streamlining operations and optimizing sales, Jazz has demonstrated its ability to back on track of profitability in 2023 while maintaining revenue growth.

Based on a projected net profit margin of 10% for 2025, Jazz could achieve a net profit of approximately $609.7 million on an estimated revenue of $6.097 billion.

Valuation

As of September 2024, Jazz Pharmaceuticals had approximately 62,882,000 shares outstanding. Based on a projected profit of $609.7 million, the company's earnings per share (EPS) would be $9.69.

At a current share price of $108, Jazz Pharmaceuticals' price-to-earnings (P/E) ratio would be 11.13. This is significantly lower than the P/E ratios of comparable companies like AmerisourceBergen (21.7x) and Novartis (30.9x), suggesting that Jazz's stock may be undervalued.

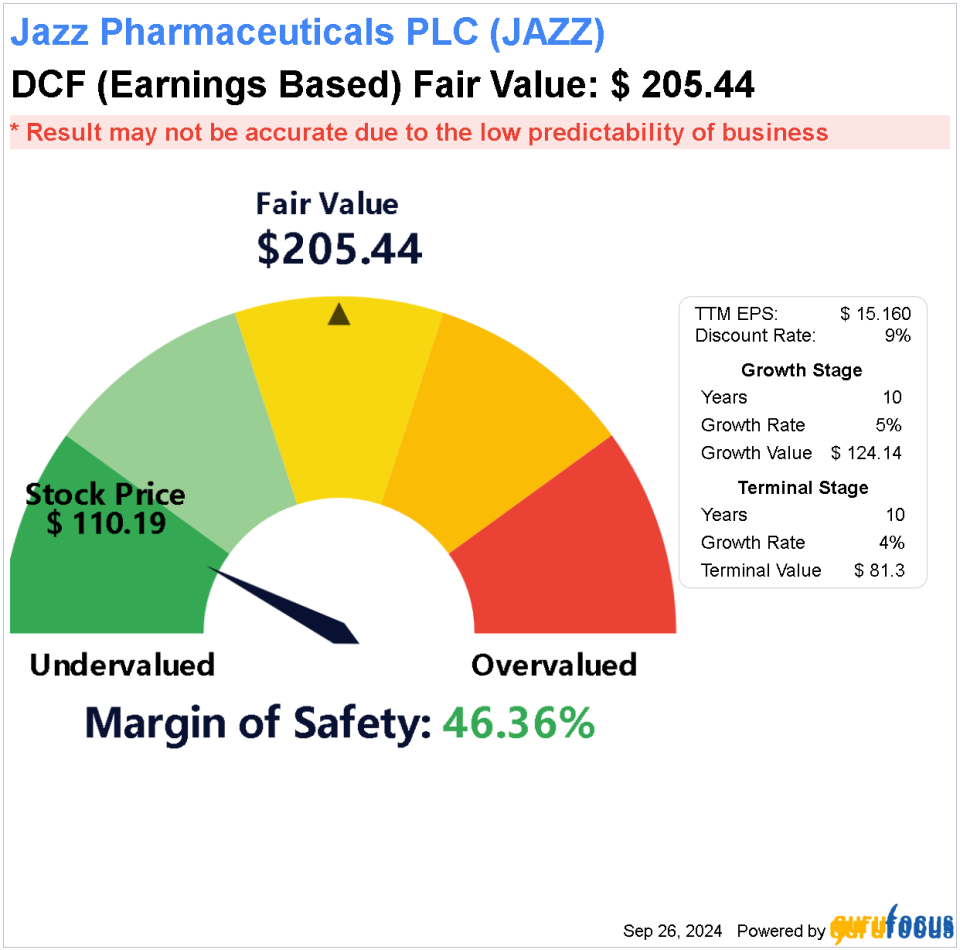

By DCF valuation, Jazz is also undervalued. Below is DCF valuation by GuruFocus:

A discounted cash flow (DCF) valuation suggests that Jazz Pharmaceuticals is significantly undervalued. The estimated fair value of the stock is $205.44, which is substantially higher than the current price of $110. This suggests an upside potential of over 100%.Conclusion

Jazz Pharmaceuticals is a company with a strong presence in established markets especially in the narcolepsy market. While challenges exist in some areas, the upcoming launch of Zanidatamab and continued R&D efforts suggest potential for significant future growth. The potential undervaluation of the stock based on P/E ratios might be an attractive opportunity for investors seeking exposure to the pharmaceutical industry.

This article first appeared on GuruFocus.