July 2024 Insight Into Three SEHK Stocks Estimated Below Market Value

Amidst a global atmosphere of cautious optimism, the Hong Kong market has recently shown signs of volatility, reflecting broader economic uncertainties and localized challenges. In this context, identifying stocks that are potentially undervalued becomes a critical strategy for investors looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

China Resources Mixc Lifestyle Services (SEHK:1209) | HK$25.35 | HK$48.68 | 47.9% |

China Cinda Asset Management (SEHK:1359) | HK$0.66 | HK$1.29 | 48.9% |

Zijin Mining Group (SEHK:2899) | HK$16.62 | HK$31.53 | 47.3% |

United Energy Group (SEHK:467) | HK$0.31 | HK$0.57 | 45.6% |

WuXi XDC Cayman (SEHK:2268) | HK$16.64 | HK$31.99 | 48% |

Super Hi International Holding (SEHK:9658) | HK$13.96 | HK$26.08 | 46.5% |

Genscript Biotech (SEHK:1548) | HK$8.63 | HK$15.92 | 45.8% |

Melco International Development (SEHK:200) | HK$5.25 | HK$10.40 | 49.5% |

Vobile Group (SEHK:3738) | HK$1.19 | HK$2.32 | 48.8% |

AK Medical Holdings (SEHK:1789) | HK$4.37 | HK$7.87 | 44.5% |

Here we highlight a subset of our preferred stocks from the screener

AK Medical Holdings

Overview: AK Medical Holdings Limited is an investment holding company that specializes in designing, developing, producing, and marketing orthopedic joint implants and related products both in China and internationally, with a market capitalization of approximately HK$4.90 billion.

Operations: The company generates revenue primarily through the sale of orthopedic implants, with CN¥993.59 million from China and CN¥152.49 million from the United Kingdom.

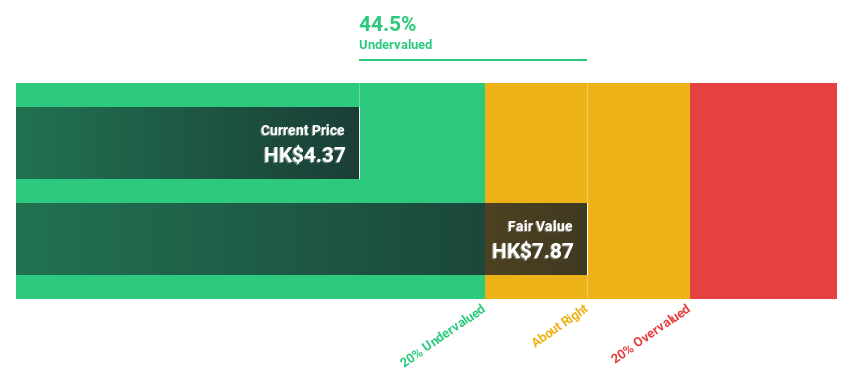

Estimated Discount To Fair Value: 44.5%

AK Medical Holdings is notably undervalued based on cash flows, trading at HK$4.37 against a fair value of HK$7.87, reflecting a significant discount. Analyst consensus suggests an 83.5% potential price increase, supported by earnings expected to grow at 26% annually—outpacing the Hong Kong market's 11.3%. Despite recent dividend cuts and board changes, its robust forecasted revenue growth of 22.3% annually further underscores its appeal as an undervalued asset in the region.

ESR Group

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India and Europe with a market capitalization of approximately HK$44.24 billion.

Operations: The company's revenue is generated from three main segments: Fund Management at HK$774.64 million, New Economy Development at HK$105.48 million, and Investment at -HK$17.25 million.

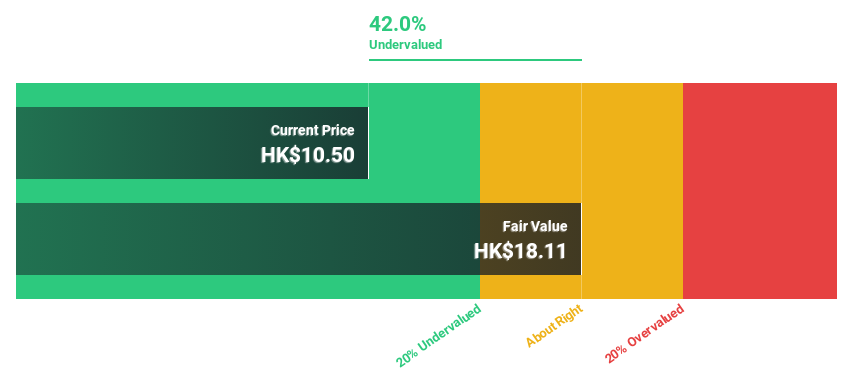

Estimated Discount To Fair Value: 42%

ESR Group Limited, currently trading at HK$10.5, is perceived as undervalued with a fair value estimation of HK$18.11 based on discounted cash flows. Despite a low forecasted return on equity of 7.3% in three years and profit margins dropping from 54.8% to 23.9%, the company's revenue growth is expected to outpace the Hong Kong market at 9.6% annually compared to 7.8%. Additionally, earnings are projected to increase by an impressive 26.5% per year, signaling potential for significant financial improvement and attractiveness based on cash flow metrics.

Our growth report here indicates ESR Group may be poised for an improving outlook.

Unlock comprehensive insights into our analysis of ESR Group stock in this financial health report.

Yeahka

Overview: Yeahka Limited, operating in the People's Republic of China, is an investment holding company that offers payment and business services to merchants and consumers, with a market capitalization of approximately HK$4.27 billion.

Operations: The company generates revenue primarily through its business services segment, amounting to CN¥3.95 billion.

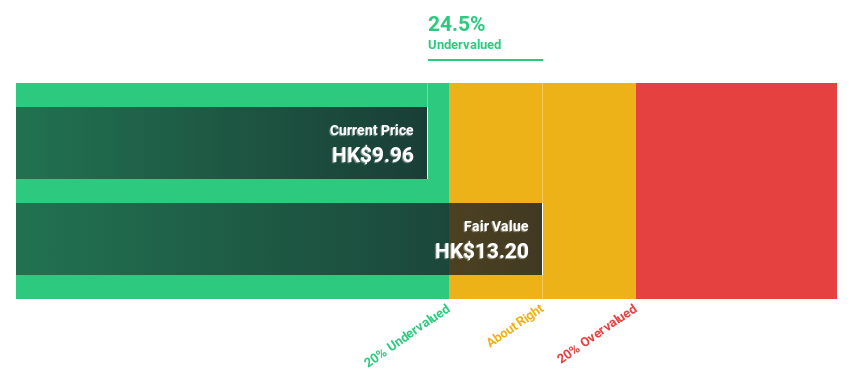

Estimated Discount To Fair Value: 24.5%

Yeahka is trading at HK$9.96, significantly below its estimated fair value of HK$13.20, suggesting it is undervalued based on discounted cash flows. Despite a low return on equity forecast at 13% in three years and a decline in profit margins from 4.5% to 0.3%, Yeahka's revenue growth, projected at 15.6% annually, exceeds the Hong Kong market average of 7.8%. Analysts expect the stock price to rise by 57.4%, with earnings anticipated to grow by an impressive 51.51% annually.

According our earnings growth report, there's an indication that Yeahka might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of Yeahka.

Turning Ideas Into Actions

Dive into all 41 of the Undervalued SEHK Stocks Based On Cash Flows we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1789 SEHK:1821 and SEHK:9923.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance