June Top Dividend Payers

M.P. Evans Group is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

M.P. Evans Group plc (AIM:MPE)

M.P. Evans Group PLC, through its subsidiaries, operates oil palm plantations in Indonesia. Established in 1981, and headed by CEO Tristan R. Price, the company size now stands at 4,800 people and has a market cap of GBP £410.96M, putting it in the small-cap group.

MPE has a good-sized dividend yield of 3.70% and is distributing 58.93% of earnings as dividends . The company’s dividends per share have risen from US$0.07 to US$0.28 over the last 10 years. They have been consistent too, not missing a payment during this 10 year period. The company outperformed the gb food industry’s earnings growth of 5.20%, reporting an EPS growth of 80.69% over the past 12 months. Interested in M.P. Evans Group? Find out more here.

Photo-Me International plc (LSE:PHTM)

Photo-Me International plc operates, sells, and services a range of instant-service equipment in Continental Europe, the United Kingdom, Ireland, Asia, and internationally. Started in 1962, and now run by Serge Crasnianski, the company employs 1,720 people and with the stock’s market cap sitting at GBP £419.02M, it comes under the small-cap group.

PHTM has a juicy dividend yield of 6.33% and has a payout ratio of 77.45% , with the expected payout in three years being 87.60%. Despite some volatility in the yield, DPS has risen in the last 10 years from UK£0 to UK£0.07. Photo-Me International’s performance over the last 12 months beat the europe leisure industry, with the company reporting 15.07% EPS growth compared to its industry’s figure of 4.12%. Dig deeper into Photo-Me International here.

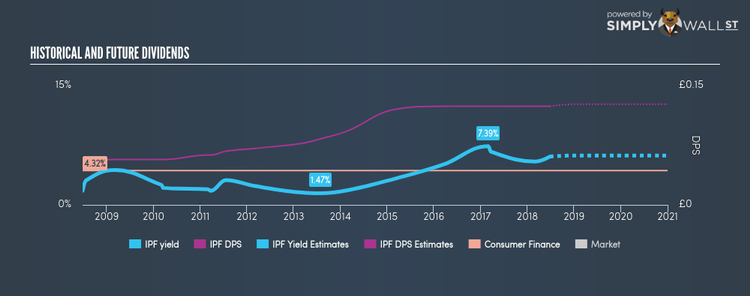

International Personal Finance plc (LSE:IPF)

International Personal Finance plc, together with its subsidiaries, provides consumer credit products in Northern Europe, Lithuania, Slovakia, Mexico, Southern Europe, and Australia. Started in 1997, and currently headed by CEO Gerard Ryan, the company provides employment to 11,671 people and has a market cap of GBP £454.90M, putting it in the small-cap group.

IPF has a juicy dividend yield of 6.08% and the company currently pays out 61.28% of its profits as dividends . Over the past 10 years, IPF has increased its dividends from UK£0.048 to UK£0.12. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. It should comfort potential investors that the company isn’t expensive when we look at its PE ratio compared to the GB Consumer Finance industry. International Personal Finance’s PE ratio is 10.1 while its industry average is 11.9. More on International Personal Finance here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance