July 2024 Insight Into Three Value Stocks On SIX Swiss Exchange

The Switzerland market recently displayed a moderate uptick, ending higher as investors responded positively to regional cues and anticipated key economic data, including a forthcoming report on Swiss inflation. In such a climate, identifying undervalued stocks on the SIX Swiss Exchange can offer potential opportunities for value-driven investment strategies.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF47.00 | CHF76.50 | 38.6% |

Burckhardt Compression Holding (SWX:BCHN) | CHF596.00 | CHF848.11 | 29.7% |

Julius Bär Gruppe (SWX:BAER) | CHF51.04 | CHF96.45 | 47.1% |

Sonova Holding (SWX:SOON) | CHF280.30 | CHF463.40 | 39.5% |

Temenos (SWX:TEMN) | CHF62.50 | CHF85.78 | 27.1% |

Comet Holding (SWX:COTN) | CHF358.50 | CHF581.12 | 38.3% |

SGS (SWX:SGSN) | CHF80.10 | CHF125.39 | 36.1% |

Medartis Holding (SWX:MED) | CHF68.40 | CHF129.60 | 47.2% |

Sika (SWX:SIKA) | CHF255.10 | CHF328.71 | 22.4% |

Kudelski (SWX:KUD) | CHF1.435 | CHF1.88 | 23.6% |

We're going to check out a few of the best picks from our screener tool

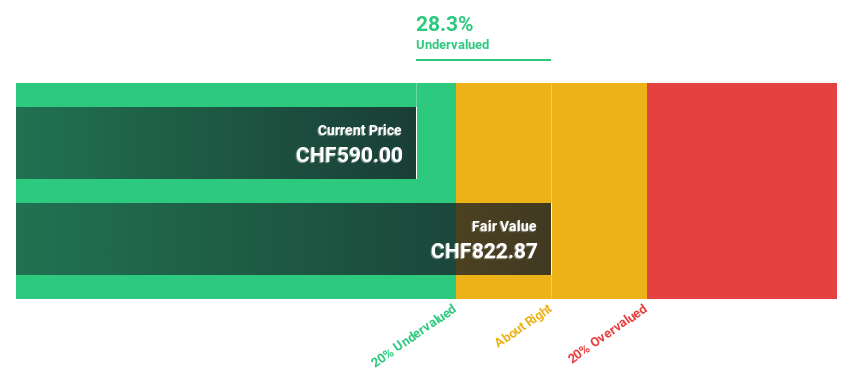

Burckhardt Compression Holding

Overview: Burckhardt Compression Holding AG is a global manufacturer and seller of reciprocating compressors, with a market capitalization of approximately CHF 2.02 billion.

Operations: The company generates revenue through two primary segments: the Systems Division, which brought in CHF 642.81 million, and the Services Division, which contributed CHF 339.15 million.

Estimated Discount To Fair Value: 29.7%

Burckhardt Compression Holding AG, despite its slower expected revenue growth of 6.3% per year compared to a more aggressive market average, has shown robust financial health with earnings increasing by 28.7% over the past year and net income rising from CHF 69.94 million to CHF 89.99 million. Trading at CHF 596, significantly below the estimated fair value of CHF 848.11, it appears undervalued based on discounted cash flows, although its dividend coverage by cash flow remains a concern.

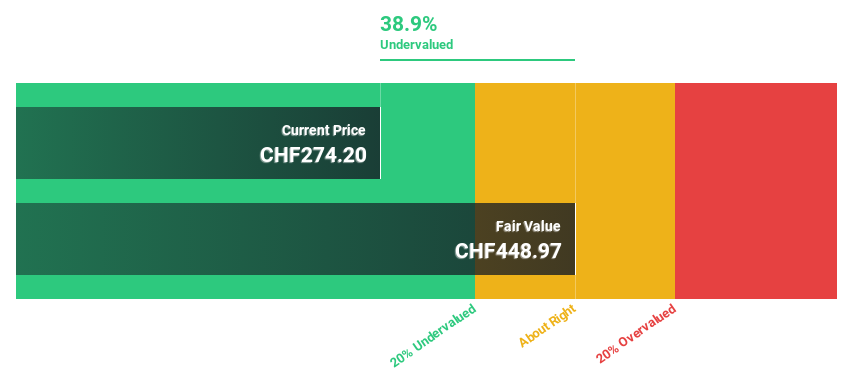

Sonova Holding

Overview: Sonova Holding AG is a company that manufactures and sells hearing care solutions for adults and children across regions including the United States, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of CHF 16.71 billion.

Operations: Sonova's revenue is primarily generated from two segments: Cochlear Implants, which contributed CHF 282.40 million, and Hearing Instruments, accounting for CHF 3.36 billion.

Estimated Discount To Fair Value: 39.5%

Sonova Holding AG, with a current trading price of CHF 280.3 against a fair value estimate of CHF 463.4, appears significantly undervalued based on discounted cash flows. The company's revenue and earnings are projected to outpace the Swiss market with growth rates of 7.1% and 9.9% per year respectively, despite carrying a high level of debt which could impact financial flexibility. Recent earnings reports confirm robust sales at CHF 3,626.9 million and net income at CHF 609.5 million for the fiscal year ending March 2024.

Our growth report here indicates Sonova Holding may be poised for an improving outlook.

Get an in-depth perspective on Sonova Holding's balance sheet by reading our health report here.

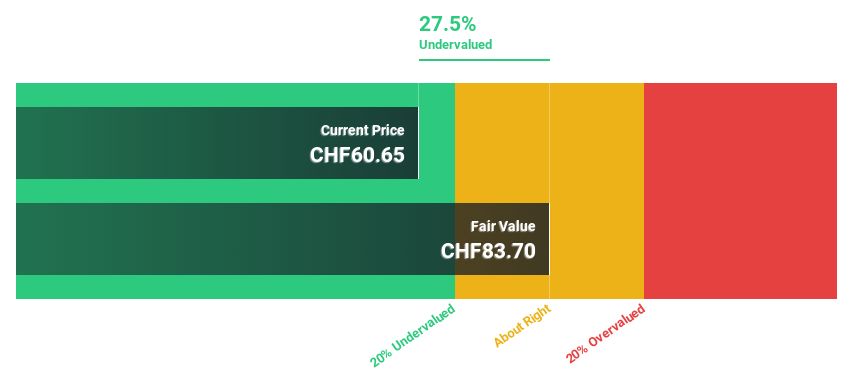

Temenos

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of CHF 4.53 billion.

Operations: The firm generates its revenues by providing integrated banking software systems to financial institutions globally.

Estimated Discount To Fair Value: 27.1%

Temenos, priced at CHF 62.5, is valued below its estimated fair value of CHF 85.78, suggesting undervaluation based on discounted cash flow analysis. Despite a high debt level, Temenos has shown promising financial dynamics with earnings forecasted to grow by 14.7% annually—outpacing the Swiss market's average of 8.4%. Recent strategic client partnerships and continuous investment in scalable SaaS solutions underscore its potential for sustained business growth and agility in the competitive digital banking sector.

Insights from our recent growth report point to a promising forecast for Temenos' business outlook.

Click here to discover the nuances of Temenos with our detailed financial health report.

Make It Happen

Explore the 13 names from our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BCHN SWX:SOON and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance