July 2024 SEHK Growth Companies With High Insider Ownership

As global markets navigate through a period of relative calm and anticipation of upcoming earnings reports, Hong Kong's market has shown resilience despite broader economic concerns. This backdrop sets a compelling stage for examining growth companies in the SEHK with high insider ownership, which can signal strong confidence in a company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Fenbi (SEHK:2469) | 32.6% | 43% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 90.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Underneath we present a selection of stocks filtered out by our screen.

Xiamen Yan Palace Bird's Nest Industry

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. is involved in the research, development, production, and marketing of edible bird’s nest products in China, with a market capitalization of HK$4.52 billion.

Operations: The company generates revenue through various channels, including CN¥16.75 million from online distributors, CN¥509.04 million from offline distributors, CN¥824.40 million from direct online customer sales, CN¥351.17 million from direct offline customer sales, and CN¥262.89 million from e-commerce platforms.

Insider Ownership: 26.7%

Revenue Growth Forecast: 12.6% p.a.

Xiamen Yan Palace Bird's Nest Industry, a growth company with significant insider ownership, demonstrates solid financial health with high-quality earnings primarily from non-cash sources. The company's revenue and earnings are expected to grow annually by 12.6% and 15.6%, respectively, outpacing the Hong Kong market averages of 7.8% for revenue and 11.3% for earnings growth. Recent corporate actions include a dividend affirmation of RMB 2.15 per ten shares and amendments to its Articles of Association, underscoring active management engagement and shareholder alignment.

Beijing Fourth Paradigm Technology

Simply Wall St Growth Rating: ★★★★☆☆

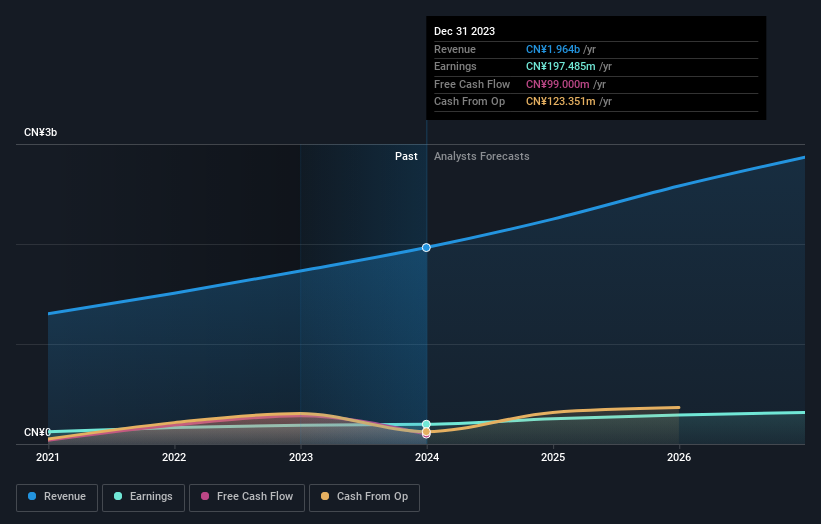

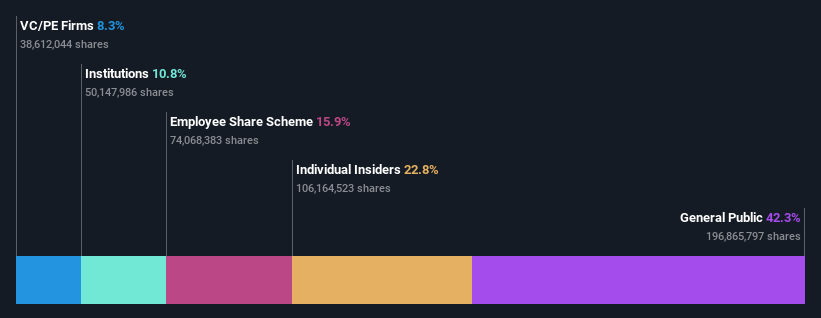

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of HK$24.84 billion.

Operations: The company generates revenue through its Sage AI Platform (CN¥2.51 billion), SageGPT AiGS Services (CN¥415.50 million), and Shift Intelligent Solutions (CN¥1.28 billion).

Insider Ownership: 22.8%

Revenue Growth Forecast: 19.3% p.a.

Beijing Fourth Paradigm Technology, a growth-focused firm in Hong Kong, is witnessing substantial strategic shifts with high insider involvement. Recently, it promoted Mr. Yu to vice chairman to enhance decision-making and sustainable growth, alongside appointing Ms. Guo as acting CFO. The company's revenue is expected to grow by 19.3% annually, outstripping the local market's 7.8%. Despite a forecasted low return on equity of 6% in three years, earnings are anticipated to surge by approximately 96% annually.

Angelalign Technology

Simply Wall St Growth Rating: ★★★★☆☆

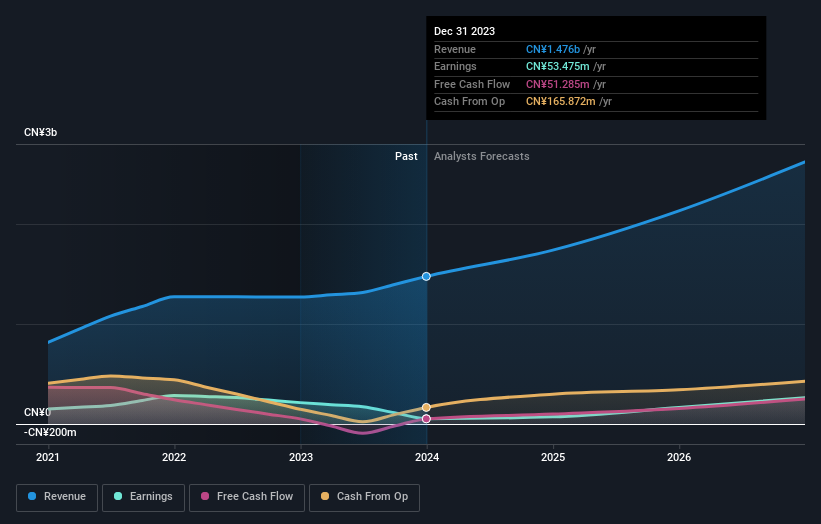

Overview: Angelalign Technology Inc. is an investment holding company that focuses on researching, developing, designing, manufacturing, and marketing clear aligner treatment solutions in the People’s Republic of China, with a market capitalization of HK$10.41 billion.

Operations: The company generates revenue primarily from its dental equipment and supplies segment, totaling CN¥1.48 billion.

Insider Ownership: 18.5%

Revenue Growth Forecast: 16% p.a.

Angelalign Technology, a Hong Kong-based growth company with significant insider ownership, is expected to outperform the local market with a revenue increase of 16% per year and earnings growth of 50.9% annually. Despite these strong growth forecasts, the company's profit margins have declined from last year's 16.8% to 3.6%. Recent expansions into the Canadian market and product innovations underscore its commitment to enhancing orthodontic care globally. However, its return on equity is projected to remain low at 7.4% in three years' time.

Key Takeaways

Click this link to deep-dive into the 54 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1497 SEHK:6682 and SEHK:6699.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance