June Top Dividend Payers

N Brown Group is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. Here are other similar dividend stocks that could be valuable additions to your current holdings.

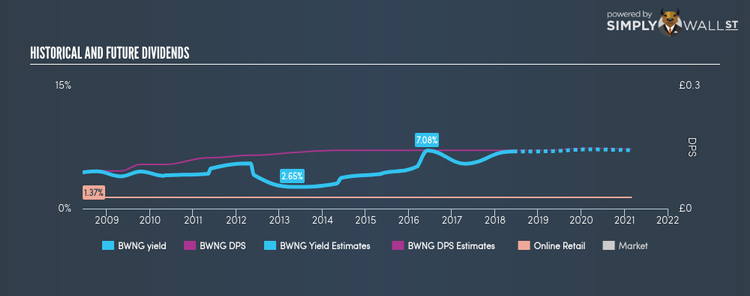

N Brown Group plc (LSE:BWNG)

N Brown Group PLC operates as a digital fashion retailer primarily in the United Kingdom, the Republic of Ireland, and the United States. Established in 1859, and now run by Angela Spindler, the company provides employment to 2,600 people and with the stock’s market cap sitting at GBP £574.07M, it comes under the small-cap category.

BWNG has an alluring dividend yield of 6.98% with a high payout ratio. . BWNG’s dividends have increased in the last 10 years, with DPS increasing from UK£0.091 to UK£0.14. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. N Brown Group is also a strong prospect for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next three years. Dig deeper into N Brown Group here.

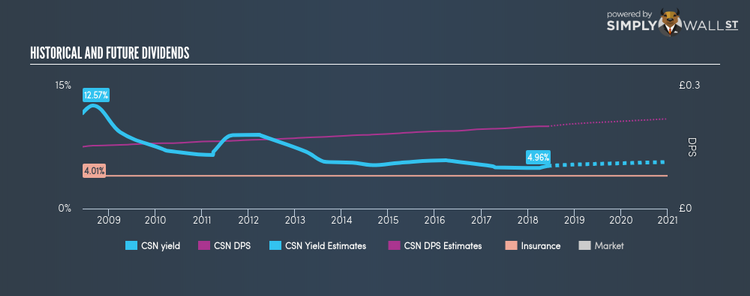

Chesnara plc (LSE:CSN)

Chesnara plc, together with its subsidiaries, engages in life assurance and pension businesses primarily in the United Kingdom, the Netherlands, and Sweden. Established in 2003, and currently run by John Deane, the company provides employment to 329 people and with the market cap of GBP £582.96M, it falls under the small-cap group.

CSN has an appealing dividend yield of 5.21% and the company currently pays out 38.32% of its profits as dividends . Over the past 10 years, CSN has increased its dividends from UK£0.15 to UK£0.20. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Chesnara’s earnings per share growth of 122.32% over the past 12 months outpaced the gb insurance industry’s average growth rate of 33.83%. More detail on Chesnara here.

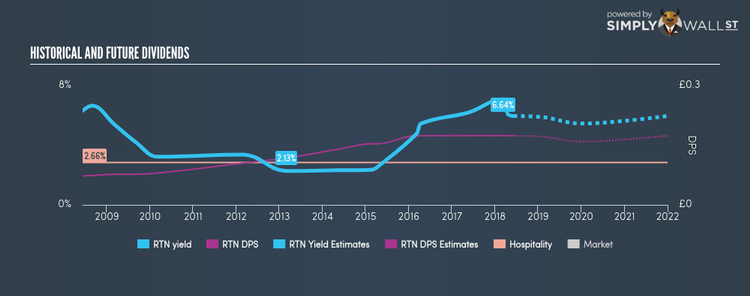

The Restaurant Group plc (LSE:RTN)

The Restaurant Group plc operates restaurants and pub restaurants in the United Kingdom. Started in 1954, and currently run by Andy McCue, the company now has 15,200 employees and with the stock’s market cap sitting at GBP £623.18M, it comes under the small-cap group.

RTN has an appealing dividend yield of 5.59% and their current payout ratio is 105.87% . RTN’s last dividend payment was UK£0.17, up from it’s payment 10 years ago of UK£0.072. They have been consistent too, not missing a payment during this 10 year period. Continue research on Restaurant Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance