JD Wetherspoon to raise prices as pub sales continue recovery

The boss of JD Wetherspoon has warned of increased costs caused by the rising price of food and drink products and soaring energy bills, as the pub chain cut losses and said business was close to returning to pre-pandemic levels.

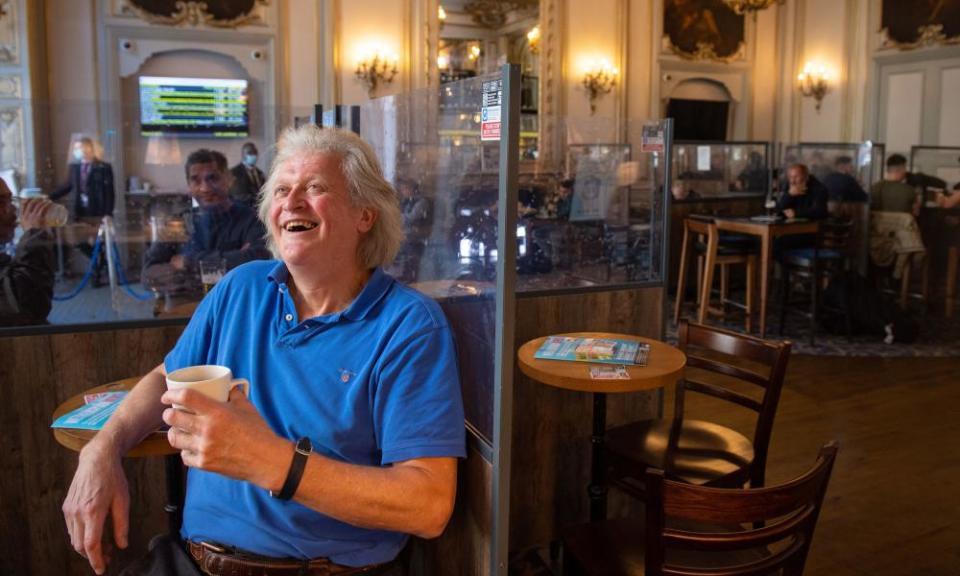

Tim Martin, the outspoken chairman and founder, said he expected to be able to hold the increase in costs to just below the level of inflation.

UK inflation is at a 30-year high of 5.5% and is expected to rise to almost 8% in April, with fears it could hit double digits as a consequence of the war in Ukraine.

“There is pressure on input costs from food, drink and energy suppliers, mitigated to an extent, by a number of long-term contracts,” Martin said. “Overall, the company expects the increase in input prices to be slightly less than the level of inflation.”

On Thursday, the Bank of England raised interest rates to 0.75% in an attempt to curb the soaring cost of living.

Martin said JD Wetherspoon had benefited from nearly 70% of its 800-plus pubs being freehold, with mortgage rates fixed for the next decade. He added that most of its leasehold pubs had rent reviews that were also fixed below the current level of inflation.

JD Wetherspoon said it was finally seeing a return to more normal trading patterns, after the last restrictions were lifted after the spread of the Omicron Covid variant over Christmas and the new year.

Sales in the three weeks to 13 March were only 2.6% down on pre-pandemic levels, as the group more than halved its losses to £21.6m in the six months to 23 January.

“Following a traumatic two years for many businesses and people, the ending of Covid restrictions has brought a return to more normal trading patterns in recent weeks,” Martin said.

The company had not been affected by labour shortages reported in some sectors, operating with a “full complement of staff”, he added. There were no significant supply chain issues affecting the business, which he described as “fully stocked, with some minor exceptions”.

Martin, an outspoken critic of government policies to curb the pandemic, said: “Draconian restrictions, which amount to a lockdown-by-stealth, are, of course, kryptonite for hospitality, travel, leisure and many other businesses. The company is confident of a strong future if restrictions are avoided.”

The London-listed business has a market value of more than £1bn. It has 859 pubs across the country – 13 fewer than a year ago and down from a peak of 951 in 2015.

Yahoo Finance

Yahoo Finance