Jones Lang LaSalle (JLL) Stock Up Despite Q4 Earnings Miss

Shares of Jones Lang LaSalle Inc. JLL — popularly known as JLL — gained 3.65% during Feb 28 regular trading session on the NYSE after it reported decent performance in annuity-based businesses like Workplace Management under Work Dynamics and Property Management under Markets Advisory.

However, transaction-based businesses, specifically the Capital Markets and Leasing under Markets Advisory, were hit by higher interest rates and rapid changes in the economic sentiment globally.

The real estate services company reported fourth-quarter 2022 adjusted earnings per share (EPS) of $4.36, lagging the Zacks Consensus Estimate of $4.47. The reported figure declined 49.6% from the prior-year quarter’s $8.66.

Revenues totaled $5.60 billion, falling 5.7% from the year-ago quarter’s $5.94 billion. Nonetheless, the figure surpassed the Zacks Consensus Estimate of $5.33 billion.

The quarterly adjusted EBITDA margin, calculated on a fee-revenue basis, fell to 15.3% (USD) from 22.6% in 2021 due to a decrease in equity earnings, fall in higher-margin transaction-based revenue, higher fixed compensation expense and wage inflation over the trailing 12 months.

Segment-Wise Performance

During the fourth quarter, the Markets Advisory segment’s revenues and fee revenues came in at $1.18 billion and $915.3 million, respectively, reflecting a fall of 13% and 17% (in USD) year over year. Lower transaction volume across asset types and a decrease in average deal size, mainly in the office sector, led to a fall in Leasing fee revenues, which was the prime reason for the decline in Markets Advisory revenues and fee revenues.

Revenues and fee revenues for the Capital Markets segment were $607.9 million and $598.9 million, respectively, decreasing 38% and 37% (in USD) year over year. The fall was due to lower Investment Sales and Debt Advisory fees as rising interest rates and economic uncertainty hurt market transaction volumes and elongated the deal-cycle time.

JLL’s Work Dynamics segment reported revenues and fee revenues of $3.63 billion and $534.3 million, respectively, up 7% and 6% (in USD) year over year. The rise in revenues and fee growth was attributable to new client wins and the expansion of existing global mandates in Workplace Management services. The continued momentum in project demand from the return-to-office movement and lower pandemic-related restrictions drove the Project Management services’ growth.

JLL Technologies segment reported revenues and fee revenues of $57.3 million and $54.2 million, respectively, rising 29% and 35% (in USD) from the prior-year quarter levels. Backed by new customers and growth from existing customers in software and solutions offerings, JLL Technologies' organic fee revenues increased 21% year over year.

The revenues and fee revenues in the LaSalle segment fell 27% and 29% (in USD) year over year to $118.7 million and $11.4 million, respectively. The rise in advisory fees was driven by strong capital raising and a rise in the fair value of assets under management over the trailing 12 months. However, greater economic uncertainty and lower annual valuation gains in a U.S. fund slowed down transaction activity and led to lower incentive fees associated, offsetting the growth in advisory fees.

As of Dec 31, 2022, LaSalle had $79.1 billion of real estate assets under management (AUM), down from $81.7 billion as of Sep 30, 2022. This resulted from the decrease in foreign currency and dispositions and withdrawals, partially offset by the rise in acquisitions and net valuation.

Balance Sheet

JLL exited fourth-quarter 2022 with cash and cash equivalents of $519.3 million, up from $489.4 million as of Sep 30, 2022.

As of Dec 31, 2022, the net leverage ratio was 1.0, up from 1.1 as of Sep 30, 2022, and 0.2 as of Dec 31, 2021. The corporate liquidity was $2.6 billion as of the same date.

The company did not repurchase any shares during the fourth quarter.

JLL currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

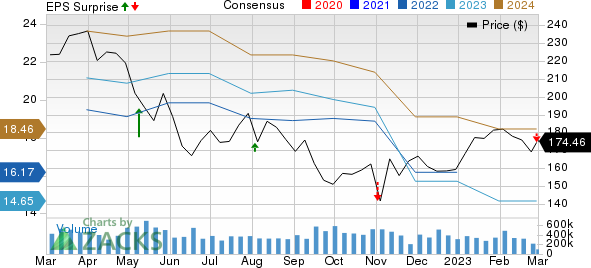

Jones Lang LaSalle Incorporated Price, Consensus and EPS Surprise

Jones Lang LaSalle Incorporated price-consensus-eps-surprise-chart | Jones Lang LaSalle Incorporated Quote

Performance of Other Broader Real Estate Market Stocks

CBRE Group Inc.’s CBRE fourth-quarter 2022 core EPS of $1.33 surpassed the Zacks Consensus Estimate of $1.19. Quarterly revenues of $8.19 billion also compared favorably with the Zacks Consensus Estimate of $8.13 billion.

However, on a year-over-year basis, the core EPS declined 26.0%, while revenues fell 4.2%. Despite the challenging macro environment, CBRE benefited from the expansion of its resilient business in recent years.

Public Storage PSA reported fourth-quarter 2022 core funds from operations (FFO) per share of $4.16, increasing 17.5% year over year. The core FFO per share, excluding the contribution from the company’s equity investment in PS Business Parks, Inc., was $4.16. Both figures surpassed the Zacks Consensus Estimate of $3.99.

PSA’s results reflected better-than-anticipated top-line growth, aided by an improvement in the realized annual rent per occupied square foot. The company also benefited from its expansion efforts through acquisitions, developments and extensions.

Iron Mountain Incorporated IRM reported fourth-quarter adjusted funds from operations (AFFO) per share of 98 cents, which surpassed the Zacks Consensus Estimate of 94 cents. This figure improved 6.5% from the year-ago quarter’s 92 cents, attributable to improved adjusted EBITDA, partially offset by higher interest expenses and cash taxes.

Iron Mountain’s results reflect solid performances in the storage and service segments, and the data-center business. However, higher operating expenses in the quarter created a headwind. The company issued its outlook for 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance