Job openings decline at the fastest pace since 2009: Morning Brief

Wednesday, February 12, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Openings are down 14% from last year

The last two months of hiring have indicated the U.S. labor market remains solid.

In January, 225,000 jobs were added to the economy; in December, the U.S. economy created 145,000 jobs. Over the last three months, job gains have averaged 211,000.

But data from the Bureau of Labor Statistics released Tuesday shows the labor market might not be quite as strong as these headline job gains suggest.

And bolster the case being made by both economists and the bond market that the labor market could soften further in 2020.

The December data on job openings and labor turnover survey, or JOLTS report, published Tuesday showed that in the final month of 2019 there were 6.42 million jobs available, down from 6.79 million November and a precipitous drop from the 7.45 million jobs available in December 2018.

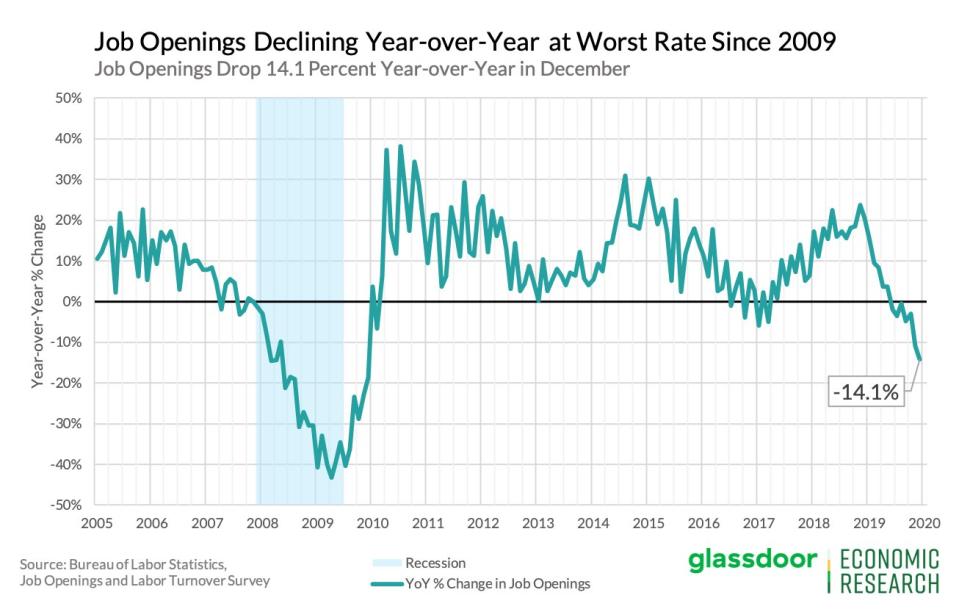

Daniel Zhao, an economist at Glassdoor, noted Tuesday that this 14.1% year-over-year drop in job openings was the largest since 2009. Since job openings hit all-time records at 7.6 million in November 2018 and again in January 2019, the fall-off in the number of job openings has been stark.

Zhao adds that this decline is consistent with Glassdoor’s data that shows an annual decline in job listings for both December and January. Though Zhao notes Glassdoor’s data might be too optimistic, with January’s monthly decline just 3.1% and December’s less than 2%, a significant divergence from the BLS’ 14% drop.

“Employers can adjust job openings more quickly in response to changing economic winds,” Zhao notes, “and keep in mind that [Tuesday’s JOLTS report] doesn't yet incorporate uncertainty from coronavirus.

“The steep decline suggests the 2019 surge in job openings may have been a sugar high.”

JP Morgan economist Daniel Silver had a somewhat more positive view on Tuesday’s JOLTS report, noting that the hires rate in December rose to 3.9% and is near the high end of what we’ve seen since the crisis. The post-crisis high for the hires rate — which measures the number of monthly hires as a percentage of total employment — is 4%, reached back in April 2019.

Silver notes, however, that, “The trend in job growth has remained strong through January in separate data reported by the BLS, but the recent decline in job openings signals that job growth could slow at some point.”

Speaking before lawmakers on Capitol Hill on Tuesday, Federal Reserve chair Jay Powell reiterated his view that the labor market remains in a good place, saying in prepared remarks before his testimony, “Job openings remain plentiful. Employers are increasingly willing to hire workers with fewer skills and train them. As a result, the benefits of a strong labor market have become more widely shared.”

Back in October, we noted that the U.S. economy was creating more jobs than it needed. A story that remains true today. Against this backdrop, a decline in open jobs should’t be surprising.

But with employers having spent years complaining that labor shortages were the only thing holding back business, the sharp fall-off in efforts to find workers bears watching.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

MBA Mortgage Applications, week ended Feb. 7 (5.0% prior)

Monthly Budget Statement, January ($8.9 billion expected, -$13.3 billion in December)

Earnings

Pre-market

6:30 a.m. ET: CVS (CVS) is expected to report adjusted earnings of $1.68 per share on $63.95 billion in revenue

Other notable reports: Molson Coors (TAP)

Post-market

4 p.m. ET: Applied Materials (AMAT) is expected to report adjusted earnings of 93 cents per share on $4.11 billion in revenue

4:05 p.m. ET: Cisco (CSCO) is expected to report adjusted earnings of 76 cents per share on $11.98 billion in revenue

Other notable reports: MGM Resorts (MGM), TripAdvisor (TRIP)

READ MORE

Top News

Nissan files $91m lawsuit against Carlos Ghosn [Yahoo Finance UK]

Lyft 4Q sales top expectations, active riders jump 23% [Yahoo Finance]

Google takes on EU in court over record antitrust fines [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

China hack 'doesn't absolve Equifax of being careless,' say consumer groups

The mammoth cost of Bernie Sanders’ big plans

Fed Chair Jay Powell grilled on China's cryptocurrency plans, US response

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance