JP Morgan predicts $1tn boost for equities in 2021

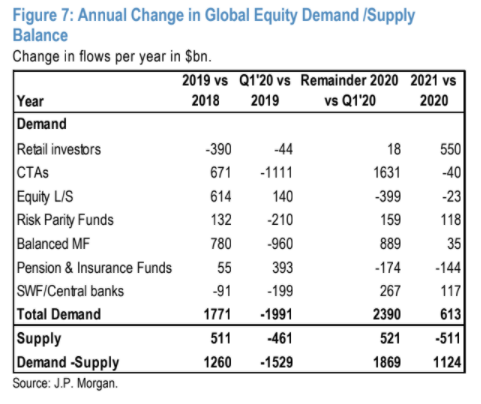

Global market strategists at JPMorgan Chase & Co. (JPM) have a bullish outlook for stocks in 2021, predicting there will be more demand and less supply to the value of $1.1tn (£817.9bn) overall.

Equity demand will rise to about $600bn relative to this year, while supply will drop by $500bn.

“This is similar to the equivalent equity demand/supply improvement in 2019 relative to 2018 which at the time had seen global equities rising by around 25%,” said JPMorgan in a note.

Yet, the sector demand breakdowns slightly differ. The appetite for retail stocks, for instance, will rise in 2021 compared to 2020, according to the research, whereas it fell in 2019 compared to 2018. The analysts see retail inflows of about $40bn a month for 2021, close to the historical average.

The demand for commodity trading advisors (CTAs) and long/short funds will go down in the year ahead but they were projected to be up in 2019 compared to 2018.

Sovereign wealth funds and central banks are also expected to be “modest” equity buyers and so-called risk parity funds, according to JPMorgan, and so will want to consider increasing their exposure after a decline in 2020. Simultaneously, supply will need to be cut by a normalisation of leveraged buyouts and share buybacks and a slowing need for equity raising, JPMorgan said.

READ MORE: European markets rally as Boris Johnson heads to Brussels and US stimulus hopes grow

The bank sees bitcoin’s intrinsic value rising significantly over the coming month as mining activity improves. The cryptocurrency has been trading north of $18,000 since late last month as demand reaches record levels.

COVID-19 has roiled markets through most of 2020, and other large investment houses say the shift towards a new investment order has already begun.

In a recent note on the three themes shaping markets in 2021, Blackrock (BLK) said the pandemic has accelerated shifts in how economies and societies operate across four dimensions: sustainability, inequality, geopolitics and the joint macro policy revolution.

“We believe this calls for a fundamental rethink of investment portfolios,” said Blackrock.

WATCH: Global equities move higher over next year

Yahoo Finance

Yahoo Finance