Johnston Press appeals to pension trustees to back salvage deal as local newspapers struggle

The newspaper publisher Johnston Press is appealing to the trustees of its £600m pension fund to join in a radical restructuring of the company to prevent its collapse under heavy debts.

As it revealed half year results showing sustained pressure on the scores of local newspapers that form the core of its business, Johnston Press said it had opened discussions with its pension trustees around a potential debt for equity swap with its bondholders.

The company owes £220m to lenders in bonds that are due for to be repaid in less than two years.

Johnston Press admitted the decline of its local circulation and advertising revenues means it is unlikely to be able to refinance the bonds and that “could have a material impact on the group's operations and its ability to continue as a going concern”.

Chief executive Ashley Highfield, who is attempting to engineer a deal with bondholders that could see them write off some of the debt in exchange for shares, said he is focused on securing the approval of pension trustees. Johnston Press has defined benefit liabilities of more than £600m and a funding deficit of £53m.

Mr Highfield said: “The pension trustees are a very important stakeholder.

“It is evident that there is common ground and everyone is broadly agreed on where we need to get to. There is a still a lot of work to get through.

“This is a business which we have long believed needed to transform, but once done, could return to growth”

Johnston Press could seek to persuade trustees to accept equity in a new financial structure, for instance, to provide reassurance pensions will be paid. Such a deal could require the approval of the pensions regulator.

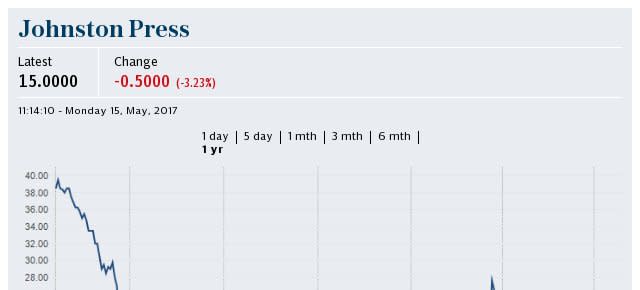

The US hedge fund GoldenTree is Johnston Press’s biggest lender, holding bonds with a face value of around £70m. It has the whip hand in talk with shareholders, who face wipeout if the company defaults on its debts. Johnston Press’s total market capitalisation is only £11m.

GoldenTree has a record of buying up distressed debt to engineer mergers, including in the newspaper industry. Such a deal with a rival could form part of Johnston Press's restructuring, although senior sources at other local newspaper publishers questioned whether they might be able to pick up titles such as the Sheffield Star and the Scotsman cheaper in an administration.

As Mr Highfield attempts to convince trustees to join in restructuring, Johnston Press continues to be battered by the digital forces that have hit local newspapers over the last decade. In the first half, newspaper sales were down 11.5pc on last year, excluding the boost from the takeover of the i national title last April.

On the same basis display advertising was down 12.5pc and classifieds by nearly 30pc. The overall decline on last year was 15.7pc, despite digital growth.

Including the i, which increased its circulation and advertising sales, Johnston Press’s total first half revenues were £103.3m, down 8.4pc. It made a pre-tax loss of £10.2m, compared with a loss of £184m last year when it took a heavy write down on the accounting value of its newspapers. Excluding exceptional charges Johnston Press made a pre-tax profit of £6.7m, down from £9.7m.

Mr Highfield highlighted that the growth of digital display advertising sales had outpaced the decline of print display.

He said in the wake of controversy over “fake news” and advertising appearing alongside illegal material online, he was hopeful that Google and Facebook will be persuaded to give a bigger cut to news publishers.

He said: “We want them to change their algorithms to increase the prominence of our content and give us a better cut of the revenue.”

Yahoo Finance

Yahoo Finance