Jobs market bounce-back sees rate hike speculation mount

Britain’s jobs market rebound has sparked speculation that policymakers may look to hike interest rates sooner rather than later amid rampant inflation.

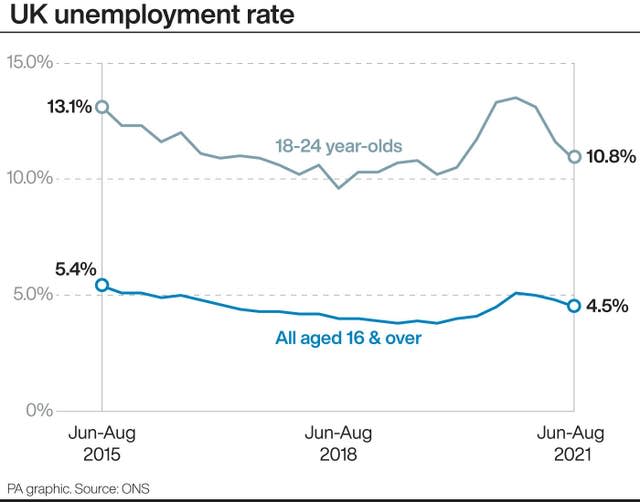

The latest official figures show a labour market getting back to rude health, with record numbers of workers on payrolls and wages rising above inflation.

Financial markets have been pricing in an increased chance that the Bank of England will hike rates even before the end of this year to cool inflation, with little in the rosy employment picture to hold it back.

Experts are less convinced that a move to raise rates above the all-time historic low of 0.1% could come as soon as the next meeting in November, but many believe it is just a matter of time.

Economist James Smith at ING said: “If markets are right, we may only be a matter of weeks away from the first Bank of England rate hike.

“That’s undoubtedly bold, but at face value there’s little in the latest UK jobs report that will sow any fresh seeds of doubt in the minds of investors.”

Soaring prices of everything from gas and fuel to clothing and groceries has led to concerns among Bank policymakers over a worrying spiral of inflation as the supply chain crisis mounts.

Bank governor Andrew Bailey warned at the weekend over a potentially “very damaging” period of inflation for British consumers, having previously assured it was only a temporary blip.

The Bank has been watching the jobs market carefully, in particular what effect the ending of furlough may have.

But with vacancies close to matching the number of people left on furlough when the scheme came to a close last month, it is hoped the UK will avoid a sudden spike in redundancies.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The market has been rapidly pricing in an interest rate rise in recent weeks, with the chances of a hike this year now standing at two in three.”

He added: “The Bank of England is expecting elevated inflation this winter, but the recent spike in gas and oil prices will test their resolve, as the increasing cost of these vital economic inputs will mean that inflation will be higher, and potentially longer lasting.

“The UK now looks firmly on the path to higher interest rates. The question is how quickly the central bank takes us there.”

Most economists see it as unlikely that the Bank will increase rates next month, though inflation may well force its hand quicker than initially expected.

Mr Smith said: “Before hiking, the Bank will want to be sure that wage growth is going to be sustained and more importantly, widespread, and that the furlough scheme hasn’t resulted in a material increase in jobs market slack.”

“For now, we’re pencilling in the first rate rise for May 2022, but we accept we may soon need to bring that forward,” he added.

Yahoo Finance

Yahoo Finance