Jones Lang LaSalle (JLL) Q1 Earnings Miss, Revenues Fall Y/Y

Jones Lang LaSalle Incorporated JLL — popularly known as JLL — reported first-quarter 2023 adjusted earnings per share (EPS) of 65 cents, lagging the Zacks Consensus Estimate of $1.69. The reported figure plunged 81.3% from the prior-year quarter’s $3.47. Shares of JLL were marginally down during May 4 regular trading session on the NYSE following the announcement.

JLL’s transaction-based businesses, specifically the Capital Markets and Leasing under Markets Advisory, performed poorly as higher interest rates and macroeconomic uncertainty resulted in lower transaction volumes. However, the company’s Work Dynamics and Technologies segments did well in the reported quarter.

Revenues totaled $4.72 billion, falling 1.8% from the year-ago quarter’s $4.80 billion. Nonetheless, the figure surpassed the Zacks Consensus Estimate of $4.53 billion.

The quarterly adjusted EBITDA margin dipped to 6.9% (USD) from 14.4% in the prior-year period due to a decrease in transaction-based revenues, specifically Leasing, Investment Sales and Debt/Equity Advisory and the change in equity earnings.

Per Christian Ulbrich, CEO of JLL, “Our first quarter financial results were in line with the expectations we had at the beginning of the year. Strong fee revenue growth in our resilient business lines was offset by the continuation of the industry-wide slowdown in investment sales and leasing volumes.”

Segment-Wise Performance

During the first quarter, the Markets Advisory segment’s revenues and fee revenues came in at $906.4 million and $627.3 million, respectively, reflecting a fall of 9.3% and 15.4% (in USD) year over year. Lower transaction volume across asset types and a decrease in average deal size, mainly in the office sector, led to a fall in Leasing fee revenues, which was the prime reason for the decline in Markets Advisory revenues and fee revenues.

Revenues and fee revenues for the Capital Markets segment were $357.1 million and $349.6 million, respectively, decreasing 40.5% and 41% (in USD) year over year. The fall was due to lower Investment Sales and Debt/Equity Advisory fees as rising interest rates and macroeconomic uncertainty hurt market transaction volumes and elongated the deal-cycle time.

JLL’s Work Dynamics segment reported revenues and fee revenues of $3.28 billion and $442 million, respectively, up 8% and 7.8% (in USD) year over year. The rise in revenues and fee growth was attributable to the continued resiliency within Workplace Management services. Also, the continued momentum in project demand in several geographies, predominantly in the United States, France and MENA, drove the Project Management services’ growth.

JLL Technologies segment reported revenues and fee revenues of $61.4 million and $57.8 million, respectively, rising 24.3% and 27.6% (in USD) from the prior-year quarter levels. The growth was backed by an increase in existing customers, led by solutions and service offerings, especially large enterprise clients.

The revenues and fee revenues in the LaSalle segment fell 3.3% and 4.2% (in USD) year over year to $114.4 million and $107.3 million, respectively. The rise in advisory fees was concentrated in core open-end funds, mainly in North America and Asia Pacific. However, lower transaction fees due to muted deal activity offset the growth in advisory fees.

As of Mar 31, 2023, LaSalle had $78.5 billion of real estate assets under management (AUM), down from $79.1 billion as of Dec 31, 2022. This resulted from the decrease in dispositions and withdrawals, and net valuation, partially offset by the rise in foreign currency and acquisitions.

Balance Sheet

JLL exited first-quarter 2023 with cash and cash equivalents of $485.4 million, down from $519.3 million as of Dec 31, 2022.

As of Mar 31, 2023, the net leverage ratio was 1.9, up from 1.0 as of Dec 31, 2022, and 0.8 as of Mar 31, 2022. The corporate liquidity was $1.7 billion as of the same date.

The company did not repurchase any shares during the first quarter.

JLL currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

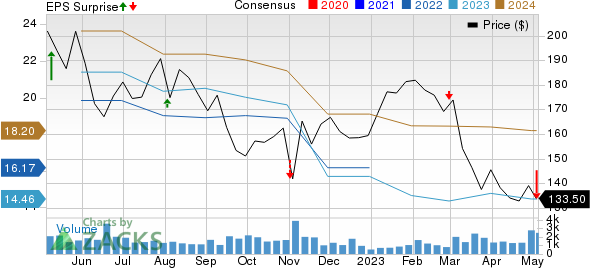

Jones Lang LaSalle Incorporated Price, Consensus and EPS Surprise

Jones Lang LaSalle Incorporated price-consensus-eps-surprise-chart | Jones Lang LaSalle Incorporated Quote

Performance of Other Broader Real Estate Market Stocks

CBRE Group Inc.’s CBRE first-quarter 2023 core EPS of 92 cents surpassed the Zacks Consensus Estimate of 81 cents. Quarterly revenues of $7.41 billion also compared favorably with the Zacks Consensus Estimate of $7.30 billion.

However, on a year-over-year basis, the core EPS declined by 34%. Revenues managed to increase 1.1%. Despite the challenging macro environment, CBRE Group benefited from the diversification across asset types, business lines, client types and geographies and the expansion of its resilient business in recent years, as well as cost-containment efforts.

Public Storage PSA reported first-quarter 2023 core funds from operations (FFO) per share of $4.08, which increased 11.8% year over year. The core FFO per share, excluding the contribution from the company’s equity investment in PS Business Parks, Inc., was also $4.08, rising 16.2% from the year-ago quarter’s tally. Both figures surpassed the Zacks Consensus Estimate by a penny and our estimate of $4.04.

PSA’s results reflected a better-than-anticipated top line, aided by an improvement in the realized annual rent per available square foot in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions. Furthermore, it revised its 2023 outlook.

Iron Mountain Incorporated IRM reported first-quarter adjusted FFO per share of 97 cents, which surpassed the Zacks Consensus Estimate of 93 cents and our estimate of 92 cents. Moreover, the figure improved 6.6% from the year-ago quarter’s 91 cents, attributable to improved adjusted EBITDA.

Iron Mountain’s results reflect solid performance in the storage and service segments, and the data-center business. However, higher operating expenses in the quarter acted as a dampener. The company reaffirmed its outlook for 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance