John Rogers Bolsters Portfolio with Strategic Additions in Aptiv PLC

Insights from Ariel Investment's Latest 13F Filing for Q1 2024

John Rogers (Trades, Portfolio), the founder of Ariel Investment, LLC, has been a prominent figure in the investment community since 1983. Managing both small and mid-cap portfolios, Rogers is known for his column "Patient Investor" in Forbes and his strategic focus on undervalued small to medium-sized companies. His investment philosophy emphasizes patience, independent thinking, and a long-term outlook, aiming to identify companies with high barriers to entry, sustainable competitive advantages, and predictable fundamentals that allow for significant earnings growth. Rogers targets companies trading at low valuations relative to their potential earnings and intrinsic worth.

Summary of New Buys

During the first quarter of 2024, John Rogers (Trades, Portfolio) expanded his portfolio by adding six new stocks. Notably:

Aptiv PLC (NYSE:APTV) emerged as the most significant new addition with 1,078,219 shares, representing 0.84% of the portfolio and valued at $85.88 million.

CVS Health Corp (NYSE:CVS) followed, comprising 606,609 shares or approximately 0.48% of the portfolio, with a total value of $48.38 million.

Capital One Financial Corp (NYSE:COF) was also added with 263,724 shares, accounting for 0.39% of the portfolio and valued at $39.27 million.

Key Position Increases

Rogers also strategically increased his stakes in 31 existing holdings, including:

A significant boost in ADT Inc (NYSE:ADT), with an additional 7,131,950 shares, bringing the total to 29,579,797 shares. This adjustment significantly increased the share count by 31.77%, impacting the current portfolio by 0.47% and valued at $198.78 million.

JM Smucker Co (NYSE:SJM) also saw a notable increase of 321,049 shares, bringing the total to 868,375 shares. This represents a 58.66% increase in share count, valued at $109.30 million.

Summary of Sold Out Positions

In the same quarter, John Rogers (Trades, Portfolio) exited five positions, including:

Amdocs Ltd (NASDAQ:DOX), where all 410,733 shares were sold, impacting the portfolio by -0.36%.

Equity Commonwealth (NYSE:EQC), with all 1,191,361 shares liquidated, causing a -0.23% impact on the portfolio.

Key Position Reductions

Conversely, Rogers reduced his positions in 69 stocks. Significant reductions include:

Philip Morris International Inc (NYSE:PM) was reduced by 871,654 shares, resulting in a -67.33% decrease in shares and a -0.81% impact on the portfolio. The stock traded at an average price of $92.21 during the quarter and has returned 13.46% over the past three months and 7.60% year-to-date.

The Carlyle Group Inc (NASDAQ:CG) saw a reduction of 1,504,398 shares, resulting in a -23.55% reduction in shares and a -0.61% impact on the portfolio. The stock traded at an average price of $43.22 during the quarter and has returned -2.37% over the past three months and 5.65% year-to-date.

Portfolio Overview

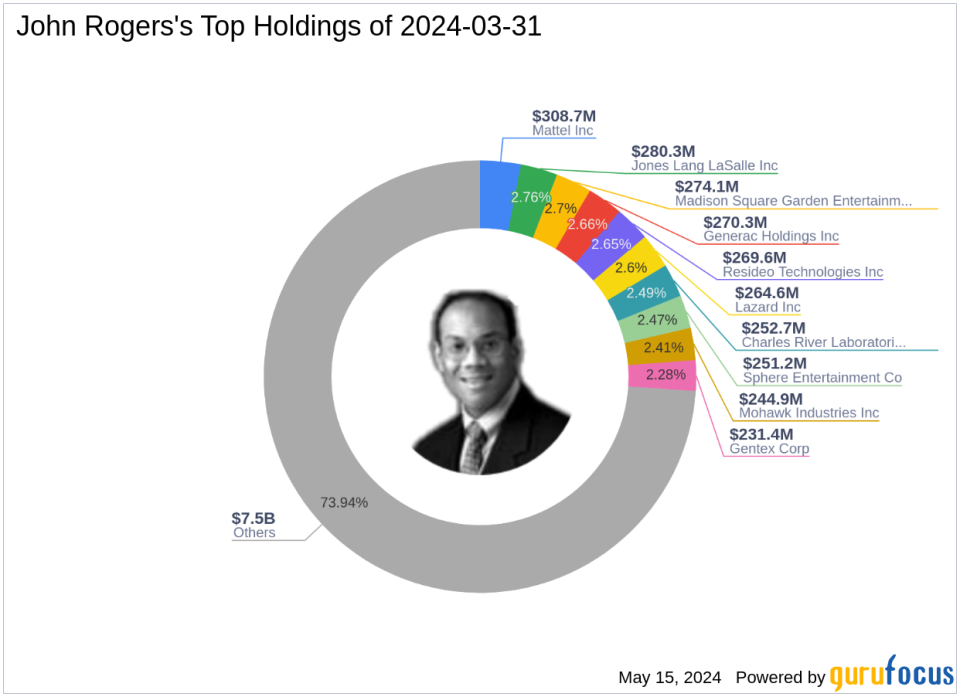

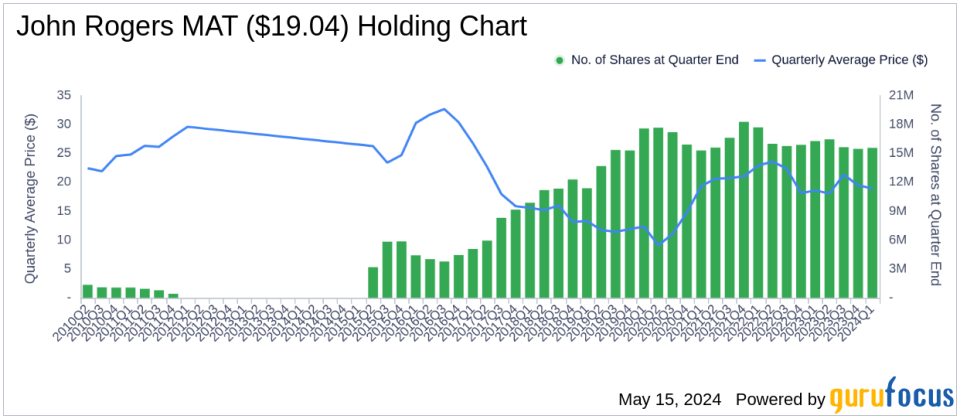

As of the first quarter of 2024, John Rogers (Trades, Portfolio)'s portfolio included 115 stocks. The top holdings were 3.04% in Mattel Inc (NASDAQ:MAT), 2.76% in Jones Lang LaSalle Inc (NYSE:JLL), 2.7% in Madison Square Garden Entertainment Corp (NYSE:MSGE), 2.66% in Generac Holdings Inc (NYSE:GNRC), and 2.65% in Resideo Technologies Inc (NYSE:REZI). The holdings are mainly concentrated across 10 of the 11 industries, including Consumer Cyclical, Financial Services, Industrials, Healthcare, Communication Services, Technology, Consumer Defensive, Real Estate, Energy, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance