June Top Cheap Financial Stocks To Buy

The fortunes of financial services companies often follow that of the broader economy, since these businesses provide services such as consumer financing and investment banking, which tend to do well when times are good. Financial ompanies that are recently trading at a market price lower than their real values include Oakley Capital Investments and Arrow Global Group. Investors can benefit from buying these financial companies while they are discounted, because they gain when the market prices move towards the stocks’ true values. Below is a list of stocks I’ve compiled that are deemed undervalued based on the latest financial data.

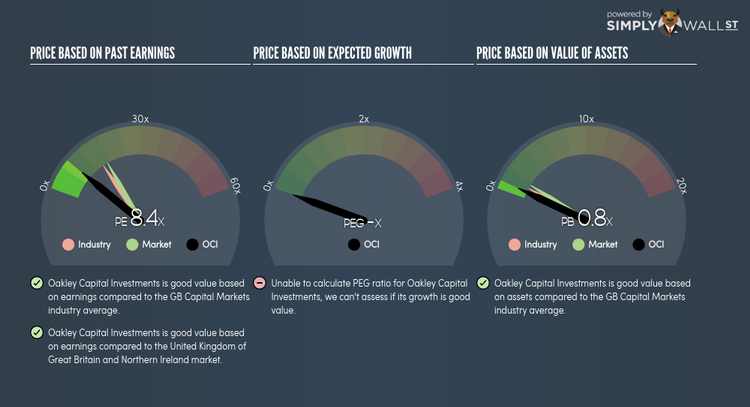

Oakley Capital Investments Limited (AIM:OCI)

Oakley Capital Investments Limited is private equity and venture capital firm specializing in investments in any stage of businesses development including start-up, early, growth, established businesses, late stage, mid markets, restructuring, management buy-outs, management buy-ins, public to privates, re-financings, secondary purchases, growth capital, turnarounds, and buy-and-build investments as well as investments in other funds. Oakley Capital Investments was established in 2007 and has a market cap of GBP £377.86M, putting it in the small-cap group.

OCI’s shares are currently trading at -29% under its intrinsic level of £2.62, at a price of UK£1.85, based on my discounted cash flow model. The divergence signals an opportunity to buy OCI shares at a low price. Moreover, OCI’s PE ratio is trading at 8.39x compared to its Capital Markets peer level of, 15.51x suggesting that relative to its comparable company group, OCI’s stock can be bought at a cheaper price. OCI is also in great financial shape, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. OCI has zero debt on its books as well, meaning it has no long term debt obligations to worry about. Continue research on Oakley Capital Investments here.

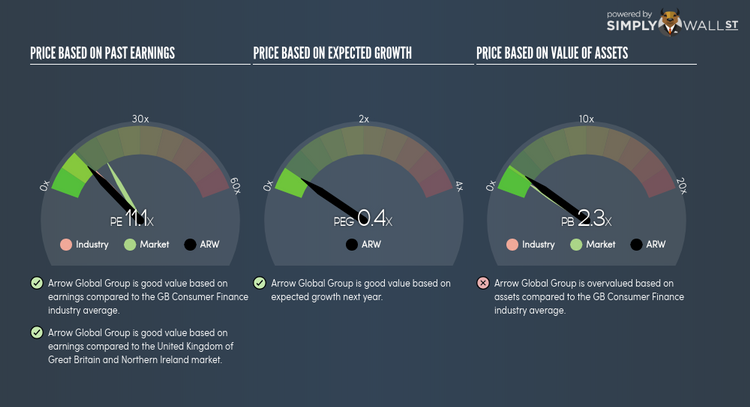

Arrow Global Group PLC (LSE:ARW)

Arrow Global Group PLC, together with its subsidiaries, identifies, acquires, and manages secured and unsecured defaulted loan portfolios consisting of consumer and SME accounts from financial institutions, such as banks and credit card companies in the United Kingdom and mainland Europe. Founded in 2005, and now led by CEO Lee Rochford, the company size now stands at 1,500 people and has a market cap of GBP £462.90M, putting it in the small-cap category.

ARW’s stock is now trading at -60% less than its intrinsic level of £6.34, at a price of UK£2.54, based on its expected future cash flows. This mismatch signals an opportunity to buy ARW shares at a discount. Furthermore, ARW’s PE ratio is around 11.11x while its Consumer Finance peer level trades at, 11.88x implying that relative to other stocks in the industry, you can buy ARW’s shares at a cheaper price. ARW also has a healthy balance sheet, with current assets covering liabilities in the near term and over the long run.

More detail on Arrow Global Group here.

The Law Debenture Corporation p.l.c. (LSE:LWDB)

The Law Debenture Corporation p.l.c. engages in investment trust and independent fiduciary services businesses. Formed in 1889, and headed by CEO Denis Jackson, the company currently employs 120 people and has a market cap of GBP £730.23M, putting it in the small-cap category.

LWDB’s shares are currently floating at around -37% lower than its true value of £9.93, at the market price of UK£6.22, based on its expected future cash flows. This mismatch signals an opportunity to buy LWDB shares at a discount. Additionally, LWDB’s PE ratio is trading at 7.01x compared to its Capital Markets peer level of, 15.51x implying that relative to other stocks in the industry, LWDB can be bought at a cheaper price right now. LWDB is also robust in terms of financial health, with near-term assets able to cover upcoming and long-term liabilities.

Continue research on Law Debenture here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance