Jobs report, Costco earnings, tariff fallout — What you need to know for the week ahead

The chaotic month of February came to an end for investors last week.

And the first two days of March proved no less volatile.

On Thursday, President Donald Trump announced tariffs on imports of steel and aluminum which shook markets and set off fears of a trade war breaking out. Trump said Friday that trade wars are “good, and easy to win.”

In the week ahead, investors will continue to grapple with the economic consequences of newly-imposed tariffs and potential retaliation from other U.S. trading partners, while also bracing for the month’s biggest economic report — the February jobs report.

Set for release on Friday morning, the Bureau of Labor Statistics’ latest reading employment in the U.S. is expected to show that 205,000 jobs were added to the economy in the second month of the year while Wall Street economists expect the unemployment rate fell to a new post-crisis low of 4%.

This report will come a little less than two weeks before the Federal Reserve’s next interest rate decision, scheduled for March 21, which is expected to see the central bank raise interest rates by 0.25%.

On the earnings calendar, notable reporters in the week ahead should include Target (TGT), Costco (COST), Kroger (KR), Dollar Tree (DLTR), and Caesars Entertainment (CZR).

Economic calendar

Monday: Markit U.S. services PMI, February (55.9 expected; 55.9 previously); ISM non-manufacturing PMI, February (58.9 expected; 59.9 previously)

Tuesday: Factory orders, January (-1.2% expected; +1.7% previously)

Wednesday: ADP private payrolls, February (+200,000 expected; +234,000 previously); Nonfarm productivity, fourth quarter (-0.1% expected;-0.1% previously); Trade balance, January (-$55. billion expected; -$53.1 billion previously); Consumer credit, January (+$18.25 billion expected; +$18.45 billion previously); Federal Reserve Beige Book set for release

Thursday: European Central Bank policy announcement; Initial jobless claims (220,000 expected; 210,000 previously); Z.1 Flow of Funds report, fourth quarter

Friday: Nonfarm payrolls, February (+205,000 expected; +200,000 previously); Unemployment rate, February (4% expected; 4.1% previously); Average hourly earnings, month-on-month, February (+0.2% expected; +0.3% previously); Average hourly earnings, year-on-year (+2.8% expected; +2.9% previously)

Trump’s tariffs

On Wednesday evening, investors were looking at returns for February that were the worst in two years and looking at historical performance trends which suggested March and April would be better. The market story for the spring was setting up to be about interest rates, earnings, and the potential for a bounce back in stocks.

And then, near noon on Thursday, the story became all about tariffs.

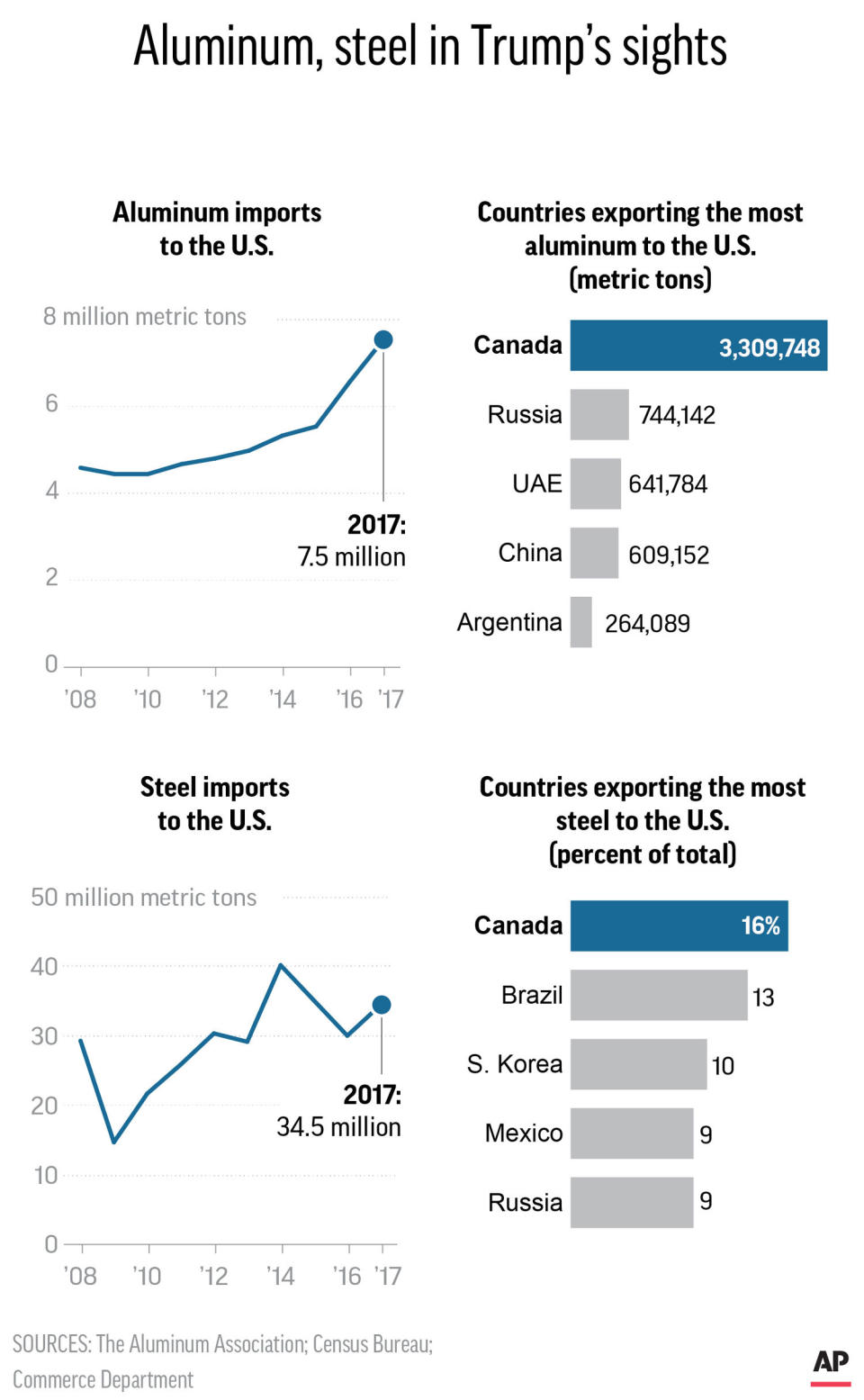

On Thursday, President Donald Trump announced he would impose 25% tariffs on imported steel and a 10% tariff on aluminum imports. Markets sold off.

The reaction from Wall Street strategists has been somewhat mixed, as Trump’s tariff announcement was a surprise or a long-known risk, depending on who you ask. And because the real thing which appears to be unsettling markets is not the economic impact of these tariffs but the potential for retaliatory tariffs from global trading partners, either the bout of selling at week’s end was a dip to buy or the beginning of something much more serious.

Ben Inker, head of asset allocation at GMO, is in the former camp.

“A trade war is probably more dangerous for investors at this time than at any other time in recent history given the implications it would have for inflation, monetary policy, and economic growth,” Inker writes.

Inker adds that, “A trade war would increase prices on a much broader array of goods and services, while simultaneously depressing aggregate global demand. This pushes us in the direction of not just inflation but stagflation, where both valuations and corporate cash flow would be under pressure.

“While there are scenarios that would be worse for financial markets—the proverbial asteroid on a collision path with Earth comes to mind—a trade war has the potential to be very bad for both the global economy and investor portfolios. As I wrote about last December, a significant inflation problem might well be the worst thing that could happen to a balanced portfolio, leading to losses on the order of 40%. A global trade war would be exactly the kind of economic event that could foreseeably lead to losses of that magnitude.” (Emphasis ours.)

A key risk for markets as we turned to 2018 was the return of inflation. Indeed, the sell-off seen in early February was in part blamed on investor fears over more inflation, higher rates, and a more aggressive Federal Reserve. The impact of tariffs may take time to fully work through the global economy, but higher prices are a certainty. In 2017, the Trump administration imposed tariffs on lumber imports, and prices for lumber have risen 31%, pressuring an already-tight U.S. housing markets.

At Capital Economics, Andrew Hunter writes that if Trump’s tariffs have the desired effect of ramping up U.S. domestic steel production, labor shortages which are already a feature of the economy could become even more pronounced, pressuring wages and, thus, inflation. Higher inflation because of higher wages and an improving economy combined with what you might call “artificially higher inflation” due to tariffs could, then, prove to be a dangerous mix for markets.

Inker also argues that a trade war could cause a psychological shift from investors who seem uniquely assured of long-term outcomes to pull their investment horizons forward and change the mix of assets they’d like to own.

“One of the most striking features of investors today is their apparent willingness to look far into the future in assessing the value of investments,” Inker writes. “Whether this is in the form of high valuations for currently unprofitable but fast growing companies, or real estate and infrastructure investments priced with extremely long payback periods, investors today seem serenely convinced that they can predict what the future will look like. A global trade war could (and probably should) cause investors to shorten their time horizons, which is a negative for long duration risky assets such as equities.” (Emphasis ours.)

And it’s this final worry from Inker that will have investors wrestling with the impacts of Trump’s tariffs into the new week and the months ahead.

For so many investors, the market feels like it is in a fragile state. The promised tax cuts that bolstered markets in 2017 have passed and now investors are looking at a landscape of higher interest rates, a new Federal Reserve chair, and a Trump economic agenda that may be less friendly.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

A few major topics were missing from Warren Buffett’s latest annual letter

The Trump tax cut earned Warren Buffett’s Berkshire Hathaway $29 billion in 2017

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Yahoo Finance

Yahoo Finance