Job openings and small business — What you need to know for the day ahead

The stock market’s first Monday of 2018 was less exciting than the holiday-shortened week that kicked off the year, but when the dust settled the benchmark S&P 500 and the tech-heavy Nasdaq each made new record highs.

Most of the action on Monday was confined to the cryptocurrency space, where bitcoin (BTC-USD) and Ripple (XRP-USD) were the notable decliners as Ethereum once again became the second-largest digital currency by market cap.

Looking ahead to Tuesday, the biggest highlights on the calendar should be the latest job openings and labor turnover survey from the BLS as well as the NFIB’s December reading on small business optimism, both due out in the morning.

The NFIB’s report has been one of the strongest economic readings since President Donald Trump’s surprise election win in November 2016, while job openings have been tracked for signs of increasing tightness in the labor market.

On the earnings side, the biggest results expected Tuesday are from Acuity Brands (AYI) and WD-40 Company (WDFC).

Earnings estimates going up

2018 is setting up to be a unique year for markets.

Aside from all the political noise that remains in the background of U.S. stocks at record highs and global growth enjoying its best run in a decade, a recent investing trend looks set to be turned on its ear.

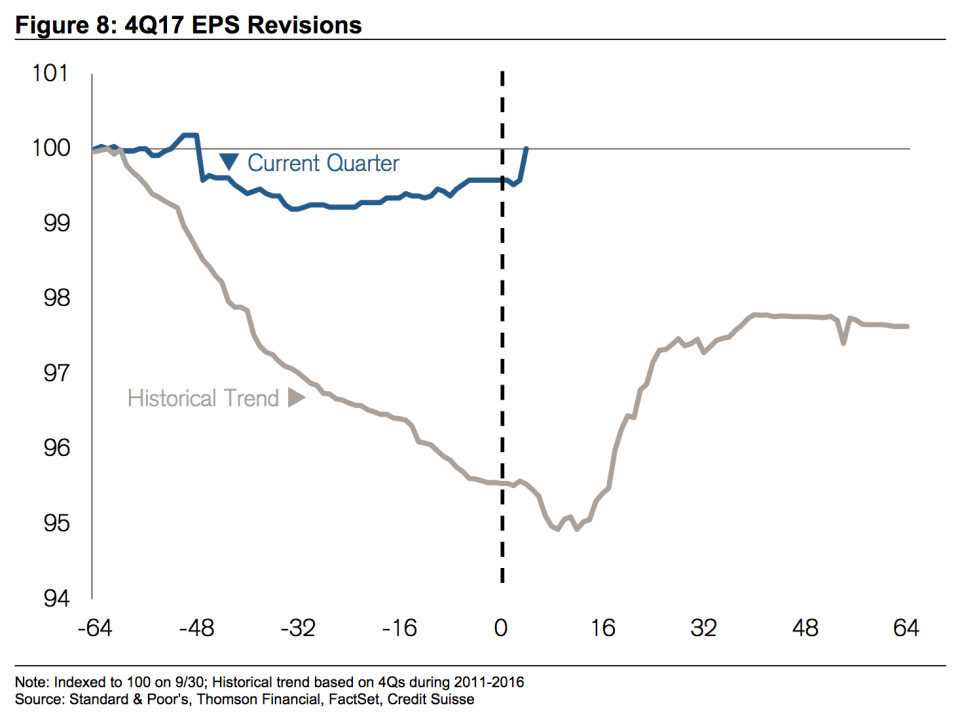

Since the financial crisis, earnings estimates have consistently started out too bullish. Wall Street analysts have over-estimated growth and then steadily cut estimates with expectations for earnings bottoming about a month out from actual reports.

This chart from Credit Suisse shows how recent years have had steady cuts in earnings expectations with 2018 poised to show an uptick as the year goes on.

But 2018 is shaping up to be a year in which analysts are too conservative in their estimates for earnings growth and forced to revise expectations higher. And this so-far modest uptick in earnings expectations in the quarters to come should accelerate, with Credit Suisse’s Jonathan Golub writing that, “Analysts have adjusted their 2018 forecasts by less than 2% for recent tax changes, a fraction of the likely impact.

Golub adds that, “During reporting season, investors will be focused on guidance around (1) each company’s new effective tax rate, (2) plans to redeploy capital back into businesses, (3) impacts on EPS from increased buybacks, and (4) the potential for higher dividends. We expect conservative guidance given the recency of new legislation. This should lead to above average revisions throughout 2018.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance