JDE Peet's (AMS:JDEP) Has Affirmed Its Dividend Of €0.35

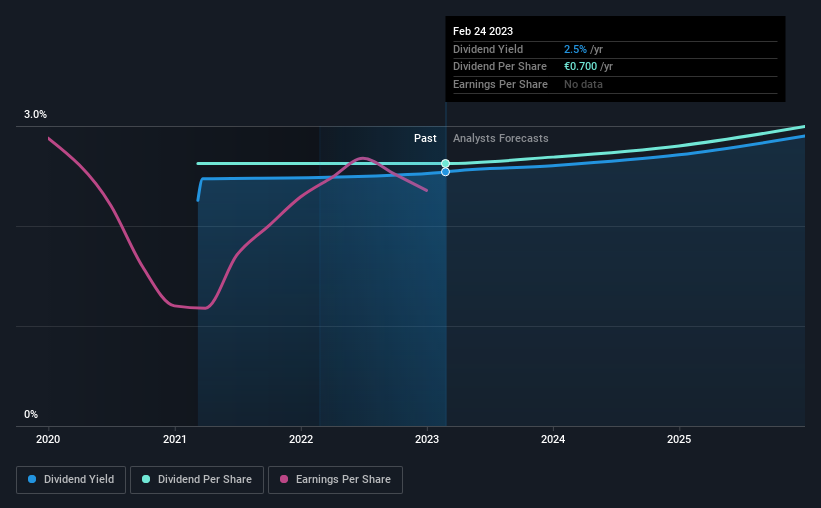

The board of JDE Peet's N.V. (AMS:JDEP) has announced that it will pay a dividend of €0.35 per share on the 14th of July. This payment means that the dividend yield will be 2.5%, which is around the industry average.

View our latest analysis for JDE Peet's

JDE Peet's' Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, JDE Peet's' dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 15.0%. If the dividend continues on this path, the payout ratio could be 38% by next year, which we think can be pretty sustainable going forward.

JDE Peet's Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The last annual payment of €0.70 was flat on the annual payment from2 years ago. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth May Be Hard To Come By

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past three years, it looks as though JDE Peet's' EPS has declined at around 6.1% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Our Thoughts On JDE Peet's' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think JDE Peet's is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for JDE Peet's that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance