June 2024's Top Three Dividend Stocks

As global markets exhibit mixed signals with modest gains in the U.S. and challenges in China, investors continue to search for stable returns amidst fluctuating economic indicators. In this context, dividend stocks often attract attention for their potential to offer regular income and relative stability in diverse market conditions.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.18% | ★★★★★★ |

Globeride (TSE:7990) | 3.66% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.85% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.90% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Innotech (TSE:9880) | 3.91% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Lautan Luas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Lautan Luas Tbk operates in the manufacturing and distribution of basic and specialty chemicals, serving industrial clients mainly in Indonesia and the Asia-Pacific, with a market capitalization of approximately IDR 1.64 trillion.

Operations: PT Lautan Luas Tbk generates revenue through its distribution and manufacturing segments, with IDR 3.62 billion from distribution and IDR 3.53 billion from manufacturing.

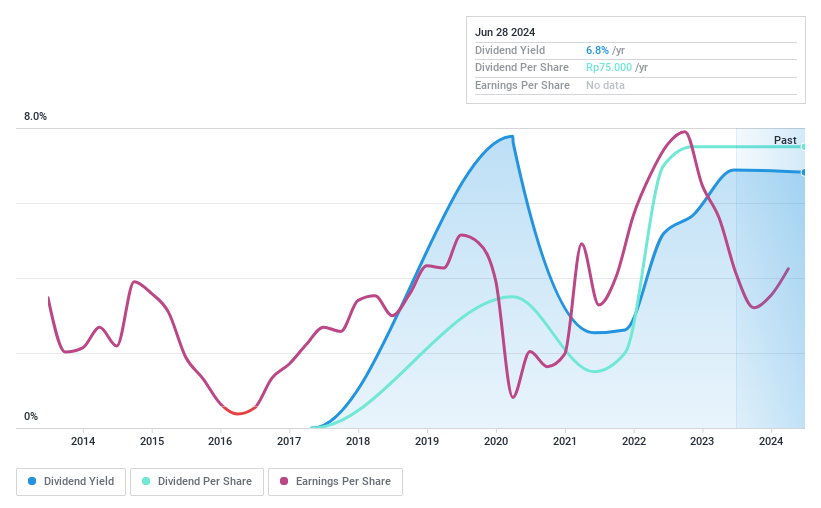

Dividend Yield: 6.8%

Lautan Luas maintains a reasonable payout ratio of 54.2% and a cash payout ratio of 25.7%, suggesting dividends are well-covered by both earnings and cash flow. Despite its attractive dividend yield of 6.82%, which ranks in the top quartile for its market, the firm has only been distributing dividends for four years with some volatility in payments, indicating potential concerns about stability and reliability. Recent financials show improved earnings, supporting current dividend levels amidst ongoing corporate activities like fixed-income offerings.

Take a closer look at Lautan Luas' potential here in our dividend report.

Upon reviewing our latest valuation report, Lautan Luas' share price might be too pessimistic.

Wismilak Inti Makmur

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Wismilak Inti Makmur Tbk is an Indonesian company that manufactures and sells cigarettes both domestically and internationally, with a market capitalization of approximately IDR 2.38 billion.

Operations: PT Wismilak Inti Makmur Tbk generates revenue primarily through its cigarette production, totaling IDR 4.64 billion, and its marketing and distribution activities, which contribute IDR 4.30 billion.

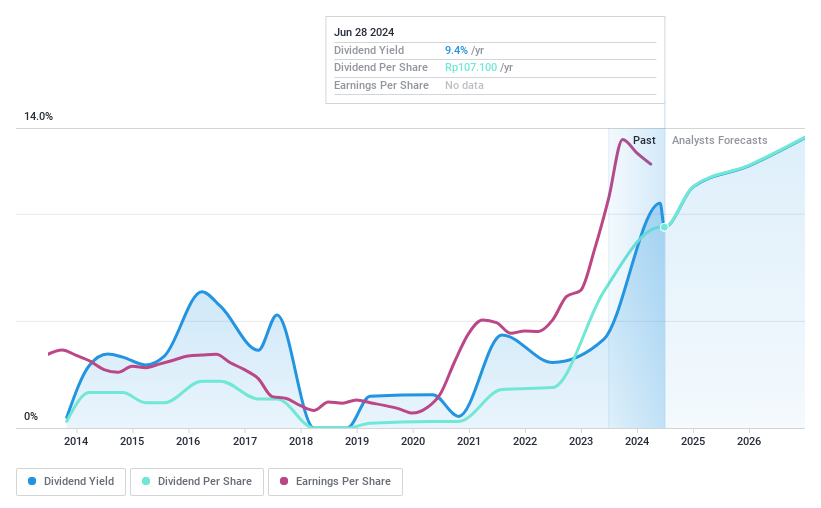

Dividend Yield: 9.4%

PT Wismilak Inti Makmur reported a decline in net income to IDR 90.57 billion from IDR 110.84 billion year-over-year, with sales marginally increasing to IDR 583.32 million. Despite a high dividend yield of 9.35%, the sustainability is questionable as dividends are not well covered by free cash flow or earnings, indicating potential risk for long-term investors. The company's share price has also been highly volatile recently, adding to the uncertainty around its dividend reliability despite a historical increase over the past decade.

Acter Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian regions, with a market capitalization of approximately NT$33.75 billion.

Operations: Acter Group Corporation Limited generates revenue primarily from engineering services, with NT$10.61 billion from Taiwan, NT$12.68 billion from Mainland China, and NT$2.16 billion from other Asian regions.

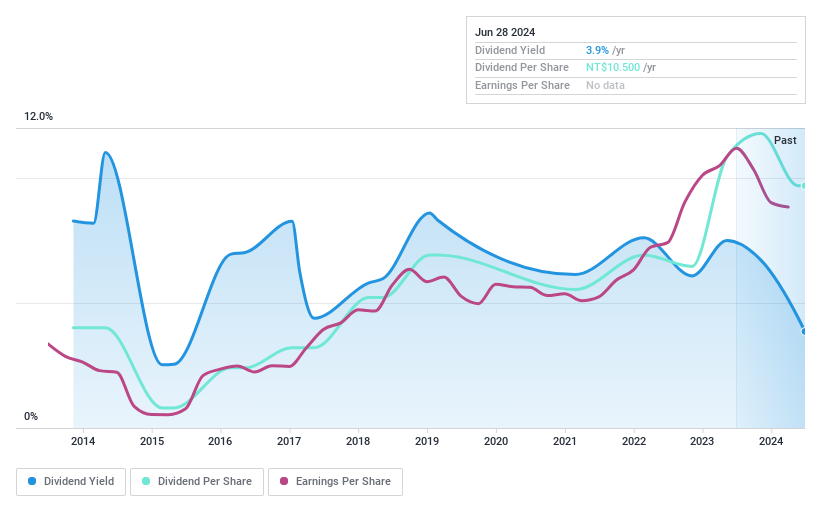

Dividend Yield: 3.9%

Acter Group Corporation Limited has a mixed track record with dividends, showing both growth and volatility over the past decade. While the dividend yield stands at 3.86%, it is lower than the top quartile of TW market payers at 4.26%. Dividends are supported by earnings with a payout ratio of 71.3% and cash flows with a cash payout ratio of 31.8%. However, historical payment inconsistencies may raise concerns about future reliability despite recent corporate governance changes aimed at enhancing sustainability practices.

Where To Now?

Navigate through the entire inventory of 1973 Top Dividend Stocks here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IDX:LTLSIDX:WIIM and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance