July 2024 Insights Into Three Stocks Estimated as Undervalued on SIX Swiss Exchange

Swiss stocks recently showcased robust performance, with the benchmark SMI index climbing 0.95% amid positive earnings expectations and favorable interest rate outlooks. This buoyant market environment underscores the potential for identifying undervalued stocks that could offer appealing opportunities for investors attentive to valuation metrics and market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sulzer (SWX:SUN) | CHF132.80 | CHF221.74 | 40.1% |

COLTENE Holding (SWX:CLTN) | CHF47.40 | CHF77.41 | 38.8% |

Burckhardt Compression Holding (SWX:BCHN) | CHF595.00 | CHF858.78 | 30.7% |

Temenos (SWX:TEMN) | CHF64.90 | CHF85.32 | 23.9% |

Julius Bär Gruppe (SWX:BAER) | CHF51.30 | CHF95.50 | 46.3% |

Sonova Holding (SWX:SOON) | CHF273.30 | CHF468.07 | 41.6% |

SGS (SWX:SGSN) | CHF81.04 | CHF125.50 | 35.4% |

Comet Holding (SWX:COTN) | CHF371.00 | CHF589.71 | 37.1% |

Medartis Holding (SWX:MED) | CHF72.80 | CHF131.32 | 44.6% |

Sika (SWX:SIKA) | CHF259.00 | CHF338.90 | 23.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Barry Callebaut

Overview: Barry Callebaut AG operates in the manufacturing and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.75 billion.

Operations: The company's revenue is derived from its Global Cocoa segment, which generated CHF 5.31 billion.

Estimated Discount To Fair Value: 12.5%

Barry Callebaut, priced at CHF1599, trades below our fair value estimate of CHF1827.66, reflecting a modest undervaluation. Despite this, the company's revenue and earnings growth are forecasted to outpace the Swiss market at 7.4% and 25.2% per year respectively. However, its debt is not well covered by operating cash flows, introducing some financial risk. The recent sales trading statement on May 2nd indicates sustained operational activity but does not significantly alter the financial outlook.

Sika

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the construction and automotive industries globally, with a market capitalization of approximately CHF 41.55 billion.

Operations: Sika's revenue is derived mainly from two segments: CHF 9.45 billion from construction industry products and CHF 1.78 billion from industrial manufacturing products.

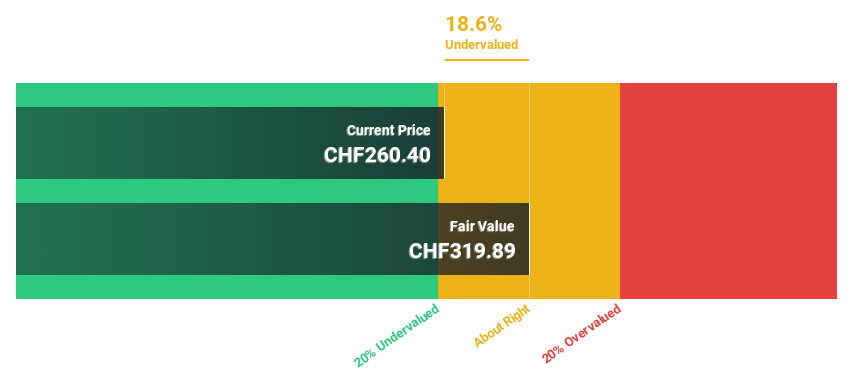

Estimated Discount To Fair Value: 23.6%

Sika, valued at CHF259, is perceived as undervalued with a fair value estimate of CHF338.9, trading 23.6% below this mark. Its revenue and earnings growth forecasts of 6.1% and 12.7% respectively outstrip the Swiss market predictions, though the company's high debt levels pose some financial concerns. Recent expansions in China and Peru highlight strategic growth initiatives aimed at meeting increasing market demands and enhancing sustainability in construction materials.

According our earnings growth report, there's an indication that Sika might be ready to expand.

Delve into the full analysis health report here for a deeper understanding of Sika.

Temenos

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.70 billion.

Operations: The company generates its revenue by providing integrated banking software systems to financial institutions globally.

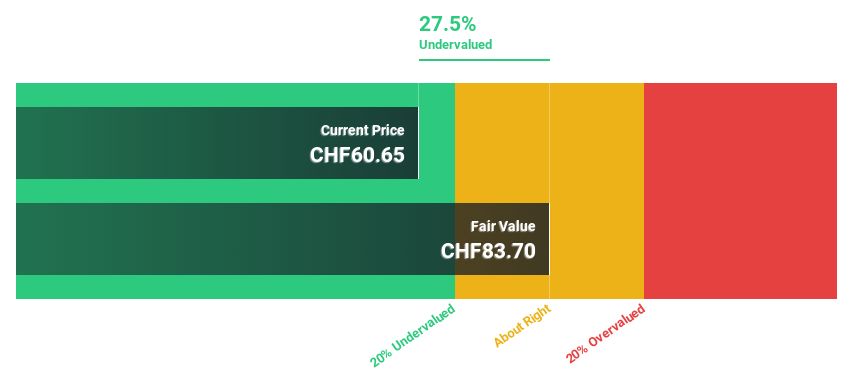

Estimated Discount To Fair Value: 23.9%

Temenos, priced at CHF64.9, is considered undervalued with a fair value estimate of CHF85.32, reflecting a significant discount. While its revenue growth at 7.6% annually is modest compared to some market benchmarks, earnings are expected to increase by 14.7% yearly, outpacing the Swiss market's 8.3%. However, high debt levels and share price volatility present challenges. Recent strategic moves include a share buyback program and partnerships for digital transformations with Haventree Bank and PC Financial®, enhancing its business agility and market reach through scalable SaaS solutions.

Next Steps

Click here to access our complete index of 14 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BARN SWX:SIKA and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance